MetLife 2000 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

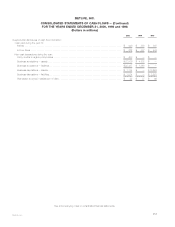

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

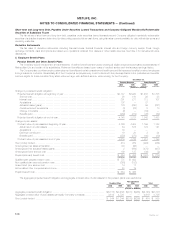

2. Investments

Fixed Maturities and Equity Securities

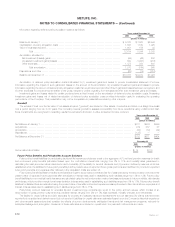

Fixed maturities and equity securities at December 31, 2000 were as follows:

Cost or Gross Unrealized

Amortized Estimated

Cost Gain Loss Fair Value

(Dollars in millions)

Fixed Maturities:

Bonds:

U.S. Treasury securities and obligations of U.S. government corporations and

agencies ************************************************************* $ 8,461 $1,189 $ 16 $ 9,634

States and political subdivisions ******************************************** 1,563 79 3 1,639

Foreign governments ***************************************************** 5,153 341 153 5,341

Corporate ************************************************************** 48,893 1,181 1,493 48,581

Mortgage- and asset-backed securities ************************************* 33,039 699 165 33,573

Other ****************************************************************** 13,872 384 366 13,890

Total bonds ********************************************************* 110,981 3,873 2,196 112,658

Redeemable preferred stocks************************************************ 321 — — 321

Total fixed maturities************************************************** $111,302 $3,873 $2,196 $112,979

Equity Securities:

Common stocks*********************************************************** $ 872 $ 785 $ 55 $ 1,602

Nonredeemable preferred stocks ********************************************* 577 19 5 591

Total equity securities************************************************* $ 1,449 $ 804 $ 60 $ 2,193

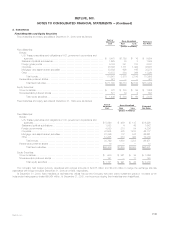

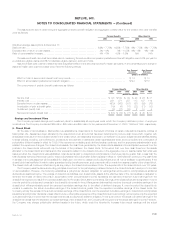

Fixed maturities and equity securities at December 31, 1999 were as follows:

Cost or Gross Unrealized

Amortized Estimated

Cost Gain Loss Fair Value

(Dollars in millions)

Fixed Maturities:

Bonds:

U.S. Treasury securities and obligations of U.S. government corporations and

agencies********************************************************** $ 5,990 $ 456 $ 147 $ 6,299

States and political subdivisions **************************************** 1,583 4 45 1,542

Foreign governments ************************************************* 4,090 210 94 4,206

Corporate*********************************************************** 47,505 585 1,913 46,177

Mortgage- and asset-backed securities ********************************** 27,396 112 847 26,661

Other ************************************************************** 12,235 313 462 12,086

Total bonds ***************************************************** 98,799 1,680 3,508 96,971

Redeemable preferred stocks ******************************************** 10 — — 10

Total fixed maturities ********************************************** $98,809 $1,680 $3,508 $96,981

Equity Securities:

Common stocks ******************************************************* $ 980 $ 921 $ 35 $ 1,866

Nonredeemable preferred stocks ***************************************** 151 — 11 140

Total equity securities ********************************************* $ 1,131 $ 921 $ 46 $ 2,006

The Company held foreign currency derivatives with notional amounts of $3,885 million and $4,002 million to hedge the exchange rate risk

associated with foreign bonds at December 31, 2000 and 1999, respectively.

At December 31, 2000, fixed maturities at estimated fair values held by the Company that were below investment grade or not rated by an

independent rating agency totaled $9,864 million. At December 31, 2000, non-income producing fixed maturities were insignificant.

MetLife, Inc. F-13