MetLife 2000 Annual Report Download - page 14

Download and view the complete annual report

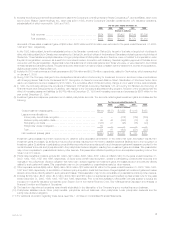

Please find page 14 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.existing block of traditional life policyholder liabilities. Policyholder benefits and claims for annuity and investment products decreased by $66 million, or

27%, to $175 million in 1999 from $241 million in 1998 consistent with the decreased premiums discussed above.

Interest credited to policyholder account balances decreased by $64 million, or 4%, to $1,359 million in 1999 from $1,423 million in 1998. Interest

on insurance products decreased by $18 million, or 4%, to $419 million in 1999 from $437 million in 1998. This decrease is primarily due to reduced

crediting rates on universal life products. Interest on annuity and investment products decreased by $46 million, or 5%, to $940 million in 1999 from

$986 million in 1998. This decrease is due to a 1998 reinsurance transaction, a shift in policyholders’ preferences to separate account alternatives and

reduced crediting rates.

Policyholder dividends increased by $64 million, or 4%, to $1,509 million in 1999 from $1,445 million in 1998. This increase is due to dividend

increases from growth in cash values of policies associated with this segment’s large block of traditional individual life insurance business, combined with

a dividend scale increase in 1999.

Other expenses increased by $142 million, or 6%, to $2,719 million in 1999 from $2,577 million in 1998. Excluding the net capitalization of deferred

policy acquisition costs, other expenses decreased by $71 million, or 2%, to $2,876 million in 1999 from $2,947 million in 1998. Other expenses related

to insurance products decreased by $152 million, or 6%, to $2,237 million in 1999 from $2,389 million in 1998. This decrease was attributable to

expense management initiatives instituted in 1999 and an adjustment to the allocation of expenses in 1999 between insurance and annuity products to

better match expenses to the mix of its business. These decreases are partially offset by a $44 million increase due to the inclusion of a full year’s activity

of Nathan & Lewis. Other expenses related to annuity and investment products increased by $81 million, or 15%, to $639 million in 1999 from $558

million in 1998, primarily due to the adjustment of expenses noted above.

Deferred policy acquisition costs are principally amortized in proportion to gross margins or gross profits, including investment gains or losses. The

amortization is allocated to investment gains (losses) to provide consolidated statement of income information regarding the impact of investment gains

and losses on the amount of the amortization, and other expenses to provide amounts related to gross margins or profits originating from transactions

other than investment gains and losses.

Capitalization of deferred policy acquisition costs increased to $782 million in 1999 from $756 million in 1998 while total amortization of such costs,

charged to operations, decreased to $579 million in 1999 from $626 million in 1998. Amortization of deferred policy acquisition costs of $625 million and

$386 million are allocated to other expenses in 1999 and 1998, respectively, while the remainder of the amortization in each year is allocated to

investment gains and losses. Amortization of deferred policy acquisition costs allocated to other expenses related to insurance products increased to

$517 million in 1999 from $277 million in 1998 attributable to the reinsurance transaction discussed above and refinements in the calculation of

estimated gross margins. Amortization of deferred policy acquisition costs allocated to other expenses related to annuity products remained essentially

unchanged at $108 million in 1999 compared with $109 million in 1998.

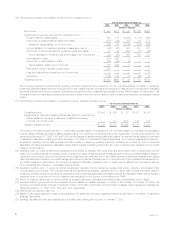

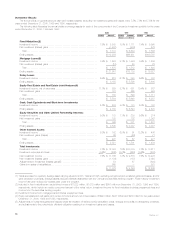

Institutional Business

Year ended December 31, 2000 compared with the year ended December 31, 1999

Premiums increased by $1,375 million, or 25%, to $6,900 million in 2000 from $5,525 million in 1999. Excluding the impact of the GenAmerica

acquisition, premiums increased by $1,297 million, or 23%, to $6,822 million in 2000 from $5,525 million in 1999. Group insurance premiums increased

by $953 million, or 19%, to $6,048 million in 2000 from $5,095 million in 1999. This increase is predominately the result of strong sales and continued

favorable policyholder retention in this segment’s group life, dental and disability businesses, as well as $121 million of additional insurance coverages

purchased by existing customers with funds received in the demutualization. In addition, the BMA and Lincoln National acquisitions contributed $103

million to the variance. Retirement and savings premiums increased by $344 million, or 80%, to $774 million in 2000 from $430 million in 1999, primarily

due to significant premiums received from existing customers in 2000.

