MetLife 2000 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

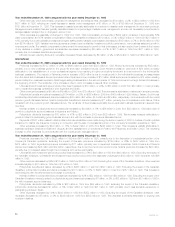

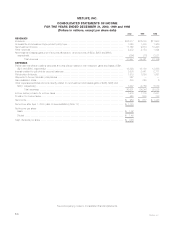

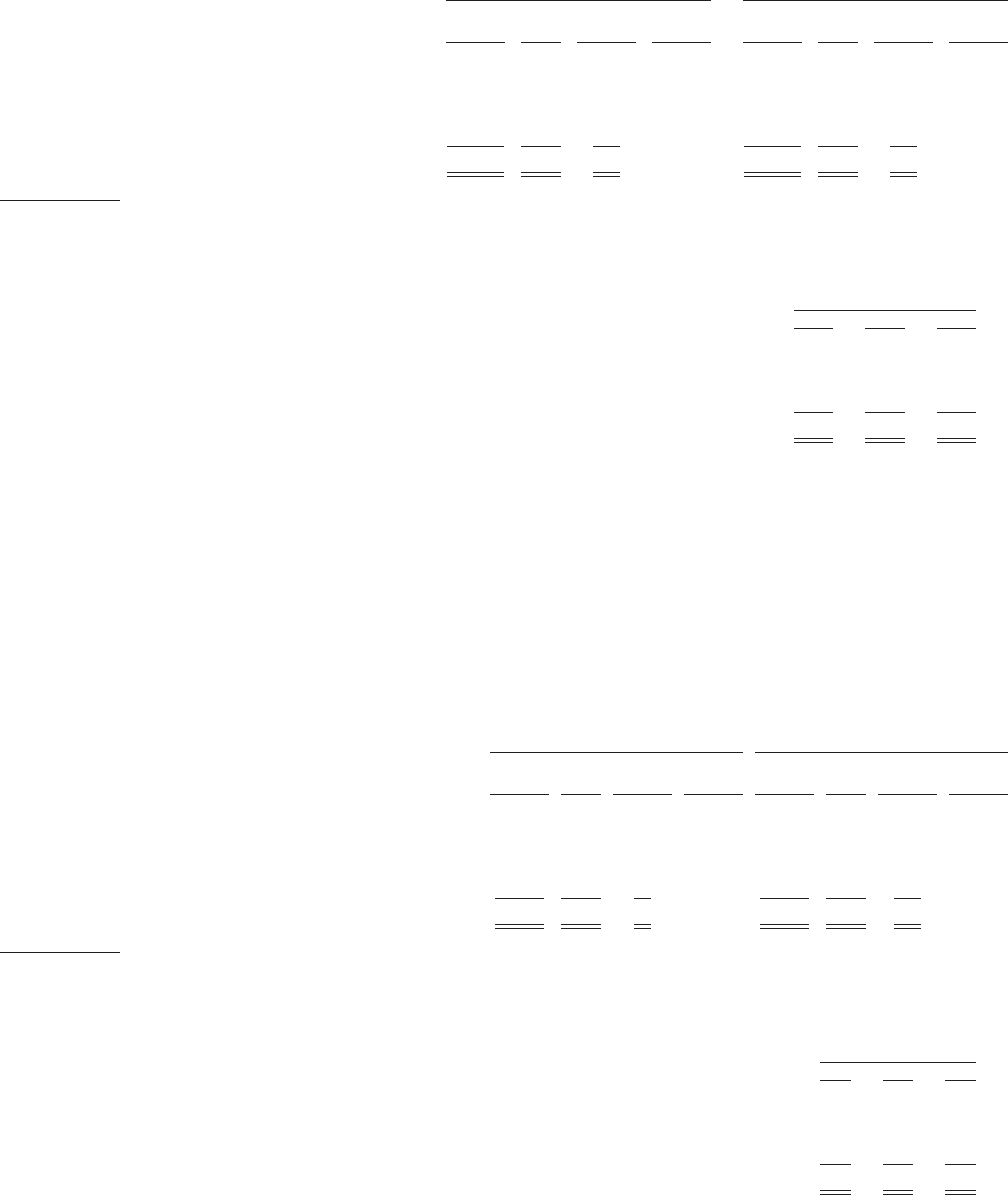

The following table presents the amortized cost and valuation allowances for commercial mortgage loans distributed by loan classification at

December 31, 2000 and 1999:

