MetLife 2000 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

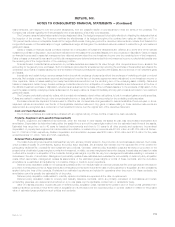

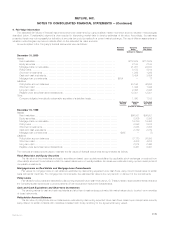

3. Derivative Instruments

The table below provides a summary of the carrying value, notional amount and current market or fair value of derivative financial instruments held at

December 31, 2000 and 1999:

2000 1999

Current Market Current Market

or Fair Value or Fair Value

Carrying Notional Carrying Notional

Value Amount Assets Liabilities Value Amount Assets Liabilities

(Dollars in millions)

Financial futures ********************************************** $23 $ 254 $ 23 $ — $ 27 $ 3,140 $37 $ 10

Interest rate swaps******************************************** 41 1,549 49 1 (32) 1,316 11 40

Floors******************************************************* — 325 3 — — — — —

Caps ******************************************************* — 9,950 — — 1 12,376 3 —

Foreign currency swaps *************************************** (1) 1,469 267 85 — 4,002 26 103

Exchange traded options*************************************** 110—1————

Total contractual commitments ********************************** $64 $13,557 $342 $ 87 $ (4) $20,834 $77 $153

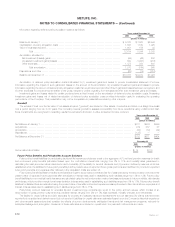

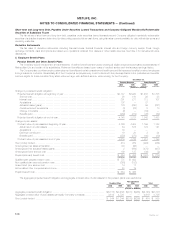

The following is a reconciliation of the notional amounts by derivative type and strategy at December 31, 2000 and 1999:

December 31, 1999 Terminations/ December 31, 2000

Notional Amount Additions Maturities Notional Amount

(Dollars in millions)

BY DERIVATIVE TYPE

Financial futures *************************************************** $ 3,140 $14,255 $17,141 $ 254

Financial forwards************************************************** —1212 —

Interest rate swaps************************************************* 1,316 1,605 1,372 1,549

Floors************************************************************ — 325 — 325

Caps ************************************************************ 12,376 1,000 3,426 9,950

Foreign currency swaps ******************************************** 4,002 687 3,220 1,469

Exchange traded options******************************************** —4131 10

Total contractual commitments *************************************** $20,834 $17,925 $25,202 $13,557

BY STRATEGY

Liability hedging *************************************************** $12,571 $ 2,876 $ 3,830 $11,617

Invested asset hedging ********************************************* 4,215 781 3,310 1,686

Portfolio hedging*************************************************** 2,021 14,255 16,022 254

Anticipated transaction hedging ************************************** 2,027 13 2,040 —

Total contractual commitments *************************************** $20,834 $17,925 $25,202 $13,557

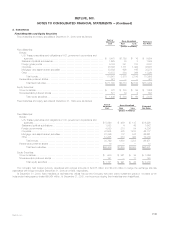

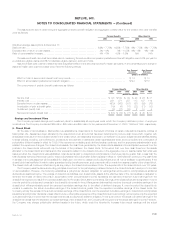

The following table presents the notional amounts of derivative financial instruments by maturity at December 31, 2000:

Remaining Life

After One After Five

One Year Year Through Years Through After Ten

or Less Five Years Ten Years Years Total

(Dollars in millions)

Financial futures ***************************************************** $ 254 $ — $ — $ — $ 254

Interest rate swaps*************************************************** 243 714 268 324 1,549

Floors************************************************************** — — 325 — 325

Caps ************************************************************** 5,210 4,740 — — 9,950

Foreign currency swaps *********************************************** 91 508 685 185 1,469

Exchange traded options ********************************************** 10 — — — 10

Total contractual commitments ****************************************** $5,808 $5,962 $1,278 $509 $13,557

MetLife, Inc.

F-18