MetLife 2000 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

settlement lump sum contracts accounted for as a financing transaction. Reinsurance and ceded commissions payables, included in other liabilities,

were $225 million and $148 million at December 31, 2000 and 1999, respectively.

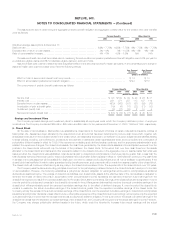

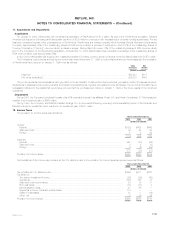

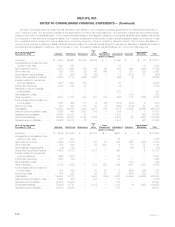

The following provides an analysis of the activity in the liability for benefits relating to property and casualty and group accident and non-medical

health policies and contracts:

Years ended December 31,

2000 1999 1998

(Dollars in millions)

Balance at January 1 ********************************************************************** $ 3,789 $ 3,320 $ 3,655

Reinsurance recoverables **************************************************************** (415) (382) (378)

Net balance at January 1 ****************************************************************** 3,374 2,938 3,277

Acquisition of business ******************************************************************** 35 204 —

Incurred related to:

Current year *************************************************************************** 3,773 3,129 2,726

Prior years ***************************************************************************** (111) (16) (245)

3,662 3,113 2,481

Paid related to:

Current year *************************************************************************** (2,243) (2,012) (1,967)

Prior years ***************************************************************************** (1,023) (869) (853)

(3,266) (2,881) (2,820)

Net balance at December 31 *************************************************************** 3,805 3,374 2,938

Add: reinsurance recoverables ************************************************************ 214 415 382

Balance at December 31 ****************************************************************** $ 4,019 $ 3,789 $ 3,320

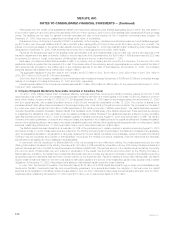

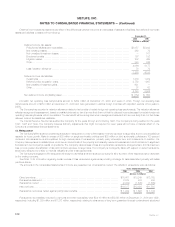

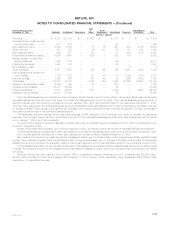

14. Other Expenses

Other expenses were comprised of the following:

Years ended December 31,

2000 1999 1998

(Dollars in millions)

Compensation**************************************************************************** $ 2,712 $ 2,590 $ 2,478

Commissions **************************************************************************** 1,768 937 902

Interest and debt issue costs *************************************************************** 424 405 379

Amortization of policy acquisition costs (excludes amortization of $(95), $(46) and $240, respectively,

related to investment (losses) gains)******************************************************** 1,478 930 641

Capitalization of policy acquisition costs ****************************************************** (1,863) (1,160) (1,025)

Rent, net of sublease income *************************************************************** 296 239 155

Minority interest*************************************************************************** 115 55 67

Restructuring charge ********************************************************************** ——81

Other *********************************************************************************** 3,297 2,759 4,341

Total other expenses ************************************************************** $ 8,227 $ 6,755 $ 8,019

During 1998, the Company recorded charges of $81 million to restructure headquarters operations and consolidate certain agencies and other

operations. These costs were paid during 1999.

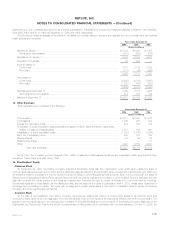

15. Stockholders’ Equity

Preferred Stock

On September 29, 1999, the Holding Company adopted a stockholder rights plan (the ‘‘rights plan’’) under which each outstanding share of

common stock issued between April 4, 2000 and the distribution date (as defined in the rights plan) will be coupled with a stockholder right. Each right

will entitle the holder to purchase one one-hundredth of a share of Series A Junior Participating Preferred Stock. Each one one-hundredth of a share of

Series A Junior Participating Preferred Stock will have economic and voting terms equivalent to one share of common stock. Until it is exercised, the right

itself will not entitle the holder thereof to any rights as a stockholder, including the right to receive dividends or to vote at stockholder meetings.

Stockholder rights are not exercisable until the distribution date, and will expire at the close of business on April 4, 2010, unless earlier redeemed or

exchanged by the Holding Company. The rights plan is designed to protect stockholders in the event of unsolicited offers to acquire the Holding

Company and other coercive takeover tactics.

Common Stock

On the date of demutualization, the Holding Company conducted an initial public offering of 202,000,000 shares of its common stock and

concurrent private placements of an aggregate of 60,000,000 shares of its common stock at an initial public offering price of $14.25 per share. The

shares of common stock issued in the offerings were in addition to 494,466,664 shares of common stock of the Holding Company distributed to the

Metropolitan Life Policyholder Trust for the benefit of policyholders of Metropolitan Life in connection with the demutualization. On April 10, 2000, the

MetLife, Inc. F-31