MetLife 2000 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.METLIFE, INC.

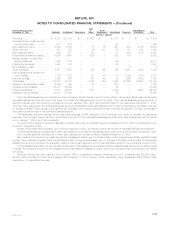

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

negligence, intentional tort claims and conspiracy claims concerning the health risks associated with asbestos. While Metropolitan Life believes it has

meritorious defenses to these claims, and has not suffered any adverse judgments in respect of these claims, most of the cases have been resolved by

settlements. Metropolitan Life intends to continue to exercise its best judgment regarding settlement or defense of such cases, including when trials of

these cases are appropriate. The number of such cases that may be brought or the aggregate amount of any liability that Metropolitan Life may ultimately

incur is uncertain.

Significant portions of amounts paid in settlement of such cases have been funded with proceeds from a previously-resolved dispute with

Metropolitan Life’s primary, umbrella and first level excess liability insurance carriers. Metropolitan Life was involved in litigation with several of its excess

liability insurers regarding amounts payable under its policies with respect to coverage for these claims. The trial court granted summary judgment to

these insurers and Metropolitan Life appealed. The Connecticut Supreme Court in 2001 affirmed the decision of the trial court. The Company believes

that Metropolitan Life’s asbestos-related litigation with these insurers should have no effect on its recoveries under excess insurance policies that were

obtained in 1998 for asbestos-related claims.

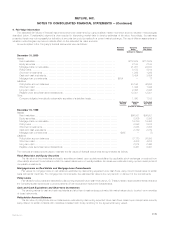

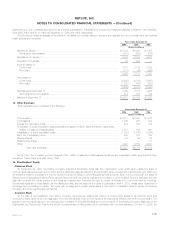

The Company has recorded, in other expenses, charges of $15 million ($10 million after-tax), $499 million ($317 million after-tax), and $1,895 million

($1,203 million after-tax) for the years ended December 31, 2000, 1999, and 1998, respectively, for sales practices claims and claims for personal

injuries caused by exposure to asbestos or asbestos-containing products. The 2000 charge was principally related to sales practices claims. The 1999

charge was principally related to the settlement of the multidistrict litigation proceeding involving alleged improper sales practices, accruals for sales

practices claims not covered by the settlement and other legal costs. The 1998 charge was comprised of $925 million and $970 million for sales

practices claims and asbestos-related claims, respectively. The Company recorded the charges for sales practices claims in 1998 based on preliminary

settlement discussions and the settlement history of other insurers.

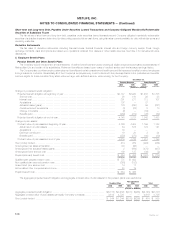

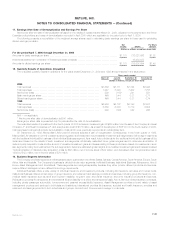

Prior to the fourth quarter of 1998, Metropolitan Life established a liability for asbestos-related claims based on settlement costs for claims that

Metropolitan Life had settled, estimates of settlement costs for claims pending against Metropolitan Life and an estimate of settlement costs for

unasserted claims. The amount for unasserted claims was based on management’s estimate of unasserted claims that would be probable of assertion. A

liability is not established for claims which management believes are only reasonably possible of assertion. Based on this process, the accrual for

asbestos-related claims at December 31, 1997 was $386 million. Potential liabilities for asbestos-related claims are not easily quantified, due to the

nature of the allegations against Metropolitan Life, which are not related to the business of manufacturing, producing, distributing or selling asbestos or

asbestos-containing products, adding to the uncertainty as to the number of claims that may be brought against Metropolitan Life.