At December 31, 2000 At December 31, 1999

% of % of

Amortized % of Valuation Amortized Amortized % of Valuation Amortized

Cost(1) Total Allowance Cost Cost(1) Total Allowance Cost

(Dollars in millions)

Performing ******************************************** $16,169 95.5% $15 0.1% $14,098 94.5% $11 0.1%

Restructured******************************************* 646 3.8 47 7.3% 810 5.4 52 6.4%

Delinquent or under foreclosure*************************** 24 0.1 4 16.7% 17 0.1 4 25.0%

Potentially delinquent************************************ 106 0.6 10 9.4% 6 0.0 2 33.3%

Total ***************************************** $16,945 100.0% $76 0.4% $14,931 100.0% $69 0.5%

(1) Amortized cost is equal to carrying value before valuation allowances.

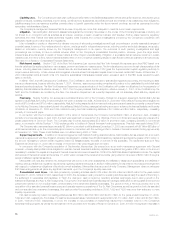

The following table presents the changes in valuation allowances for commercial mortgage loans for the years ended December 31, 2000, 1999

and 1998:

Year ended December 31,

2000 1999 1998

(Dollars in millions)

Balance, beginning of year ********************************************************************** $ 69 $ 142 $ 259

Additions ************************************************************************************* 61 36 30

Deductions for writedowns and dispositions ******************************************************** (54) (109) (147)

Balance, end of year *************************************************************************** $ 76 $ 69 $ 142

The principal risks in holding commercial mortgage loans are property specific, supply and demand, financial and capital market risks. Property

specific risks include the geographic location of the property, the physical condition of the property, the diversity of tenants and the rollover of their leases

and the ability of the property manager to attract tenants and manage expenses. Supply and demand risks include changes in the supply and/or demand

for rental space which cause changes in vacancy rates and/or rental rates. Financial risks include the overall level of debt on the property and the amount

of principal repaid during the loan term. Capital market risks include the general level of interest rates, the liquidity for these securities in the marketplace

and the capital available loan for refinancing.

Agricultural mortgage loans. The Company diversifies its agricultural mortgage loans by both geographic region and product type. The

Company manages these investments through a network of regional offices and field professionals overseen by its investment department.

Approximately 59.9% of the $4,973 million of agricultural mortgage loans outstanding at December 31, 2000 was subject to rate resets prior to

maturity. A substantial portion of these loans were successfully renegotiated and remain outstanding to maturity. The process and policies for monitoring

the agricultural mortgage loans and classifying them by performance status are generally the same as those for the commercial loans.

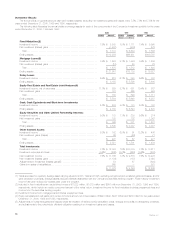

The following table presents the amortized cost and valuation allowances for agricultural mortgage loans distributed by loan classification at

December 31, 2000 and 1999:

At December 31, 2000 At December 31, 1999

% of % of

Amortized % of Valuation Amortized Amortized % of Valuation Amortized

Cost(1) Total Allowance Cost Cost(1) Total Allowance Cost

(Dollars in millions)

Performing ************************************************** $4,771 95.7% $1 0.0% $4.616 95.8% $ 1 0.0%

Restructured************************************************* 172 3.5 2 1.2% 165 3.4 11 6.7%

Delinquent or under foreclosure********************************* 24 0.5 4 16.7% 27 0.6 2 7.4%

Potentially delinquent******************************************* 13 0.3 0 2.3% 8 0.2 4 50.0%

Total *********************************************** $4,980 100.0% $7 0.1% $4,816 100.0% $18 0.4%

(1) Amortized cost is equal to carrying value before valuation allowances.

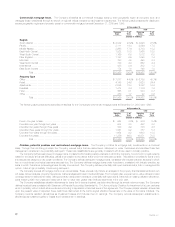

The following table presents the changes in valuation allowances for agricultural mortgage loans for the years ended December 31, 2000, 1999 and

1998:

Year ended December 31,

2000 1999 1998

(Dollars in millions)

Balance, beginning of year************************************************************************** $18 $28 $27

Additions **************************************************************************************** 8410

Deductions for writedowns and dispositions *********************************************************** (19) (14) (9)

Balance, end of year ****************************************************************************** $7 $18 $28

The principal risks in holding agricultural mortgage loans are property specific, supply and demand, financial and capital market risks. Property

specific risks include the geographic location of the property, soil types, weather conditions and the other factors that may impact the borrower’s

MetLife, Inc. 23