MetLife 2000 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

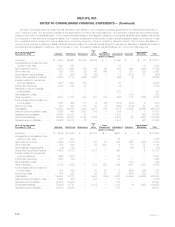

Holding Company issued 30,300,000 additional shares of common stock as a result of the exercise of over-allotment options granted to underwriters in

the initial public offering.

On June 27, 2000, the Holding Company’s Board of Directors authorized the repurchase of up to $1 billion of the Holding Company’s outstanding

common stock, over an unspecified period of time. Under this authorization, the Holding Company may purchase the common stock from the

Metropolitan Life Policyholder Trust, in the open market, and in private transactions. Through December 31, 2000, 26,084,751 shares of common stock

have been acquired for $613 million.

Dividend Restrictions

Under the New York Insurance Law, Metropolitan Life is permitted without prior insurance regulatory clearance to pay a stockholder dividend to the

Holding Company as long as the aggregate amount of all such dividends in any calendar year does not exceed the lesser of (i) 10% of its surplus to

policyholders as of the immediately preceding calendar year and (ii) its net gain from operations for the immediately preceding calendar year (excluding

realized investment gains). Metropolitan Life will be permitted to pay a stockholder dividend to the Holding Company in excess of the lesser of such two

amounts only if it files notice of its intention to declare such a dividend and the amount thereof with the Superintendent and the Superintendent does not

disapprove the distribution. Under the New York Insurance Law, the Superintendent has broad discretion in determining whether the financial condition of

a stock life insurance company would support the payment of such dividends to its stockholders. The New York State Insurance Department (the

‘‘Department’’) has established informal guidelines for such determinations. The guidelines, among other things, focus on the insurer’s overall financial

condition and profitability under statutory accounting practices. At December 31, 2000, Metropolitan Life could pay the Holding Company a stockholder

dividend of $721 million without prior approval of the Superintendent.

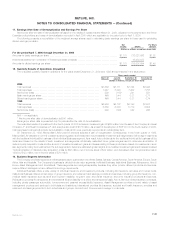

Stock Option Plans

The Holding Company has adopted the MetLife, Inc. 2000 Stock Incentive Plan (‘‘Stock Incentive Plan’’) and the MetLife, Inc. 2000 Directors Stock

Plan (‘‘Directors Stock Plan’’). These plans provide for the issuance of incentive stock options primarily to employees and directors of the Company.

Under the terms of these plans, options will be granted at not less than the fair market value of the common stock on the date of grant. Under the terms

of the Stock Incentive Plan, options will become exercisable as established by the board of directors (generally ratably over three years) and generally will

expire ten years from the date of grant. Under the terms of the Directors Stock Plan, options will have a term of ten years and vest immediately at the date

of grant. At December 31, 2000, 37,823,333 shares of common stock are available for grant. There were no options granted or outstanding relating to

these plans at December 31, 2000.

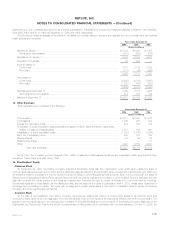

Statutory Equity and Income

Applicable insurance department regulations require that the insurance subsidiaries prepare statutory financial statements in accordance with

statutory accounting practices prescribed or permitted by the insurance department of the state of domicile. Statutory accounting practices primarily differ

from accounting principles generally accepted in the United States of America by charging policy acquisition costs to expense as incurred, establishing

future policy benefit liabilities using different actuarial assumptions, not providing for deferred income taxes, reporting surplus notes as surplus, and

valuing securities on a different basis. Statutory net income of Metropolitan Life, as filed with the Department, was $1,027 million, $790 million, and $875

million for the years ended 2000, 1999 and 1998, respectively; statutory capital and surplus,as filed, was $7,213 million and $7,630 million at

December 31, 2000 and 1999, respectively.

In March 1998, the National Association of Insurance Commissioners (‘‘NAIC’’) adopted the Codification of Statutory Accounting Principles (the

‘‘Codification’’). The Codification, which is intended to standardize regulatory accounting and reporting to state insurance departments, is effective

January 1, 2001. However, statutory accounting principles will continue to be established by individual state laws and permitted practices. The

Department requires adoption of the Codification, with certain modifications, for the preparation of statutory financial statements effective January 1,

2001. The Company believes that the adoption, effective January 1, 2001, of the Codification by the NAIC and the Codification as modified by the

Department, as currently interpreted, will not adversely affect statutory capital and surplus.

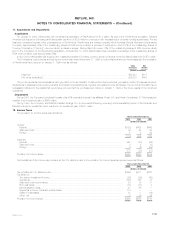

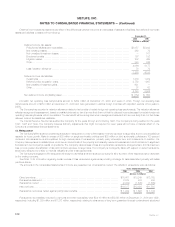

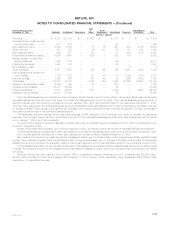

16. Other Comprehensive Income (Loss)

The following table sets forth the reclassification adjustments required for the years ended December 31, 2000, 1999 and 1998 to avoid double-

counting in other comprehensive income (loss) items that are included as part of net income for the current year that have been reported as a part of

other comprehensive income (loss) in the current or prior year:

2000 1999 1998

(Dollars in millions)

Holding gains (losses) on investments arising during the year ********************************************* $2,789 $(6,314) $1,493

Income tax effect of holding gains or losses************************************************************ (969) 2,262 (617)

Reclassification adjustments:

Recognized holding losses (gains) included in current year income*************************************** 989 38 (2,013)

Amortization of premium and discount on investments ************************************************* (499) (307) (350)

Recognized holding (losses) gains allocated to other policyholder amounts ******************************** (54) (67) 608

Income tax effect ******************************************************************************** (151) 120 729

Allocation of holding (gains) losses on investments relating to other policyholder amounts ********************** (971) 3,788 (351)

Income tax effect of allocation of holding gains or losses to other policyholder amounts *********************** 338 (1,357) 143

Net unrealized investment gains (losses) *************************************************************** 1,472 (1,837) (358)

Foreign currency translation adjustments arising during the year ******************************************* (6) 50 (115)

Reclassification adjustment for sale of investment in foreign operation****************************************** —— 2

Foreign currency translation adjustment**************************************************************** (6) 50 (113)

Minimum pension liability adjustment ****************************************************************** (9) (7) (12)

Other comprehensive income (loss) ******************************************************************* $1,457 $(1,794) $ (483)

MetLife, Inc.

F-32