During 1998, Metropolitan Life decided to pursue the purchase of excess insurance to limit its exposure to asbestos-related claims. In connection

with the negotiations with the casualty insurers to obtain this insurance, Metropolitan Life obtained information that caused management to reassess the

accruals for asbestos-related claims. This information included:

)Information from the insurers regarding the asbestos-related claims experience of other insureds, which indicated that the number of claims that

were probable of assertion against Metropolitan Life in the future was significantly greater than it had assumed in its accruals. The number of

claims brought against Metropolitan Life is generally a reflection of the number of asbestos-related claims brought against asbestos defendants

generally and the percentage of those claims in which Metropolitan Life is included as a defendant. The information provided to Metropolitan Life

relating to other insureds indicated that Metropolitan Life had been included as a defendant for a significant percentage of total asbestos-related

claims and that it may be included in a larger percentage of claims in the future, because of greater awareness of asbestos litigation generally by

potential plaintiffs and plaintiffs’ lawyers and because of the bankruptcy and reorganization or the exhaustion of insurance coverage of other

asbestos defendants; and that, although volatile, there was an upward trend in the number of total claims brought against asbestos defendants.

)Information derived from actuarial calculations Metropolitan Life made in the fourth quarter of 1998 in connection with these negotiations, which

helped to frame, define and quantify this liability. These calculations were made using, among other things, current information regarding

Metropolitan Life’s claims and settlement experience (which reflected Metropolitan Life’s decision to resolve an increased number of these claims

by settlement), recent and historic claims and settlement experience of selected other companies and information obtained from the insurers.

Based on this information, Metropolitan Life concluded that certain claims that previously were considered as only reasonably possible of assertion

were probable of assertion, increasing the number of assumed claims to approximately three times the number assumed in prior periods. As a result of

this reassessment, Metropolitan Life increased its liability for asbestos-related claims to $1,278 million at December 31, 1998.

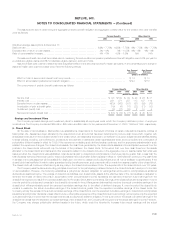

During 1998, Metropolitan Life paid $1,407 million of premiums for excess of loss reinsurance agreements and excess insurance policies,

consisting of $529 million for the excess of loss reinsurance agreements for sales practices claims and excess mortality losses and $878 million for the

excess insurance policies for asbestos-related claims.

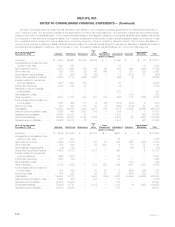

Metropolitan Life obtained the excess of loss reinsurance agreements to provide reinsurance with respect to sales practices claims made on or prior

to December 31, 1999 and for certain mortality losses in 1999. These reinsurance agreements have a maximum aggregate limit of $650 million, with a

maximum sublimit of $550 million for losses for sales practices claims. This coverage is in excess of an aggregate self-insured retention of $385 million

with respect to sales practices claims and $506 million, plus Metropolitan Life’s statutory policy reserves released upon the death of insureds, with

respect to life mortality losses. At December 31, 1999, the subject losses under the reinsurance agreements due to sales practices claims and related

counsel fees from the time Metropolitan Life entered into the reinsurance agreements did not exceed that self-insured retention. No recoveries were

made with respect to the coverage for excess mortality losses for 1999. As noted above, recoveries have been made in 2000 under the reinsurance

agreements for the sales practices claims. The maximum sublimit of $550 million for sales practices claims was within a range of losses that

management believed were reasonably possible at December 31, 1998. Each excess of loss reinsurance agreement for sales practices claims and

mortality losses contains an experience fund, which provides for payments to Metropolitan Life at the commutation date if experience is favorable at such

date. The Company accounts for the aggregate excess of loss reinsurance agreements as reinsurance; however, if deposit accounting were applied, the

effect on the Company’s consolidated financial statements in 1998, 1999 and 2000 would not be significant.

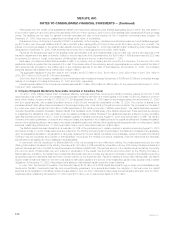

Under reinsurance accounting, the excess of the liability recorded for sales practices losses recoverable under the agreements of $550 million over

the premium paid of $529 million resulted in a deferred gain of $21 million which was amortized into income over the settlement period from

January 1999 through April 2000. Under deposit accounting, the premium would be recorded as an other asset rather than as an expense, and the

reinsurance loss recoverable and the deferred gain would not have been recorded. Because the agreements also contain an experience fund which

MetLife, Inc.

F-26