MetLife 2000 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

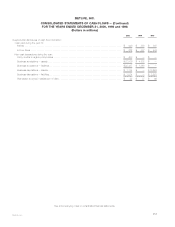

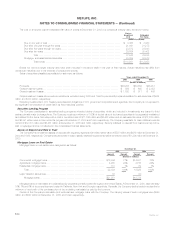

Net Investment Gains (Losses)

Net investment gains (losses), including changes in valuation allowances, were as follows:

Years ended December 31,

2000 1999 1998

(Dollars in millions)

Fixed maturities ***************************************************************************** $(1,437) $(538) $ 573

Equity securities **************************************************************************** 192 99 994

Mortgage loans on real estate***************************************************************** (18) 28 23

Real estate and real estate joint ventures ******************************************************* 101 265 424

Other limited partnership interests************************************************************** (7) 33 13

Sales of businesses ************************************************************************* 660 — 531

Other ************************************************************************************* 65 (24) 71

Total ********************************************************************************** (444) (137) 2,629

Amounts allocable to:

Future policy benefit loss recognition ********************************************************* — — (272)

Deferred policy acquisition costs ************************************************************ 95 46 (240)

Participating contracts ********************************************************************* (126) 21 (96)

Policyholder dividend obligation************************************************************** 85 — —

Net investment (losses) gains ************************************************************* $ (390) $ (70) $2,021

Investment gains and losses have been reduced by (1) additions to future policy benefits resulting from the need to establish additional liabilities due

to the recognition of investment gains, (2) deferred policy acquisition cost amortization to the extent that such amortization results from investment gains

and losses, (3) additions to participating contractholder accounts when amounts equal to such investment gains and losses are credited to the

contractholders’ accounts, and (4) adjustments to the policyholder dividend obligation resulting from investment gains and losses. This presentation may

not be comparable to presentations made by other insurers.

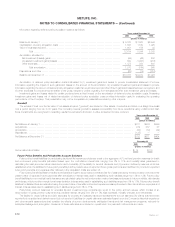

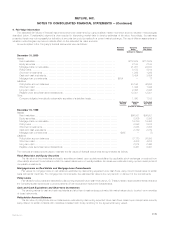

Net Unrealized Investment Gains (Losses)

The components of net unrealized investment gains (losses), included in accumulated other comprehensive income (loss), were as follows:

Years ended December 31,

2000 1999 1998

(Dollars in millions)

Fixed maturities*************************************************************************** $ 1,677 $(1,828) $ 4,809

Equity securities ************************************************************************** 744 875 832

Other invested assets ********************************************************************* 70 165 154

Total ******************************************************************************** 2,491 (788) 5,795

Amounts allocable to:

Future policy benefit loss recognition ******************************************************* (284) (249) (2,248)

Deferred policy acquisition costs ********************************************************** 107 697 (931)

Participating contracts ******************************************************************* (133) (118) (212)

Policyholder dividend obligation *********************************************************** (385) — —

Deferred income taxes********************************************************************* (621) 161 (864)

Total ******************************************************************************** (1,316) 491 (4,255)

Net unrealized investment gains (losses) ********************************************** $ 1,175 $ (297) $ 1,540

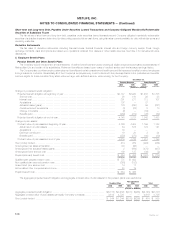

The changes in net unrealized investment gains (losses) were as follows:

Years ended December 31,

2000 1999 1998

(Dollars in millions)

Balance at January 1 *********************************************************************** $ (297) $ 1,540 $1,898

Unrealized investment gains (losses) during the year ********************************************* 3,279 (6,583) (870)

Unrealized investment gains (losses) relating to:

Future policy benefit (loss) gain recognition *************************************************** (35) 1,999 (59)

Deferred policy acquisition costs *********************************************************** (590) 1,628 216

Participating contracts ******************************************************************** (15) 94 100

Policyholder dividend obligation ************************************************************ (385) — —

Deferred income taxes********************************************************************** (782) 1,025 255

Balance at December 31 ******************************************************************* $1,175 $ (297) $1,540

Net change in unrealized investment gains (losses) ********************************************** $1,472 $(1,837) $ (358)

MetLife, Inc. F-17