MetLife 2000 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

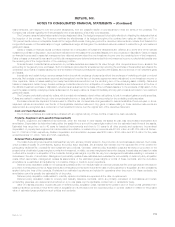

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Application of Accounting Pronouncements

Effective December 31, 2000, the Company early adopted Statement of Position (‘‘SOP’’) 00-3, Accounting by Insurance Enterprises for

Demutualizations and Formations of Mutual Insurance Holding Companies and for Certain Long-Duration Participating Contracts (‘‘SOP 00-3’’). SOP 00-3

provides guidance on accounting by insurance enterprises for demutualizations and the formation of mutual insurance holding companies, including the

emergence of earnings from and the financial statement presentation of the closed block formed as a part of a demutualization. Adoption of SOP 00-3

did not have a material effect on the Company’s consolidated results of operations other than the reclassification of demutualization costs as operating

expenses rather than as an extraordinary item.

Effective October 1, 2000, the Company adopted Staff Accounting Bulletin No. 101, Revenue Recognition in Financial Statements (‘‘SAB 101’’).

SAB 101 summarizes certain of the Securities and Exchange Commission’s views in applying generally accepted accounting principles to revenue

recognition in financial statements. The requirements of SAB 101 did not have a material effect on the Company’s consolidated financial statements.

Effective January 1, 2000, the Company adopted Statement of Position 98-7, Accounting for Insurance and Reinsurance Contracts That Do Not

Transfer Insurance Risk (‘‘SOP 98-7’’). SOP 98-7 provides guidance on the method of accounting for insurance and reinsurance contracts that do not

transfer insurance risk, defined in the SOP as the deposit method. SOP 98-7 classifies insurance and reinsurance contracts for which the deposit

method is appropriate into those that (1) transfer only significant timing risk, (2) transfer only significant underwriting risk, (3) transfer neither significant

timing nor underwriting risk and (4) have an indeterminate risk. Adoption of SOP 98-7 did not have a material effect on the Company’s consolidated

financial statements.

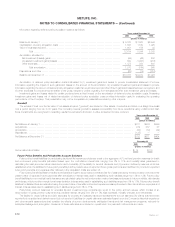

In September 2000, the Financial Accounting Standards Board (‘‘FASB’’) issued Statement of Financial Accounting Standards (‘‘SFAS’’) No. 140,

Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities — a replacement of FASB Statement No. 125 (‘‘SFAS 140’’).

SFAS 140 is effective for transfers and extinguishments of liabilities occurring after March 31, 2001 and is effective for disclosures about securitizations

and collateral and for recognition and reclassification of collateral for fiscal years ending after December 15, 2000. The Company is in the process of

quantifying the impact, if any, of the provisions of SFAS 140 effective for future periods.

Effective January 1, 1999, the Company adopted SOP 98-5, Reporting on the Costs of Start-Up Activities (‘‘SOP 98-5’’). SOP 98-5 broadly defines

start-up activities. SOP 98-5 requires costs of start-up activities and organization costs to be expensed as incurred. Adoption of SOP 98-5 did not have a

material effect on the Company’s consolidated financial statements.

Effective January 1, 1999, the Company adopted SOP 98-1, Accounting for the Costs of Computer Software Developed or Obtained for Internal

Use (‘‘SOP 98-1’’). SOP 98-1 provides guidance for determining when an entity should capitalize or expense external and internal costs of computer

software developed or obtained for internal use. Adoption of the provisions of SOP 98-1 had the effect of increasing other assets by $82 million at

December 31, 1999.

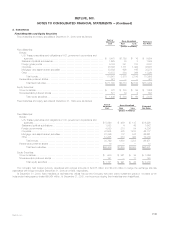

Effective January 1, 1999, the Company adopted SOP 97-3, Accounting for Insurance and Other Enterprises for Insurance Related Assessments

(‘‘SOP 97-3’’). SOP 97-3 provides guidance on accounting by insurance and other enterprises for assessments related to insurance activities including

recognition, measurement and disclosure of guaranty fund and other insurance related assessments. Adoption of SOP 97-3 did not have a material

effect on the Company’s consolidated financial statements.

In June 2000, the FASB issued Statement of Financial Accounting Standards No. 138, Accounting for Certain Derivative Instruments and Certain

Hedging Activities — an Amendment of FASB Statement No. 133 (‘‘SFAS 138’’). In June 1999, the FASB also issued Statement of Financial Accounting

Standards No. 137, Accounting for Derivative Instruments and Hedging Activities — Deferral of the Effective Date of FASB Statement No. 133 (‘‘SFAS

137’’). SFAS 137 deferred the provisions of Statement of Financial Accounting Standards No. 133, Accounting for Derivative Instruments and Hedging

Activities (‘‘SFAS 133’’) until January 1, 2001. SFAS 133 and SFAS 138 require, among other things, that all derivatives be recognized in the consolidated

balance sheets as either assets or liabilities and measured at fair value. The corresponding derivative gains and losses should be reported based upon

the hedge relationship, if such a relationship exists. Changes in the fair value of derivatives that are not designated as hedges or that do not meet the

hedge accounting criteria in SFAS 133 and SFAS 138 are required to be reported in income. The Company estimates that the cumulative effect of the

adoption SFAS 133 and SFAS 138, as of January 1, 2001, will result in a $32 million, net of income taxes of $19 million, increase in other comprehensive

income and an insignificant impact on net income.

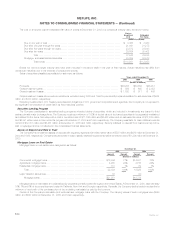

In July 2000, the Emerging Issues Task Force (‘‘EITF’’) reached consensus on Issue No. 99-20, Recognition of Interest Income and Impairment on

Certain Investments (‘‘EITF No. 99-20’’). This pronouncement requires investors in certain asset-backed securities to record changes in their estimated

yield on a prospective basis and to evaluate these securities for an other-than-temporary decline in value. This consensus is effective for financial

statements with fiscal quarters beginning after December 15, 2000. While the Company currently is in the process of quantifying the impact of EITF

No. 99-20, the provisions of the consensus are not expected to have a material impact on the Company’s consolidated financial statements.

MetLife, Inc.

F-12