Universal life and investment-type product policy fees increased by $45 million, or 9%, to $547 million in 2000 from $502 million in 1999. Excluding

the impact of the GenAmerica acquisition, universal life and investment-type product policy fees increased by $6 million, or 1%, to $508 million in 2000

from $502 million in 1999. This increase reflects growth in group universal life products.

Other revenues increased by $44 million, or 7%, to $673 million in 2000 from $629 million in 1999. Excluding the impact of the GenAmerica

acquisition, other revenues increased by $36 million, or 6%, to $665 million in 2000 from $629 million in 1999. Group insurance other revenues

increased by $53 million, or 18%, to $355 million in 2000 from $302 million in 1999. The primary driver of this increase was strong sales growth in this

segment’s dental and disability administrative services businesses. Retirement and savings other revenues decreased by $17 million, or 5%, to $310

million in 2000 from $327 million in 1999, primarily due to a special performance fee received in 1999.

Policyholder benefits and claims increased by $1,466 million, or 22%, to $8,178 million in 2000 from $6,712 million in 1999. Excluding the impact of

the GenAmerica acquisition, policyholder benefits and claims increased by $1,366 million, or 20%, to $8,078 million in 2000 from $6,712 million in 1999.

Group life increased by $411 million, or 12%, to $3,941 million in 2000 from $3,530 million in 1999, primarily due to overall growth in the business,

commensurate with the premium variance discussed above. Non-medical health increased by $614 million, or 46%, to $1,941 million in 2000 from

$1,327 million in 1999. This increase is largely attributable to significant growth in this segment’s dental and disability businesses. In addition, the BMA

and Lincoln National acquisitions contributed to the variance. Retirement and savings increased by $341 million, or 18%, to $2,196 million in 2000 from

$1,855 million in 1999 commensurate with the premium variance above.

Interest credited to policyholders increased by $60 million, or 6%, to $1,090 million in 2000 from $1,030 million in 1999. Excluding the impact of the

GenAmerica acquisition, interest credited to policyholder account balances increased by $54 million, or 5%, to $1,084 million in 2000 from $1,030

million in 1999. Group insurance increased by $84 million, or 21%, to $482 million in 2000 from $398 million in 1999. This increase is primarily due to

asset growth in customer account balances and the bank-owned life insurance business, as well as an increase in the cash values of executive and

corporate-owned universal life plans. Retirement and savings decreased by $30 million, or 5%, to $602 million in 2000 from $632 million in 1999, due to

a continued shift in customers’ investment preferences from guaranteed interest products to separate account alternatives.

Policyholder dividends decreased by $35 million, or 22%, to $124 million in 2000 from $159 million in 1999. Policyholder dividends vary from period

to period based on participating group insurance contract experience.

Other expenses increased by $164 million, or 10%, to $1,753 million in 2000 from $1,589 million in 1999. Excluding the impact of the GenAmerica

acquisition, expenses increased by $126 million, or 8%, to $1,715 million in 2000 from $1,589 million in 1999. Other expenses related to group life

increased by $56 million, or 15%, to $438 million in 2000 from $382 million in 1999. Other expenses related to group non-medical health increased by

$12 million, or 2%, to $685 million in 2000 from $673 million in 1999. Other expenses related to retirement and savings increased by $58 million, or 11%,

to $592 million in 2000 from $534 million in 1999. These increases are primarily due to costs incurred in connection with initiatives that focused on

improving service delivery capabilities through investments in technology and higher expenses associated with the Company’s securities lending

program. In addition, an increase in volume-related expenses associated with premium growth contributed to the variance. Volume-related expenses

include premium taxes, separate account investment management expenses and commissions.

MetLife, Inc. 11