MetLife 2000 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

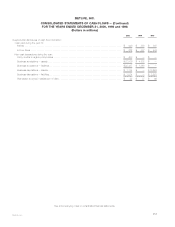

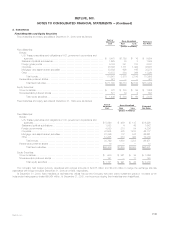

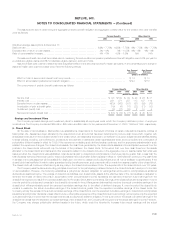

Changes in mortgage loan valuation allowances were as follows:

Years ended December 31,

2000 1999 1998

(Dollars in millions)

Balance at January 1 ********************************************************************** $ 90 $ 173 $ 289

Additions********************************************************************************* 38 40 40

Deductions for writedowns and dispositions**************************************************** (74) (123) (130)

Acquisitions (dispositions) of affiliates********************************************************** 29 — (26)

Balance at December 31 ******************************************************************* $ 83 $ 90 $ 173

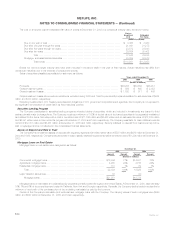

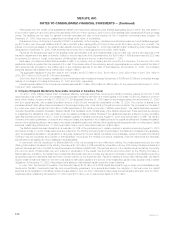

A portion of the Company’s mortgage loans on real estate was impaired and consisted of the following:

December 31,

2000 1999

(Dollars in

millions)

Impaired mortgage loans with valuation allowances ************************************************************ $592 $540

Impaired mortgage loans without valuation allowances ********************************************************* 330 437

Total *********************************************************************************************** 922 977

Less: Valuation allowances ******************************************************************************** 77 83

Impaired mortgage loans ****************************************************************************** $845 $894

The average investment in impaired mortgage loans on real estate was $912 million, $1,134 million and $1,282 million for the years ended

December 31, 2000, 1999 and 1998, respectively. Interest income on impaired mortgage loans was $76 million, $101 million and $109 million for the

years ended December 31, 2000, 1999 and 1998, respectively.

The investment in restructured mortgage loans on real estate was $784 million and $980 million at December 31, 2000 and 1999, respectively.

Interest income of $62 million, $80 million and $74 million was recognized on restructured loans for the years ended December 31, 2000, 1999 and

1998, respectively. Gross interest income that would have been recorded in accordance with the original terms of such loans amounted to $74 million,

$92 million and $87 million for the years ended December 31, 2000, 1999 and 1998, respectively.

Mortgage loans on real estate with scheduled payments of 60 days (90 days for agriculture mortgages) or more past due or in foreclosure had an

amortized cost of $40 million and $44 million at December 31, 2000 and 1999, respectively.

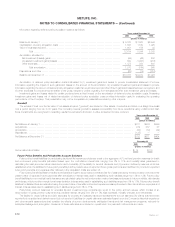

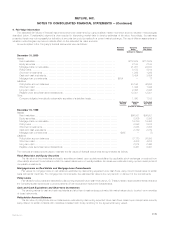

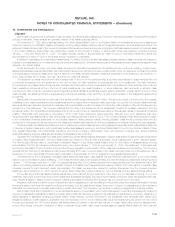

Real Estate and Real Estate Joint Ventures

Real estate and real estate joint ventures consisted of the following:

December 31,

2000 1999

(Dollars in millions)

Real estate and real estate joint ventures held-for-investment **************************************** $5,495 $5,440

Impairments ********************************************************************************* (272) (289)

Total *********************************************************************************** 5,223 5,151

Real estate and real estate joint ventures held-for-sale ********************************************** 417 719

Impairments ********************************************************************************* (97) (187)

Valuation allowance *************************************************************************** (39) (34)

Total *********************************************************************************** 281 498

Real estate and real estate joint ventures ************************************************* $5,504 $5,649

Accumulated depreciation on real estate was $2,337 million and $2,235 million at December 31, 2000 and 1999, respectively. Related

depreciation expense was $224 million, $247 million and $282 million for the years ended December 31, 2000, 1999 and 1998, respectively.

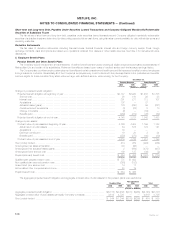

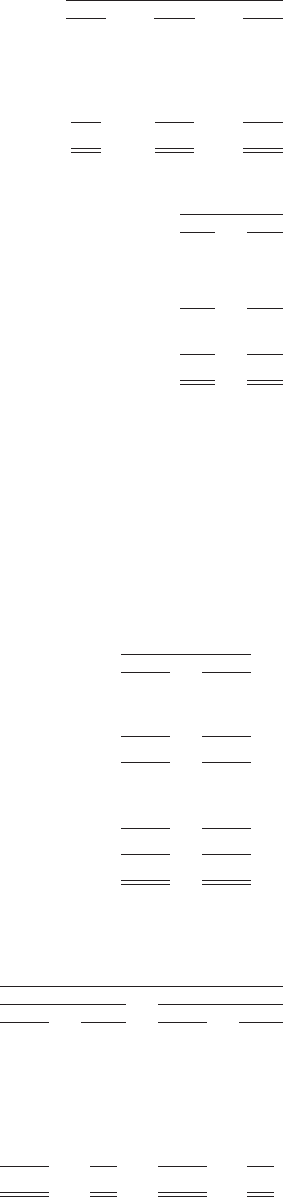

Real estate and real estate joint ventures were categorized as follows:

December 31,

2000 1999

Amount Percent Amount Percent

(Dollars in millions)

Office *************************************************************************** $3,635 66% $3,846 68%

Retail**************************************************************************** 586 10 587 10

Apartments*********************************************************************** 558 10 474 8

Land **************************************************************************** 202 4 258 5

Agriculture *********************************************************************** 84 2 96 2

Other**************************************************************************** 439 8 388 7

Total ******************************************************************** $5,504 100% $5,649 100%

MetLife, Inc. F-15