MetLife 2000 Annual Report Download - page 12

Download and view the complete annual report

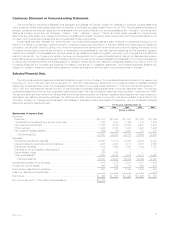

Please find page 12 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Prior to the fourth quarter of 1998, the Company established a liability for asbestos-related claims based on settlement costs for claims that it had

settled, estimates of settlement costs for claims pending against it and an estimate of settlement costs for unasserted claims. The amount for unasserted

claims is based on management’s estimate of unasserted claims that would be probable of assertion. A liability is not established for claims which the

Company believes are only reasonably possible of assertion. Based on this process, the Company’s accrual for asbestos-related claims at Decem-

ber 31, 1997 was $386 million. The Company’s potential liabilities for asbestos-related claims are not easily quantified, due to the nature of the

allegations against it, which are not related to the business of manufacturing, producing, distributing or selling asbestos or asbestos-containing products,

adding to the uncertainty in the number of claims brought against it.

During 1998, the Company decided to pursue the purchase of insurance to limit its exposure to asbestos-related claims. In connection with its

negotiations with the casualty insurers to obtain this insurance, the Company obtained information that caused it to reassess its accruals for asbestos-

related claims. This information included:

)Information from the insurers regarding the asbestos-related claims experience of other insureds, which indicated that the number of claims that

were probable of assertion against the Company in the future was significantly greater than it had assumed in its accruals. The number of claims

brought against it is generally a reflection of the number of asbestos-related claims brought against asbestos defendants generally and the

percentage of those claims in which the Company is included as a defendant. The information provided to the Company relating to other insureds

indicated that it had been included as defendants for a significant percentage of total asbestos-related claims and that it may be included in a

larger percentage of claims in the future, because of greater awareness of asbestos litigation generally by potential plaintiffs and plaintiffs’ lawyers

and because of the bankruptcy and reorganization or the exhaustion of insurance coverage of other asbestos defendants; and that, although

volatile, there was an upward trend in the number of total claims brought against asbestos defendants.

)Information derived from actuarial calculations the Company made in the fourth quarter of 1998 in connection with these negotiations, which

helped it to frame, define and quantify this liability. These calculations were made using, among other things, current information regarding its

claims and settlement experience (which reflected the Company’s decision to resolve an increased number of these claims by settlement), recent

and historic claims and settlement experience of selected other companies and information obtained from the insurers.

Based on this information, the Company concluded that certain claims that previously were considered as only reasonably possible of assertion are

probable of assertion, increasing the number of assumed claims to approximately three times the number assumed in prior periods. As a result of this

reassessment, the Company increased its liability for asbestos-related claims to $1,278 million at December 31, 1998.

During 1998, the Company paid $1,407 million of premiums for excess of loss reinsurance and insurance policies and agreements, consisting of

$529 million for the excess of loss reinsurance agreements for sales practices claims and excess mortality losses and $878 million for the excess

insurance policies for asbestos-related claims. The excess insurance policies for asbestos-related claims provide for recovery of losses of up to

$1,500 million, while the excess of loss reinsurance policies provide for recovery of sales practices losses of up to $550 million and for certain mortality

losses with a maximum aggregate limit of $650 million. The Company may recover amounts under the policies annually, with respect to claims paid

during the prior calendar year. The policies contain self-insured retentions and, with respect to asbestos-related claims, annual and per-claim sublimits,

for which the Company believes adequate provision has been made in its consolidated financial statements. For additional information regarding the

nature of these claims, see Note 10 of Notes to Consolidated Financial Statements.

