MetLife 2000 Annual Report Download - page 11

Download and view the complete annual report

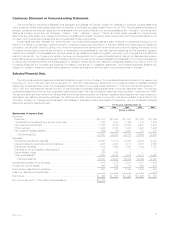

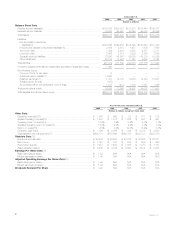

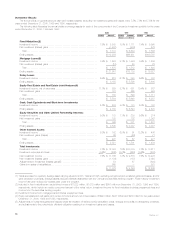

Please find page 11 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the Company’s 1998 year-end asset repositioning program. The reduction in investment income from other invested assets to $501 million in 1999 from

$841 million in 1998 is due to a reduction in leveraged lease balances, resulting from the sale of MetLife Capital Holdings, and lower fees received from

bond prepayments, calls and tenders. The reduction in real estate and real estate joint ventures income is primarily attributable to the timing of sales of

investments held by the Company’s real estate joint ventures.

Other revenues, which are primarily comprised of expense reimbursements from reinsurers and fees related to investment management and

administrative services and securities lending activities, increased by 8% to $2,154 million in 1999 from $1,994 million in 1998. This increase is primarily

attributable to growth of $84 million, or 18%, in Individual Business and $54 million, or 9%, in Institutional Business. The Individual Business increase is

primarily due to a full year of activity from Nathan & Lewis, which was acquired in April 1998. The increase in Institutional Business is due to increases in

its non-medical health and retirement and savings businesses, partially offset by a decrease in its group life business. The Company’s non-medical health

business increased $61 million primarily due to growth in its dental administrative service business. The increase in its retirement and savings business of

$44 million reflects higher administrative fees derived from separate accounts and its defined contribution record-keeping services. The decrease in the

group life business of $51 million is primarily due to lower income in 1999 related to funds used to seed separate accounts.

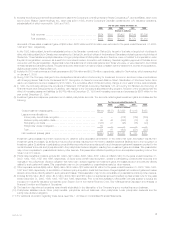

The Company’s investment gains and losses are net of related policyholder amounts. The amounts netted against investment gains and losses are

(i) amortization of deferred policy acquisition costs attributable to the increase or decrease in product gross margins or profits resulting from investment

gains and losses, (ii) future policy benefit loss recognition, and (iii) liabilities for those participating contracts in which the policyholders’ accounts are

increased or decreased by the related investment gains or losses.

Net investment gains (losses) decreased by 103% to $(70) million in 1999 from $2,021 million in 1998. This decrease reflects total gross investment

losses of $(137) million, a decrease of 105%, from total gross investment gains of $2,629 million in 1998, before the offsets for the amortization of

deferred policy acquisition costs of $46 million and $(240) million, loss recognition of $0 million and $(272) million and reductions in and (additions to)

participating contracts of $21 million and $(96) million related to assets sold in 1999 and 1998, respectively. A significant portion of the Company’s net

investment gains in 1998 is attributable to a sales program initiated in the fourth quarter of 1998, which it conducted as part of its strategy to reposition its

investment portfolio in order to provide a higher operating rate of return on its invested assets. In connection with this repositioning, the Company reduced

its investments in treasury securities and corporate equities and increased its investments in fixed maturities with a higher current yield. Net investment

losses in 1999 reflect the continuation of the Company’s strategy to reposition its investment portfolio in order to provide a higher operating rate of return

on its invested assets.

The Company believes its policy of netting related policyholder amounts against investment gains and losses provides important information in

evaluating its operating performance. Investment gains and losses are often excluded by investors when evaluating the overall financial performance of

insurers. The Company believes its presentation enables readers of its consolidated statements of income to easily exclude investment gains and losses

and the related effects on the consolidated statements of income when evaluating its operating performance. The Company’s presentation of investment

gains and losses net of policyholder amounts may be different from the presentation used by other insurance companies and, therefore, amounts in its

consolidated statements of income may not be comparable with amounts reported by other insurers.

