MetLife 2000 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

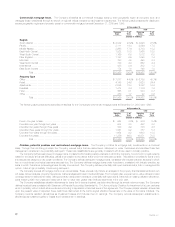

Problem and Potential Problem Equity Securities and Other Limited Partnership Interests

The Company monitors its equity securities and other limited partnership interests on a continual basis. Through this monitoring process, the

Company identifies investments that management considers to be problems or potential problems.

Problem equity securities and other limited partnership interests are defined as securities (1) in which significant declines in revenues and/or margins

threaten the ability of the issuer to continue operating or (2) where the issuer has subsequently entered bankruptcy.

Potential problem equity securities and other limited partnership interests are defined as securities issued by a company that is experiencing

significant operating problems or difficult industry conditions. Criteria generally indicative of these problems or conditions are (1) cash flows falling below

varying thresholds established for the industry and other relevant factors, (2) significant declines in revenues and/or margins, (3) public securities trading

at a substantial discount as a result of specific credit concerns, and (4) other information that becomes available.

Equity securities or other limited partnership interests which are deemed to be other than temporarily impaired are written down to fair value. Write-

downs are recorded as investment losses and are included in earnings and the cost basis of the equity securities and other limited partnership interests

are adjusted accordingly. The new cost basis is not changed for subsequent recoveries in value. For the years ended December 31, 2000 and 1999,

such write-downs were $18 million and $30 million, respectively.

Other Invested Assets

The Company’s other invested assets consisted principally of leveraged leases, which were recorded net of non-recourse debt. The Company

participates in lease transactions which are diversified by geographic area. The Company regularly reviews residual values and writes down residuals to

expected values as needed. The Company’s other invested assets represented 1.8% and 1.1% of cash and invested assets at December 31, 2000 and

1999, respectively.

Derivative Financial Instruments

The Company uses derivative instruments to reduce the risk associated with changing market values or variable cash flows related to the

Company’s financial assets and liabilities. This objective is achieved through one of two principal risk management strategies: hedging the changes in fair

value of financial assets, liabilities or firm commitments or hedging the variable cash flows of assets, liabilities or forecasted transactions. Hedged

forecasted transactions, other than the receipt or payment of variable interest payments, are not expected to occur more than 12 months after hedge

inception. The Company’s derivative strategy employs a variety of instruments including financial futures, financial forwards, interest rate and foreign

currency swaps, floors, foreign exchange contracts, caps and options.

Effective January 4, 2001, the Company is authorized, under a newly enacted provision of the New York Insurance Law, to use derivatives for

replication. This provision allows the Company to create and invest in synthetic investments by combining a derivative with an existing security to create

the characteristics of a different desired security. The Company expects to take advantage of this new law by transacting in derivatives to replicate

securities in order to manage risks or to increase risk adjusted returns. Many of these transactions are not expected to receive hedge accounting under

the requirements of Statement of Financial Accounting Standards No. 133, Accounting for Derivative Instruments and Hedging Activities. As of the date of

this filing, the Company has not entered into any replication transactions.

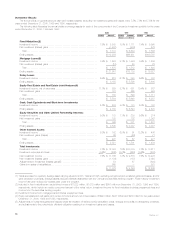

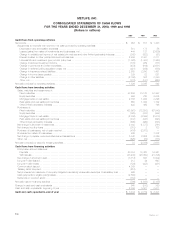

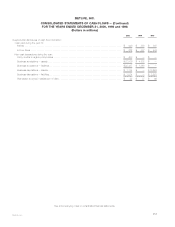

The Company held the following positions in derivative financial instruments at December 31, 2000 and 1999:

At December 31,

2000 1999

Current Market Current Market

or Fair Value or Fair Value

Carrying Notional Carrying Notional

Value Amount Assets Liabilities Value Amount Assets Liabilities

(Dollars in millions)

Financial futures *********************************************** $23 $ 254 $ 23 $— $ 27 $ 3,140 $37 $ 10

Interest rate swaps********************************************* 41 1,549 49 1 (32) 1,316 11 40

Floors******************************************************** — 325 3 — — — — —

Caps ******************************************************** — 9,950 — — 1 12,376 3 —

Foreign currency swaps **************************************** (1) 1,469 267 85 — 4,002 26 103

Exchange traded options**************************************** 110—1————

Total contractual commitments *********************************** $64 $13,557 $342 $87 $ (4) $20,834 $77 $153

Securities Lending

Pursuant to the Company’s securities lending program, it lends securities to major brokerage firms. The Company’s policy requires a minimum of

102% of the fair value of the loaned securities as collateral, calculated on a daily basis. The Company’s securities on loan at December 31, 2000 and

1999 had estimated fair values of $12,289 million and $6,391 million, respectively.

Separate Account Assets

The Company manages each separate account’s assets in accordance with the prescribed investment policy that applies to that specific separate

account. The Company establishes separate accounts on a single client and multi-client comingled basis in conformity with insurance laws. Generally,

separate accounts are not chargeable with liabilities that arise from any other business of the Company. Separate account assets are subject to claims of

the Company’s general account claims only to the extent that the value of such assets exceeds the separate account liabilities, as defined by the

account’s contract. If the Company uses a separate account to support a contract providing guaranteed benefits, the Company must comply with the

asset maintenance requirements stipulated under Regulation 128 of the New York Insurance Department. The Company monitors these requirements at

least monthly and, in addition, performs cash flow analyses, similar to that conducted for the general account, on an annual basis. The Company reports

separately as assets and liabilities investments held in separate accounts and liabilities of the separate accounts. The Company reports substantially all

separate account assets at their fair market value. Investment income and gains or losses on the investments of separate accounts accrue directly to

contract holders, and, accordingly, the Company does not reflect them in its consolidated statements of income and cash flows. The Company reflects

in its revenues fees charged to the separate accounts by the Company, including mortality charges, risk charges, policy administration fees, investment

management fees and surrender charges.

MetLife, Inc. 25