MetLife 2000 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Liquidity uses. The Company’s principal cash outflows primarily relate to the liabilities associated with its various life insurance, annuity and group

pension products, operating expenses, income taxes, contributions to subsidiaries, as well as principal and interest on its outstanding debt obligations.

Liabilities arising from its insurance activities primarily relate to benefit payments under the above-named products, as well as payments for policy

surrenders, withdrawals and loans.

The Company’s management believes that its sources of liquidity are more than adequate to meet its current cash requirements.

Litigation. Various litigation claims and assessments against the Company have arisen in the course of the Company’s business, including, but

not limited to, in connection with its activities as an insurer, employer, investor, investment advisor and taxpayer. Further, state insurance regulatory

authorities and other Federal and state authorities regularly make inquiries and conduct investigations concerning the Company’s compliance with

applicable insurance and other laws and regulations.

It is not feasible to predict or determine the ultimate outcome of all pending investigations and legal proceedings or provide reasonable ranges of

potential losses. In some of the matters referred to above, very large and/or indeterminate amounts, including punitive and treble damages, are sought.

Based on information currently known by the Company’s management, in its opinion, the outcomes of such pending investigations and legal

proceedings are not likely to have a material adverse effect on the Company’s consolidated financial position. However, given the large and/or

indeterminate amounts sought in certain of these matters and the inherent unpredictability of litigation, it is possible that an adverse outcome in certain

matters could, from time to time, have a material adverse effect on the Company’s operating results or cash flows in particular quarterly or annual periods.

See Note 10 of Notes to Consolidated Financial Statements.

Risk-based capital. Section 1322 of the New York Insurance Law requires that New York domestic life insurers report their RBC based on a

formula calculated by applying factors to various asset, premium and statutory reserve items. The formula takes into account the risk characteristics of the

insurer, including asset risk, insurance risk, interest rate risk and business risk. Section 1322 gives the Superintendent explicit regulatory authority to

require various actions by, or take various actions against, insurers whose total adjusted capital does not exceed certain RBC levels. At December 31,

2000, Metropolitan Life’s and each of its U.S. insurance subsidiaries’ total adjusted capital was in excess of each of the RBC levels required by each

state of domicile.

In March 1998, the NAIC adopted the Codification. The Codification, which is intended to standardize regulatory accounting and reporting to state

insurance departments, became effective January 1, 2001. However, statutory accounting principles will continue to be established by individual state

laws and permitted practices. The New York Insurance Department requires adoption of the Codification, with certain modifications, for the preparation of

statutory financial statements effective January 1, 2001. The Company believes that the adoption, effective January 1, 2001, of the Codification by the

NAIC and the Codification as modified by the New York Insurance Department, as currently interpreted, will not adversely affect statutory capital and

surplus.

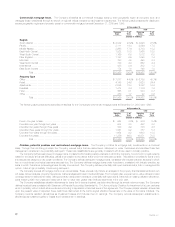

Financing. MetLife Funding, Inc. serves as a centralized finance unit for the Company. Pursuant to a support agreement, Metropolitan Life has

agreed to cause MetLife Funding to have a tangible net worth of at least one dollar. At December 31, 2000 and 1999, MetLife Funding had a tangible net

worth of $10.3 million and $10.5 million, respectively. MetLife Funding raises funds from various funding sources and uses the proceeds to extend loans

to the Holding Company, Metropolitan Life and other affiliates. MetLife Funding manages its funding sources to enhance the financial flexibility and liquidity

of MetLife. At December 31, 2000 and 1999, MetLife Funding had total outstanding liabilities of $1.1 billion and $4.2 billion, respectively, consisting

primarily of commercial paper.

In connection with the Company’s acquisition of the stock of GenAmerica, the Company incurred $900 million of short-term debt, consisting

primarily of commercial paper. In April 2000, the debt was repaid with proceeds from the offerings of Common Stock and equity security units and the

private placements of Common Stock. The Company also incurred approximately $3.2 billion of short-term debt, consisting primarily of commercial

paper, in connection with its October 1, 1999 exchange offer to holders of General American funding agreements. This debt was repaid during 2000.

The Company also maintained approximately $2 billion in committed credit facilities at December 31, 2000, as compared with $7 billion ($5 billion of

which served as back-up for the commercial paper incurred in connection with the exchange offer to holders of General American funding agreements)

at December 31, 1999. These credit facilities were not utilized during 2000 or 1999.

Support agreements. In addition to its support agreement with MetLife Funding described above, Metropolitan Life has entered into a net worth

maintenance agreement with New England, whereby it is obligated to maintain New England’s statutory capital and surplus at the greater of $10 million or

the amount necessary to prevent certain regulatory action by Massachusetts, the state of domicile of this subsidiary. The capital and surplus of New

England’s at December 31, 2000 was in excess of the amount that would trigger such an event.

In connection with the Company’s acquisition of GenAmerica, Metropolitan Life entered into a net worth maintenance agreement with General

American, whereby Metropolitan Life is obligated to maintain General American’s statutory capital and surplus at the greater of $10 million or the amount

necessary to maintain the capital and surplus of General American at a level not less than 180% of the NAIC Risk Based Capitalization Model. The capital

and surplus of General American at December 31, 2000 was in excess of the required amount after giving effect to its receipt of $300 million through a

series of affiliated capital transactions.

Metropolitan Life has also entered into arrangements with some of its other subsidiaries and affiliates to assist such subsidiaries and affiliates in

meeting various jurisdictions’ regulatory requirements regarding capital and surplus. In addition, Metropolitan Life has entered into a support arrangement

with respect to reinsurance obligations of its wholly-owned subsidiary, Metropolitan Insurance and Annuity Company. Management does not anticipate

that these arrangements will place any significant demands upon the Company’s liquidity resources.

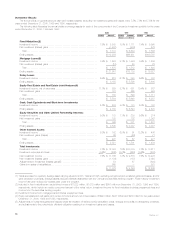

Consolidated cash flows. Net cash provided by operating activities was $1,326 million, $3,865 million and $842 million for the years ended

December 31, 2000, 1999 and 1998, respectively. In 2000, the decrease in cash provided by operating activities was primarily the result of the timing in

the settlement in receivables and payables. In 1999, the change in cash provided by operating activities was largely due to strong growth in the

Institutional Business and Auto & Home segments. The growth in the Institutional Business segment is largely attributable to strong sales and improved

policyholder retention in non-medical health, predominately in the dental and disability businesses. The growth in Auto & Home is primarily due to the

acquisition of the standard personal lines property and casualty insurance operations of The St. Paul Companies, as well as growth in both the standard

and non-standard auto insurance businesses. Net cash provided by operating activities in 2000, 1999 and 1998 was more than adequate to meet

liquidity requirements.

Net cash provided by (used in) investing activities was $83 million, $(2,389) million and $2,683 million for the years ended December 31, 2000,

1999 and 1998, respectively. Purchases of investments exceeded sales, maturities and repayments by $7,313 million, $461 million and $7,647 million

in 2000, 1999 and 1998, respectively. In 2000, the increase in net purchases of investments resulted from increased volume in the Company’s

securities lending program as well as the reinvestment of the proceeds from the sale of Nvest on October 30, 2000. In 1999, the significant decrease in

MetLife, Inc.

16