MetLife 2000 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

instruments and, with respect to over-the-counter transactions, from the possible inability of counterparties to meet the terms of the contracts. The

Company has policies regarding the financial stability and credit standing of its major counterparties.

The Company uses derivative instruments to hedge designated risks. The hedge is expected to be highly effective in offsetting the designated risk at

the inception of the contract. The Company monitors the effectiveness of its hedges throughout the contract term using an offset ratio of 80 to

125 percent as its minimum acceptable threshold for hedge effectiveness. During any period the derivative instruments are outside their threshold for

hedge effectiveness, or if the relationship no longer qualifies as a hedge, all changes in the derivative’s value are marked to market through net investment

gains and losses.

Gains or losses on financial futures contracts entered into in anticipation of investment transactions are deferred and, at the time of the ultimate

investment purchase or disposition, recorded as an adjustment to the basis of the purchased assets or to the proceeds on disposition. Gains or losses

on financial futures used in asset risk management are deferred and amortized into net investment income over the remaining term of the investment.

Gains or losses on financial futures used in portfolio risk management are deferred and amortized into net investment income or policyholder benefits over

the remaining life of the hedged sector of the underlying portfolio.

Financial forward contracts that are entered into to purchase securities are marked to fair value through other comprehensive income, similar to the

accounting for the security to be purchased. Such contracts are accounted for at settlement by recording the purchase of the specified securities at the

contracted value. Gains or losses resulting from the termination of forward contracts are recognized immediately as a component of net investment gains

and losses.

Interest rate and certain foreign currency swaps involve the periodic exchange of payments without the exchange of underlying principal or notional

amounts. Net receipts or payments are accrued and recognized over the term of the swap agreement as an adjustment to net investment income or

other expenses. Gains or losses resulting from swap terminations are amortized over the remaining term of the underlying asset or liability. Gains and

losses on swaps and certain foreign forward exchange contracts entered into in anticipation of investment transactions are deferred and, at the time of

the ultimate investment purchase or disposition, reflected as an adjustment to the basis of the purchased assets or to the proceeds of disposition. In the

event the asset or liability underlying a swap is disposed of, the swap position is closed immediately and any gain or loss is recorded in net investment

gains and losses.

The Company periodically enters into collars, which consist of purchased put and written call options, to lock in unrealized gains on equity securities.

Collars are marked to market through other comprehensive income or loss, similar to the accounting for the underlying equity securities.

Purchased interest rate caps and floors are used to offset the risk of interest rate changes related to insurance liabilities. Premiums paid on floors,

caps and options are amortized over the life of the applicable derivative instrument. Any gains or losses relating to these derivative instruments are

deferred and are recognized as a component of net investment income over the original term of the derivative instrument.

Cash and Cash Equivalents

The Company considers all investments purchased with an original maturity of three months or less to be cash equivalents.

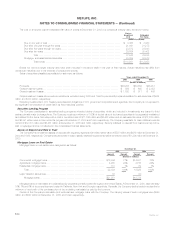

Property, Equipment and Leasehold Improvements

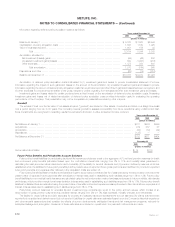

Property, equipment and leasehold improvements, which are included in other assets, are stated at cost, less accumulated depreciation and

amortization. Depreciation is determined using either the straight-line or sum-of-the-years-digits method over the estimated useful lives of the assets.

Estimated lives range from ten to 40 years for leasehold improvements and three to 15 years for all other property and equipment. Accumulated

depreciation of property and equipment and accumulated amortization on leasehold improvements was $1,304 million and $1,224 million at Decem-

ber 31, 2000 and 1999, respectively. Related depreciation and amortization expense was $120 million, $109 million and $116 million for the years

ended December 31, 2000, 1999 and 1998, respectively.

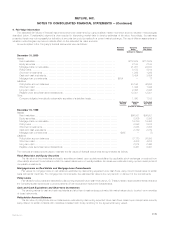

Deferred Policy Acquisition Costs

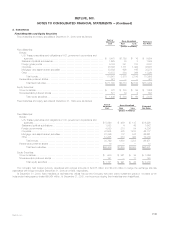

The costs of acquiring new insurance business that vary with, and are primarily related to, the production of new business are deferred. Such costs,

which consist principally of commissions, agency and policy issue expenses, are amortized with interest over the expected life of the contract for

participating traditional life, universal life and investment-type products. Generally, deferred policy acquisition costs are amortized in proportion to the

present value of estimated gross margins or profits from investment, mortality, expense margins and surrender charges. Interest rates are based on rates

in effect at the inception or acquisition of the contracts. Actual gross margins or profits can vary from management’s estimates resulting in increases or

decreases in the rate of amortization. Management periodically updates these estimates and evaluates the recoverability of deferred policy acquisition

costs. When appropriate, management revises its assumptions of the estimated gross margins or profits of these contracts, and the cumulative

amortization is re-estimated and adjusted by a cumulative charge or credit to current operations.

Deferred policy acquisition costs for non-participating traditional life, non-medical health and annuity policies with life contingencies are amortized in

proportion to anticipated premiums. Assumptions as to anticipated premiums are made at the date of policy issuance or acquisition and are consistently

applied during the lives of the contracts. Deviations from estimated experience are included in operations when they occur. For these contracts, the

amortization period is typically the estimated life of the policy.

Deferred policy acquisition costs related to internally replaced contracts are expensed at the date of replacement.

Deferred policy acquisition costs for property and casualty insurance contracts, which are primarily comprised of commissions and certain

underwriting expenses, are deferred and amortized on a pro rata basis over the applicable contract term or reinsurance treaty.

Value of business acquired, included as part of deferred policy acquisition costs, represents the present value of future profits generated from

existing insurance contracts in force at the date of acquisition and is amortized over the expected policy or contract duration in relation to the present

value of estimated gross profits from such policies and contracts.

MetLife, Inc. F-9