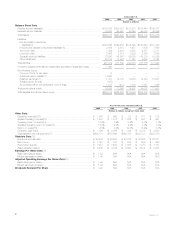

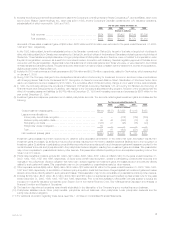

In addition to the decrease in Corporate in 1999, other expenses reflected a $104 million, or 30%, decrease in International, and increases of

$128 million, or 33%, in Auto & Home and $142 million, or 6%, in Individual Business. The International decrease is primarily due to the sale of a

substantial portion of the Company’s Canadian operations. The increase in Auto & Home is primarily due to the St. Paul acquisition. The increase in

Individual Business is attributable to the net capitalization of deferred acquisition costs, as discussed below. Excluding the net capitalization of deferred

acquisition costs, other expenses in Individual Business decreased by $71 million, or 2%. This decrease is primarily attributable to cost reduction

initiatives implemented in 1998.

Deferred policy acquisition costs are principally amortized in proportion to gross margins or gross profits, including investment gains or losses. The

amortization is allocated to investment gains and losses to provide consolidated statement of income information regarding the impact of investment

gains and losses on the amount of the amortization, and other expenses to provide amounts related to gross margins or profits originating from

transactions other than investment gains and losses.

Capitalization of deferred policy acquisition costs increased by 13% to $1,160 million in 1999 from $1,025 million in 1998, while total amortization of

such costs, charged to operations, increased to $884 million in 1999 from $881 million in 1998. Amortization of deferred policy acquisition costs of

$930 million and $641 million are allocated to other expenses in 1999 and 1998, respectively, while the remainder of the amortization in each year is

allocated to investment gains (losses). The increase in amortization of deferred policy acquisition costs allocated to other expenses is primarily attributable

to the Individual Business segment, which increased to $625 million in 1999 from $386 million in 1998. This increase is the result of its reinsurance of

mortality risk at a cost that is expected to be less than its previously estimated mortality losses in 1998, as well as refinements in its calculation of

estimated gross margins.

Income tax expense in 1999 is $558 million, or 47% of income before provision for income taxes compared with $738 million, or 35%, in 1998. The

1999 effective tax rate differs from the corporate tax rate of 35% primarily due to the impact of surplus tax. Prior to its demutualization, the Company was

subject to surplus tax imposed on mutual life insurance companies under Section 809 of the Internal Revenue Code. The surplus tax results from the

disallowance of a portion of a mutual life insurance company’s policyholder dividends as a deduction from taxable income.

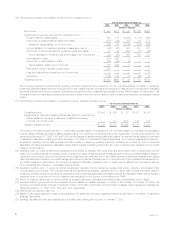

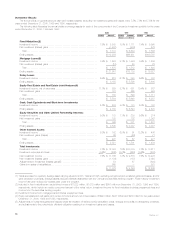

Individual Business

Year ended December 31, 2000 compared with the year ended December 31, 1999

Premiums increased by $384 million, or 9%, to $4,673 million in 2000 from $4,289 million in 1999. Excluding the impact of the GenAmerica

acquisition, premiums decreased by $72 million, or 2%. Premiums from insurance products decreased by $82 million, or 2%, to $4,133 million in 2000

from $4,215 million in 1999. This decrease is primarily due to a decline in sales of traditional life insurance policies, which reflects a continued shift in

policyholders’ preferences from those policies to variable life products. Premiums from annuity and investment products increased by $10 million, or

14%, to $84 million in 2000 from $74 million in 1999. This increase is largely attributable to increased sales of supplementary contracts with life

contingencies and immediate annuity products.

Universal life and investment-type product policy fees increased by $333 million, or 38%, to $1,221 million in 2000 from $888 million in 1999.

Excluding the impact of the GenAmerica acquisition, universal life and investment-type fees increased by $130 million, or 15%. Policy fees from

insurance products increased by $48 million, or 8%, to $619 million in 2000 from $571 million in 1999, primarily due to increased sales of variable life

products and continued growth in separate accounts, reflecting a continued shift in customer preferences from traditional life products. This increase also

MetLife, Inc. 9