MetLife 2000 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

11. Acquisitions and Dispositions

Acquisitions

On January 6, 2000, Metropolitan Life completed its acquisition of GenAmerica for $1.2 billion. As part of the GenAmerica acquisition, General

American Life Insurance Company paid Metropolitan Life a fee of $120 million in connection with the assumption of certain funding agreements. The fee

has been considered as part of the purchase price of GenAmerica. GenAmerica is a holding company which includes General American Life Insurance

Company, approximately 49% of the outstanding shares of RGA common stock, a provider of reinsurance, and 61.0% of the outstanding shares of

Conning Corporation (‘‘Conning’’) common stock, an asset manager. Metropolitan Life owned 10% of the outstanding shares of RGA common stock

prior to the completion of the GenAmerica acquisition. At December 31, 2000 Metropolitan Life’s ownership percentage of the outstanding shares of

RGA common stock was approximately 59%.

In April 2000, Metropolitan Life acquired the outstanding shares of Conning common stock not already owned by Metropolitan Life for $73 million.

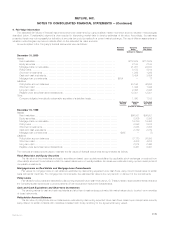

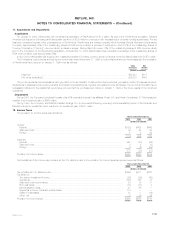

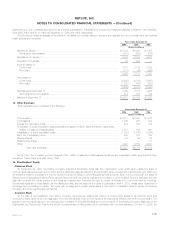

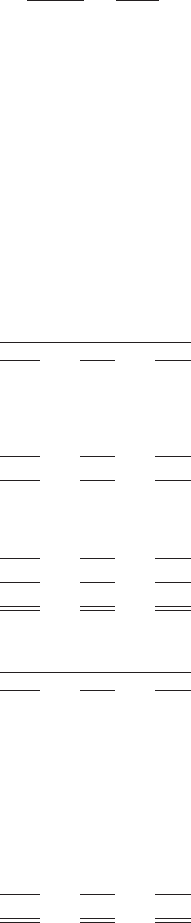

The Company’s total revenues and net income for the year ended December 31, 1999 on both a historical and pro forma basis as if the acquisition

of GenAmerica had occurred on January 1, 1999 were as follows:

Total Net

Revenues Income

(Dollars in millions)

Historical *********************************************************************************** $25,421 $617

Pro forma (unaudited) ************************************************************************* $29,278 $403

The pro forma results include adjustments to give effect to the amortization of discounts on fixed maturities, goodwill and value of business acquired,

adjustments to liabilities for future policy benefits, and certain other adjustments, together with related income tax effects. The pro forma information is not

necessarily indicative of the results that would have occurred had the purchase been made on January 1, 1999 or the future results of the combined

operations.

Dispositions

During 2000, the Company completed the sale of its 48% ownership interest in its affiliates, Nvest, L.P. and Nvest Companies L.P. This transaction

resulted in an investment gain of $663 million.

During 1998, the Company sold MetLife Capital Holdings, Inc. (a commercial financing company) and a substantial portion of its Canadian and

Mexican insurance operations, which resulted in an investment gain of $531 million.

12. Income Taxes

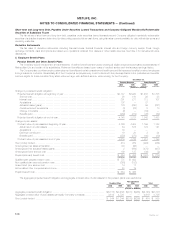

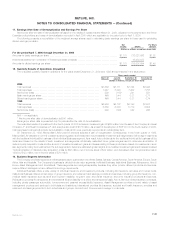

The provision for income taxes was as follows:

Years ended December 31,

2000 1999 1998

(Dollars in millions)

Current:

Federal************************************************************************************ $(153) $608 $666

State and local ***************************************************************************** 34 24 60

Foreign************************************************************************************ 5499

(114) 636 825

Deferred:

Federal************************************************************************************ 563 (78) (25)

State and local ***************************************************************************** 8 2 (8)

Foreign************************************************************************************ 6 (2) (54)

577 (78) (87)

Provision for income taxes********************************************************************** $ 463 $558 $738

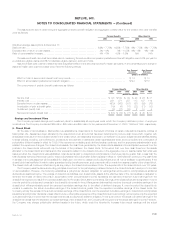

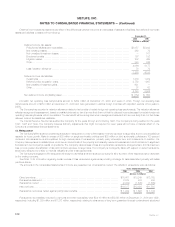

Reconciliations of the income tax provision at the U.S. statutory rate to the provision for income taxes as reported were as follows:

Years ended December 31,

2000 1999 1998

(Dollars in millions)

Tax provision at U.S. statutory rate*************************************************************** $ 496 $411 $728

Tax effect of:

Tax exempt investment income**************************************************************** (52) (39) (40)

Surplus tax ******************************************************************************** (145) 125 18

State and local income taxes ***************************************************************** 30 18 31

Prior year taxes***************************************************************************** (37) (31) 4

Demutualization costs *********************************************************************** 21 56 —

Payments to former Canadian policyholders ***************************************************** 114 — —

Sales of businesses************************************************************************* 31 — (19)

Other, net ********************************************************************************* 51816

Provision for income taxes********************************************************************** $ 463 $558 $738

MetLife, Inc. F-29