MetLife 2000 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

cumulative earnings equal the expected cumulative earnings. Amounts reported at April 7, 2000 and for the period after demutualization are as of April 1,

2000 and for the period beginning on April 1, 2000 (the effect of transaction from April 1, 2000 through April 6, 2000 are not considered material).

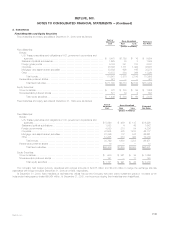

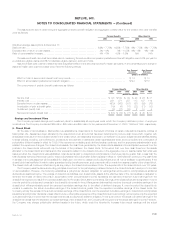

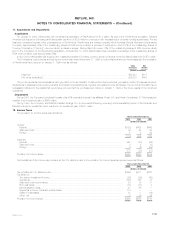

Closed block liabilities and assets designated to the closed block at December 31, 2000 and April 7, 2000 were as follows:

December 31, April 7,

2000 2000

(Dollars in millions)

Closed Block Liabilities

Future policy benefits ******************************************************************** $39,415 $38,661

Other policyholder funds****************************************************************** 278 321

Policyholder dividends payable ************************************************************ 740 747

Policyholder dividend obligation ************************************************************ 385 —

Payable under securities loaned transactions************************************************* 3,268 1,856

Other********************************************************************************** 37 330

Total closed block liabilities******************************************************** 44,123 41,915

Assets Designated to the Closed Block

Investments:

Fixed maturities available-for-sale, at fair value (amortized cost: $25,660 and $24,725)************ 25,634 23,940

Equity securities, at fair value (cost: $51) ************************************************** 54 —

Mortgage loans on real estate *********************************************************** 5,801 4,744

Policy loans ************************************************************************** 3,826 3,762

Short-term investments ***************************************************************** 223 168

Other invested assets ****************************************************************** 248 325

Total investments **************************************************************** 35,786 32,939

Cash and cash equivalents *************************************************************** 661 655

Accrued investment income *************************************************************** 557 538

Deferred income taxes ******************************************************************* 1,234 1,390

Premiums and other receivables *********************************************************** 117 267

Total assets designated to the closed block ***************************************** 38,355 35,789

Excess of closed block liabilities over assets designated to the closed block ********************** 5,768 6,126

Amounts included in other comprehensive loss:

Net unrealized investment loss, net of deferred income tax of $9 and $287 ********************* (14) (498)

Allocated to policyholder dividend obligation, net of deferred income tax of $143 **************** (242) —

(256) (498)

Maximum future earnings to be recognized from closed block assets and liabilities ***************** $ 5,512 $ 5,628

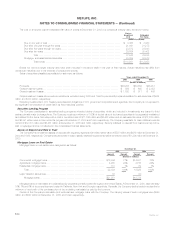

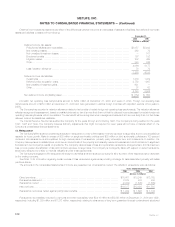

Information regarding the policyholder dividend obligation is as follows:

(Dollars in millions)

Balance at April 7, 2000 ***************************************************************** $—

Change in policyholder dividend obligation ************************************************** 85

Net investment losses ******************************************************************* (85)

Net unrealized investment gains at December 31, 2000*************************************** 385

Balance at December 31, 2000*********************************************************** $ 385

MetLife, Inc.

F-22