Policyholder benefits and claims increased by 4% to $13,100 million in 1999 from $12,638 million in 1998. This increase reflected total gross

policyholder benefits and claims of $13,079 million, an increase of $73 million from $13,006 million in 1998, before the offsets for loss recognition of

$272 million in 1998 (there were no offsets for loss recognition in 1999) and (reductions in) or additions to participating contractholder accounts of $(21)

million and $96 million directly related to net investment gains and losses for the years ended December 31, 1999 and 1998, respectively. This increase

was primarily attributable to increases of $296 million, or 5%, in Institutional Business and $272 million, or 26%, in Auto & Home, partially offset by a

decrease of $139 million, or 23%, in International. The Institutional Business increase is primarily due to overall premium growth within its group dental and

disability businesses. The increase in Auto & Home is primarily due to the St. Paul acquisition of $195 million, a 6% increase in the number of policies in

force and $23 million of unfavorable claims development due to lower than expected savings resulting from the implementation of a new technology

platform. The decrease in International is attributable to the sale of a substantial portion of the Company’s Canadian operations.

Interest credited to policyholder account balances decreased by 10% to $2,441 million in 1999 from $2,711 million in 1998. This decrease is

attributable to reductions of $169 million, or 14%, in Institutional Business, $64 million, or 4%, in Individual Business, and $37 million, or 42%, in

International. Group insurance in Institutional Business decreased by $63 million, or 14%, primarily due to cancellations in the leveraged corporate-owned

life insurance business attributable to a change in the federal income tax treatment for those products. In addition, retirement and savings products

declined by $106 million, or 14%, reflecting a shift in policyholders’ investment preferences from guaranteed interest products to separate account

alternatives. The decrease in Individual Business is the result of a 1998 annuity reinsurance transaction, as well as a shift in policyholders’ preferences to

separate account alternatives. The International decrease is due to the sale of a substantial portion of the Company’s Canadian operations.

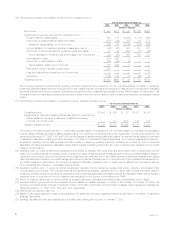

Policyholder dividends increased by 2% to $1,690 million in 1999 from $1,651 million in 1998. This increase is attributable to increases of $64

million, or 4%, in Individual Business and $17 million, or 12%, in Institutional Business, which are somewhat offset by a $42 million, or 66%, decrease in

International. The increase in Individual Business is primarily due to growth in cash values of policies associated with the Company’s large block of

traditional life insurance business combined with a dividend scale increase on certain mature policies in 1999. Policyholder dividends within Institutional

Business vary from period to period based on participating group insurance contract experience. The International decrease is due to the sale of a

substantial portion of the Company’s Canadian operations.

Demutualization costs are $260 million and $6 million for the years ended December 31, 1999 and 1998, respectively. These costs related to

Metropolitan Life’s demutualization efforts.

Other expenses decreased by 16% to $6,755 million in 1999 from $8,019 million in 1998. This decrease reflects total gross other expenses of

$6,709 million, a decrease of 19%, from $8,259 million in 1998, before the offset for amortization of deferred policy acquisition costs directly attributable

to net investment gains and losses of $(46) million and $240 million for the years ended December 31, 1999 and 1998, respectively. Excluding the effect

of the pay down of debt with proceeds from the sale of MetLife Capital Holdings, Inc. in 1998, other expenses decreased by $1,372 million. This

decrease is attributable to a $1,570 million, or 60%, decrease in Corporate. The decrease in Corporate is primarily due to a $1,895 million charge in

1998 for sales practices claims and claims for personal injuries caused by exposure to asbestos or asbestos-containing products, compared with a

$499 million charge in 1999. The 1999 charge is principally related to the settlement of a multidistrict litigation proceeding involving alleged improper sale

practices, accruals for sales practices claims not covered by the settlement and other legal costs. The 1998 charge of $1,895 million is comprised of

$925 million and $970 million for sales practices claims and asbestos-related claims, respectively. The Company recorded the accrual for sales practices

claims based on preliminary settlement discussions and the settlement history of other insurers.

MetLife, Inc.

8