MetLife 2000 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

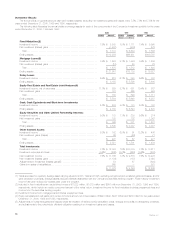

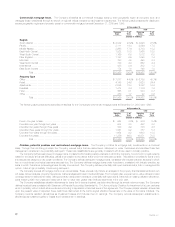

Investment Results

The annual yields on general account cash and invested assets, excluding net investment gains and losses, were 7.5%, 7.3% and 7.5% for the

years ended December 31, 2000, 1999 and 1998, respectively.

The following table illustrates the annual yields on average assets for each of the components of the Company’s investment portfolio for the years

ended December 31, 2000, 1999 and 1998:

2000 1999 1998

Yield(1) Amount Yield(1) Amount Yield(1) Amount

(Dollars in millions)

Fixed Maturities:(2)

Investment income *************************************************** 7.8% $ 8,538 7.5% $ 7,171 7.4% $ 6,990

Net investment (losses) gains ****************************************** (1,437) (538) 573

Total ************************************************************* $ 7,101 $ 6,633 $ 7,563

Ending assets ******************************************************* $112,979 $96,981 $100,767

Mortgage Loans:(3)

Investment income *************************************************** 7.9% $ 1,693 8.1% $ 1,484 8.5% $ 1,580

Net investment (losses) gains ****************************************** (18) 28 23

Total ************************************************************* $ 1,675 $ 1,512 $ 1,603

Ending assets ******************************************************* $ 21,951 $19,739 $ 16,827

Policy Loans:

Investment income *************************************************** 6.5% $ 515 6.1% $ 340 6.6% $ 387

Ending assets ******************************************************* $ 8,158 $ 5,598 $ 5,600

Equity Real Estate and Real Estate Joint Ventures:(4)

Investment income, net of expenses ************************************ 11.1% $ 629 9.7% $ 581 10.4% $ 687

Net investment gains ************************************************* 101 265 424

Total ************************************************************* $ 730 $ 846 $ 1,111

Ending assets ******************************************************* $ 5,504 $ 5,649 $ 6,287

Cash, Cash Equivalents and Short-term Investments:

Investment income *************************************************** 5.7% $ 288 4.2% $ 173 5.3% $ 187

Ending assets ******************************************************* $ 4,703 $ 5,844 $ 4,670

Equity Securities and Other Limited Partnership Interests:

Investment income *************************************************** 5.0% $ 183 7.1% $ 239 5.6% $ 274

Net investment gains ************************************************* 185 132 1,007

Total ************************************************************* $ 368 $ 371 $ 1,281

Ending assets ******************************************************* $ 3,845 $ 3,337 $ 3,387

Other Invested Assets:

Investment income *************************************************** 6.3% $ 162 6.0% $ 91 12.2% $ 406

Net investment gains (losses) ****************************************** 65 (24) 71

Total ************************************************************* $ 227 $ 67 $ 477

Ending assets ******************************************************* $ 2,821 $ 1,501 $ 1,484

Total Investments:

Investment income *************************************************** 7.7% $ 12,008 7.5% $10,079 7.7% $ 10,511

Investment expenses and fees ***************************************** (0.2%) (240) (0.2%) (263) (0.2%) (283)

Net investment income *********************************************** 7.5% $ 11,768 7.3% $ 9,816 7.5% $ 10,228

Net investment (losses) gains ****************************************** (1,104) (137) 2,098

Adjustments to investment (losses) gains(5) ****************************** 54 67 (608)

Gains from sales of subsidiaries **************************************** 660 — 531

$ 11,378 $ 9,746 $ 12,249

(1) Yields are based on quarterly average asset carrying values for 2000, 1999 and 1998, excluding recognized and unrealized gains and losses, and for

yield calculation purposes, average assets exclude collateral associated with the Company’s securities lending program. Fixed maturity investment

income has been reduced by rebates paid under the program.

(2) Included in fixed maturities are equity-linked notes of $1,232 million, $1,079 million and $916 million at December 31, 2000, 1999 and 1998,

respectively, which include an equity component as part of the notes’ return. Investment income for fixed maturities includes prepayment fees and

income from the securities lending program.

(3) Investment income from mortgage loans includes prepayment fees.

(4) Equity real estate and real estate joint venture income is shown net of depreciation of $224 million, $247 million and $282 million for the years ended

December 31, 2000, 1999 and 1998, respectively.

(5) Adjustments to investment gains and losses include amortization of deferred policy acquisition costs, charges and credits to participating contracts,

and adjustments to the policyholder dividend obligation resulting from investment gains and losses.

MetLife, Inc.

18