MetLife 2000 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fixed Maturities

Fixed maturities consist principally of publicly traded and privately placed debt securities, and represented 70.7% and 69.9% of total cash and

invested assets at December 31, 2000 and 1999, respectively.

Based on estimated fair value, public fixed maturities and private fixed maturities comprised 83.6% and 16.4%, respectively, of total fixed maturities

at December 31, 2000 and 82.6% and 17.4%, respectively, at December 31, 1999. The Company invests in privately placed fixed maturities to enhance

the overall value of its portfolio, increase diversification and obtain higher yields than can ordinarily be obtained with comparable public market securities.

Generally, private placements provide the Company with protective covenants, call protection features and, where applicable, a higher level of collateral.

However, the Company may not freely trade its private placements because of restrictions imposed by federal and state securities laws and illiquid

trading markets.

The Securities Valuation Office of the NAIC evaluates the bond investments of insurers for regulatory reporting purposes and assigns securities to

one of six investment categories called ‘‘NAIC designations.’’ The NAIC designations parallel the credit ratings of the Nationally Recognized Statistical

Rating Organizations for marketable bonds. NAIC designations 1 and 2 include bonds considered investment grade (rated ‘‘Baa3’’ or higher by Moody’s,

or rated ‘‘BBB–’’ or higher by S&P) by such rating organizations. NAIC designations 3 through 6 include bonds considered below investment grade (rated

‘‘Ba1’’ or lower by Moody’s, or rated ‘‘BB+’’ or lower by S&P).

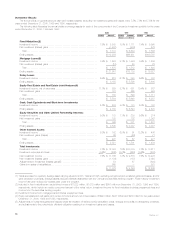

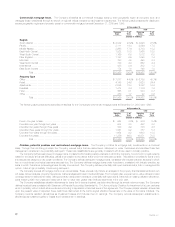

The following table presents the Company’s total fixed maturities by NAIC designation and the equivalent ratings of the Nationally Recognized

Statistical Rating Organizations at December 31, 2000 and December 31, 1999, as well as the percentage, based on estimated fair value, that each

designation comprises:

At December 31, 2000 At December 31, 1999

Estimated Estimated

NAIC Rating Agency Amortized Fair % of Amortized Fair % of

Rating Equivalent Designation Cost Value Total Cost Value Total

(Dollars in millions)

1 AAa/Aa/A **************************************** $ 72,170 $ 74,389 65.9% $62,855 $62,207 64.2%

2 Baa ********************************************* 28,470 28,405 25.1 26,883 25,951 26.8

3Ba********************************************** 5,935 5,650 5.0 5,808 5,636 5.8

4B*********************************************** 3,964 3,758 3.3 3,017 2,969 3.1

5 Caa and lower ************************************ 123 95 0.1 168 141 0.1

6 In or near default ********************************** 319 361 0.3 68 67 0.0

Subtotal**************************************** 110,981 112,658 99.7 98,799 96,971 100.0

Redeemable preferred stock ************************* 321 321 0.3 10 10 0.0

Total fixed maturities******************************** $111,302 $112,979 100.0% $98,809 $96,981 100.0%

Based on estimated fair values, total investment grade public and private placement fixed maturities comprised 91.0% of total fixed maturities in the

general account at both December 31, 2000 and 1999.

The following table shows the amortized cost and estimated fair value of fixed maturities, by contractual maturity dates (excluding scheduled sinking

funds) at December 31, 2000 and 1999:

At December 31,

2000 1999

Amortized Estimated Amortized Estimated

Cost Fair Value Cost Fair Value

(Dollars in millions)

Due in one year or less **************************************************** $ 3,465 $ 3,460 $ 3,180 $ 3,217

Due after one year through five years ***************************************** 21,041 21,275 18,152 18,061

Due after five years through ten years***************************************** 23,872 23,948 23,755 23,114

Due after ten years ******************************************************** 29,564 30,402 26,316 25,918

Subtotal ************************************************************* 77,942 79,085 71,403 70,310

Mortgage-backed and other asset-backed securities **************************** 33,039 33,573 27,396 26,661

Subtotal ************************************************************* 110,981 112,658 98,799 96,971

Redeemable preferred stock ************************************************ 321 321 10 10

Total fixed maturities ******************************************************* $111,302 $112,979 $98,809 $96,981

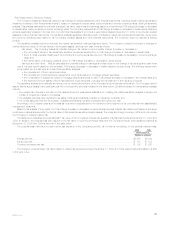

Problem, potential problem and restructured fixed maturities. The Company monitors fixed maturities to identify investments that

management considers to be problems or potential problems. The Company also monitors investments that have been restructured.

The Company defines problem securities in the fixed maturities category as securities as to which principal or interest payments are in default or are

to be restructured pursuant to commenced negotiations, or as securities issued by a debtor that has entered into bankruptcy.

The Company defines potential problem securities in the fixed maturity category as securities of an issuer deemed to be experiencing significant

operating problems or difficult industry conditions. The Company uses various criteria, including the following, to identify potential problem securities:

)debt service coverage or cash flow falling below certain thresholds which vary according to the issuer’s industry and other relevant factors;

)significant declines in revenues or margins;

)violation of financial covenants;

)public securities trading at a substantial discount as a result of specific credit concerns; and

)other subjective factors.

The Company defines restructured securities in the fixed maturities category as securities to which the Company has granted a concession that it

would not have otherwise considered but for the financial difficulties of the obligor. The Company enters into a restructuring when it believes it will realize a

greater economic value under the new terms rather than through liquidation or disposition. The terms of the restructuring may involve some or all of the

MetLife, Inc. 19