MetLife 2000 Annual Report Download - page 39

Download and view the complete annual report

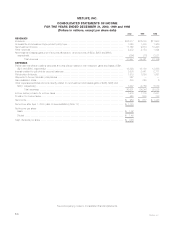

Please find page 39 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Summary of Significant Accounting Policies

Business

MetLife, Inc. (the ‘‘Holding Company’’) and its subsidiaries (‘‘MetLife’’ or the ‘‘Company’’) is a leading provider of insurance and financial services to a

broad section of institutional and individual customers. The Company offers life insurance, annuities and mutual funds to individuals and group insurance,

reinsurance and retirement and savings products and services to corporations and other institutions.

Basis of Presentation

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires

management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and

liabilities at the dates of the financial statements and the reported amounts of revenues and expenses during the reporting periods. The most significant

estimates include those used in determining deferred policy acquisition costs, investment allowances and the liability for future policyholder benefits.

Actual results could differ from those estimates.

The accompanying consolidated financial statements include the accounts of the Holding Company and its subsidiaries, partnerships and joint

ventures in which the Company has a majority voting interest or general partner interest with limited removal rights by limited partners. Closed block

assets, liabilities, revenues and expenses are combined on a line by line basis with the assets, liabilities, revenues and expenses outside the closed

block based on the nature of the particular item. Intercompany accounts and transactions have been eliminated.

The Company uses the equity method to account for its investments in real estate joint ventures and other limited partnership interests in which it

does not have a controlling interest, but has more than a minimal interest.

Minority interest related to consolidated entities included in other liabilities was $479 million and $245 million at December 31, 2000 and 1999,

respectively.

Certain amounts in the prior years’ consolidated financial statements have been reclassified to conform with the 2000 presentation.

Demutualization and Initial Public Offering

On April 7, 2000 (the ‘‘date of demutualization’’), Metropolitan Life Insurance Company (‘‘Metropolitan Life’’) converted from a mutual life insurance

company to a stock life insurance company and became a wholly-owned subsidiary of MetLife, Inc. The conversion was pursuant to an order by the New

York Superintendent of Insurance (‘‘Superintendent’’) approving Metropolitan Life’s plan of reorganization, as amended (the ‘‘plan’’).

On the date of demutualization, policyholders’ membership interests in Metropolitan Life were extinguished and eligible policyholders received, in

exchange for their interests, trust interests representing 494,466,664 shares of common stock of MetLife, Inc. to be held in a trust, cash payments

aggregating $2,550 million and adjustments to their policy values in the form of policy credits aggregating $408 million, as provided in the plan. In

addition, Metropolitan Life’s Canadian branch made cash payments of $327 million to holders of certain policies transferred to Clarica Life Insurance

Company in connection with the sale of a substantial portion of Metropolitan Life’s Canadian operations in 1998, as a result of a commitment made in

connection with obtaining Canadian regulatory approval of that sale.

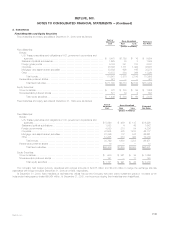

Investments

The Company’s fixed maturity and equity securities are classified as available-for-sale and are reported at their estimated fair value. Unrealized

investment gains and losses on securities are recorded as a separate component of other comprehensive income (loss), net of policyholder related

amounts and deferred income taxes. The cost of fixed maturity and equity securities is adjusted for impairments in value deemed to be other than

temporary. These adjustments are recorded as investment losses. Investment gains and losses on sales of securities are determined on a specific

identification basis. All security transactions are recorded on a trade date basis.

Mortgage loans on real estate are stated at amortized cost, net of valuation allowances. Valuation allowances are established for the excess carrying

value of the mortgage loan over its estimated fair value when it is probable that, based upon current information and events, the Company will be unable

to collect all amounts due under the contractual terms of the loan agreement. Valuation allowances are based upon the present value of expected future

cash flows discounted at the loan’s original effective interest rate or the collateral value if the loan is collateral dependent. Interest income earned on

impaired loans is accrued on the net carrying value amount of the loan based on the loan’s effective interest rate. However, interest ceases to be accrued

for loans on which interest is more than 60 days past due.

Real estate, including related improvements, is stated at cost less accumulated depreciation. Depreciation is provided on a straight-line basis over

the estimated useful life of the asset (typically 20 to 40 years). Cost is adjusted for impairment whenever events or changes in circumstances indicate the

carrying amount of the asset may not be recoverable. Impaired real estate is written down to estimated fair value with the impairment loss being included

in net investment gains (losses). Impairment losses are based upon the estimated fair value of real estate, which is generally computed using the present

value of expected future cash flows from the real estate discounted at a rate commensurate with the underlying risks. Real estate acquired in satisfaction

of debt is recorded at estimated fair value at the date of foreclosure. Valuation allowances on real estate held-for-sale are computed using the lower of

depreciated cost or estimated fair value, net of disposition costs.

Policy loans are stated at unpaid principal balances.

Short-term investments are stated at amortized cost, which approximates fair value.

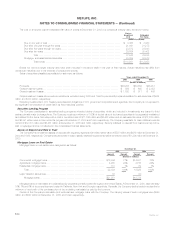

Derivative Instruments

The Company uses derivative instruments to reduce the risk associated with changing market values or variable cash flows related to the

Company’s financial assets and liabilities. This objective is achieved through one of two principal risk management strategies: hedging the changes in fair

value of financial assets, liabilities or firm commitments or hedging the variable cash flows of assets, liabilities or forecasted transactions. Hedged

forecasted transactions, other than the receipt or payment of variable interest payments, are not expected to occur more than 12 months after hedge

inception. The Company’s derivative strategy employs a variety of instruments including financial futures, financial forwards, interest rate and foreign

currency swaps, floors, foreign exchange contracts, caps and options.

The Company’s derivative program is monitored by senior management. The Company’s risk of loss is typically limited to the fair value of its

derivative instruments and not to the notional or contractual amounts of these derivatives. Risk arises from changes in the fair value of the underlying

MetLife, Inc.

F-8