MetLife 2000 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

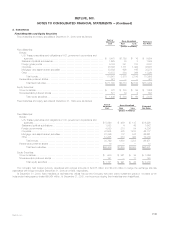

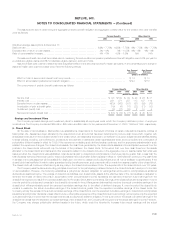

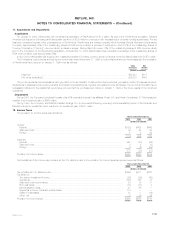

Closed block revenues and expenses were as follows:

April 7, 2000

through

December 31, 2000

(Dollars in millions)

Revenues

Premiums ***************************************************************************** $2,900

Net investment income ****************************************************************** 1,949

Net investment losses (net of amounts allocable to the policyholder dividend obligation of $(85)) ***** (150)

Total revenues 4,699

Expenses

Policyholder benefits and claims*********************************************************** 2,874

Policyholder dividends ******************************************************************* 1,132

Change in policyholder dividend obligation (includes amounts directly related to net investment losses

of $(85))***************************************************************************** 85

Other expenses ************************************************************************ 425

Total expenses 4,516

Revenues net of expenses before income taxes ********************************************* 183

Income taxes ************************************************************************** 67

Revenues net of expenses and income taxes *********************************************** $ 116

The change in maximum future earnings of the closed block was as follows:

(Dollars in millions)

April 7, 2000*************************************************************************** $5,628

December 31, 2000 ******************************************************************** 5,512

Change during the period **************************************************************** $ (116)

Metropolitan Life charges the closed block with federal income taxes, state and local premium taxes, and other additive state or local taxes, as well

as investment management expenses relating to the closed block as provided in the plan of reorganization. Metropolitan Life also charges the closed

block for expenses of maintaining the policies included in the closed block.

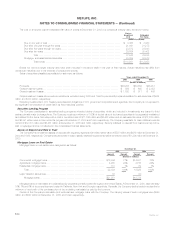

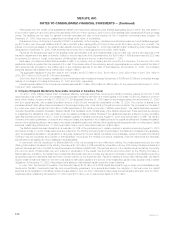

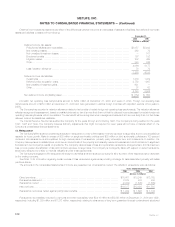

7. Separate Accounts

Separate accounts reflect two categories of risk assumption: non-guaranteed separate accounts totaling $53,656 million and $47,618 million at

December 31, 2000 and 1999, respectively, for which the policyholder assumes the investment risk, and guaranteed separate accounts totaling

$16,594 million and $17,323 million at December 31, 2000 and 1999, respectively, for which the Company contractually guarantees either a minimum

return or account value to the policyholder.

Fees charged to the separate accounts by the Company (including mortality charges, policy administration fees and surrender charges) are reflected

in the Company’s revenues as universal life and investment-type product policy fees and totaled $667 million, $485 million and $413 million for the years

ended December 31, 2000, 1999 and 1998, respectively. Guaranteed separate accounts consisted primarily of Met Managed Guaranteed Interest

Contracts and participating close out contracts. The average interest rates credited on these contracts were 6.9% and 6.5% at December 31, 2000 and

1999, respectively. The assets that support these liabilities were comprised of $15,708 million and $16,874 million in fixed maturities at December 31,

2000 and 1999, respectively. The portfolios are segregated from other investments and are managed to minimize liquidity and interest rate risk. In order

to minimize the risk of disintermediation associated with early withdrawals, these investment products carry a graded surrender charge as well as a

market value adjustment.

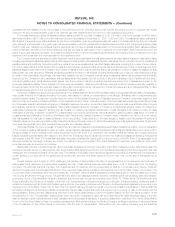

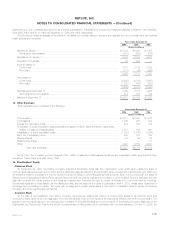

8. Debt

Debt consisted of the following:

December 31,

2000 1999

(Dollars in millions)

Surplus notes, interest rates ranging from 6.30% to 7.80%, maturity dates ranging from 2003 to 2025 ***** $1,650 $1,546

Investment related exchangeable debt, interest rates ranging from 4.90% to 5.40%, due 2001 and 2002 *** 271 369

Fixed rate notes, interest rates ranging from 5.29% to 10.50%, maturity dates ranging from 2001 to 2009 ** 316 187

Senior notes, interest rates ranging from 7.06% to 7.25%, maturity dates ranging from 2003 to 2007 ****** 98 270

Capital lease obligations *********************************************************************** 42 44

Other notes with varying interest rates *********************************************************** 49 98

Total long-term debt ************************************************************************** 2,426 2,514

Total short-term debt ************************************************************************** 1,094 4,208

Total ******************************************************************************* $3,520 $6,722

MetLife, Inc. F-23