MetLife 2000 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

chairman’s letter

To MetLife Shareholders:

MetLife’s corporate vision—to build financial freedom for everyone—guides our response to people’s

growing need for first-rate financial products and services through various life stages and economic

cycles. Our trusted brand, capital strength, and existing relationships with nine million U.S. households

and 70,000 corporations representing 33 million individuals uniquely position MetLife among its competi-

tors. We plan to become the recognized leader throughout the world for relationship building, connect-

edness and caring in financial services, serving 100 million customers by 2010. We have the talent and

resources to succeed in this effort.

The ‘‘everyone’’ in our vision took on added meaning in 2000 as we welcomed an important new

constituency: you, our shareholders.

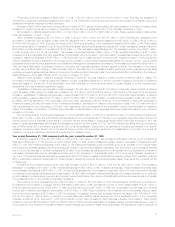

MetLife transformed itself from mutual to stock ownership in April 2000 through a demutualization and initial public offering that was

completed just 18 months after Board authorization. The transaction raised $5.2 billion and made MetLife America’s most widely held

stock. We are proud to report our annual results for the first time as a public company.

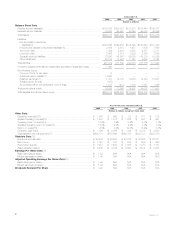

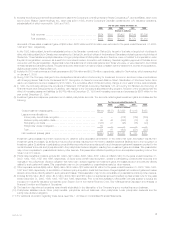

HOperating Earnings Increase 18%

For the year 2000, MetLife’s after-tax operating earnings increased 18%, to $1.54 billion from adjusted operating earnings of $1.31

billion in 1999. Diluted operating earnings per share for 2000 were $1.96, on a pro forma basis. Operating return on equity increased to

10.5% for the year, from adjusted operating return on equity of 9.5% in 1999.

Most lines of business contributed to this strong performance. Operating earnings from Individual Business rose 38%. The continuing

integration of GenAmerica Financial, the St. Louis-based insurer acquired by MetLife through a transaction completed in January 2000,

was a major contributor to the year’s growth.

Institutional Business maintained its market leadership across product lines; however, revenue increases were partially offset by a

planned increase in spending on technology and customer service improvements to support future growth. As a result, the increase in

operating earnings was 4%.

MetLife Auto & Home’s operating earnings were down 20% due to higher catastrophe losses and the cost of integrating The St. Paul

Companies personal lines property and casualty business. However, The St. Paul Companies’ business contributed to a 27% increase in

written premiums, which should bode well for future growth.

International operations showed a 39% improvement in operating earnings, thanks to stronger growth in South Korea and Mexico.

With new licenses to do business in Poland and the Philippines, and continuing efforts to enter markets in India and China, we expect

steady growth in our International operations over the next several years.

Reinsurance, a new line of business created through MetLife’s 59% ownership in Reinsurance Group of America (NYSE:RGA), part of

the GenAmerica acquisition, contributed $72 million in operating earnings.

In our asset management business, we sold the 48% interest we held in Nvest for $858 million, and made Conning Corporation a

wholly-owned subsidiary. We acquired a majority interest in Conning through our purchase of GenAmerica Financial and bought the

remaining shares outstanding in a tender offer. Going forward, our growth in the asset management field will be focused through

Conning, which serves insurance companies and institutions, and through State Street Research & Management Company, another

wholly-owned subsidiary, which serves both institutional and individual investors. As a result of the Nvest sale, total assets under

management decreased by 19% to $302.2 billion.

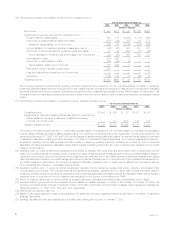

HExpense Management Through Consolidation and Integration

The on-going integration of GenAmerica Financial and New England Financial is creating greater efficiencies and economies of scale.

Our goal of supporting all our brands from a common platform—including administrative and investment support services, business

processes, product development, compliance standards and compensation and benefits packages—is nearly realized.

Expense management remains one of MetLife’s highest priorities. We continued to consolidate sales offices, reducing the total

number by 21%, and to raise the bar for office and agent productivity.

HTechnology Solutions Improve Service and Efficiency

MetLife invested $395 million in new information technology initiatives in 2000, with 50% of application development resources

devoted to re-engineering core business processes and converting and integrating Web-based e-Business and financial systems.

Before gaining approval for funding, every non-essential project underwent a rigorous return-on-investment analysis to be sure it met or

exceeded a minimum 15% standard.