MetLife 2000 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Corporate

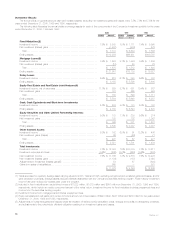

Year ended December 31, 2000 compared with the year ended December 31, 1999

Total revenues for the Corporate segment, which consist of net investment income, other revenues, and net investment losses that are not allocated

to other business segments, decreased by $40 million, or 6%, to $583 million in 2000 from $623 million in 1999. Excluding the impact of the

GenAmerica acquisition, total revenues decreased by $169 million, or 27%. This decrease is primarily due to a $179 million increase in net investment

losses. These losses reflect the continuation of the Company’s strategy to reposition its investment portfolio to provide a higher operating return on its

invested assets. Total Corporate expenses decreased by $290 million, or 22%, to $1,001 million in 2000 from $1,291 million in 1999. Excluding the

impact of the GenAmerica acquisition, total expenses decreased by $426 million, or 33%. During 1999, the Company reported a $499 million charge

principally related to the settlement of a multidistrict litigation proceeding involving alleged improper sales practices, accruals for sales practices claims not

covered by the settlement and other legal costs.

Year ended December 31, 1999 compared with the year ended December 31, 1998

Total revenues for the Corporate segment, which consist of net investment income and realized investment gains and losses that are not allocated to

other business segments, were $623 million in 1999, a decrease of $849 million, or 58%, from $1,472 million in 1998, primarily due to a reduction in

investment gains and investment income of $722 million due to the sale of MetLife Capital Holdings in 1998. Total Corporate expenses were $1,291

million in 1999, a decrease of $1,306 million, or 50%, from $2,597 million in 1998. This decrease is primarily due to a $1,895 million charge in 1998 for

sales practices claims and claims for personal injuries caused by exposure to asbestos or asbestos-containing products, as well as the elimination of

$270 million of expenses due to the sale of MetLife Capital Holdings. These decreases are partially offset by a $499 million charge in 1999 principally

related to the settlement of a multidistrict litigation proceeding involving alleged improper sales practices, accruals for sales practices claims not covered

by the settlement and other legal costs, as well as a $254 million increase in demutualization costs.

Liquidity and Capital Resources

The Holding Company

The primary uses of liquidity of the Holding Company include the payment of Common Stock dividends, interest payments on debentures issued to

MetLife Capital Trust I and other debt servicing, contributions to subsidiaries, and payment of general operating expenses. The primary source of the

Holding Company’s liquidity is dividends it receives from Metropolitan Life and the interest received from Metropolitan Life under the capital note

described in Note 9 of Notes to Consolidated Financial Statements. The Holding Company’s ability, on a continuing basis, to meet its cash needs

depends primarily on the receipt of dividends and the interest on the capital note from Metropolitan Life.

Under the New York Insurance Law, Metropolitan Life is permitted without prior insurance regulatory clearance to pay a stockholder dividend to the Holding

Company as long as the aggregate amount of all such dividends in any calendar year does not exceed the lesser of (i) 10% of its surplus to policyholders as of

the immediately preceding calendar year and (ii) its net gain from operations for the immediately preceding calendar year (excluding realized capital gains).

Metropolitan Life will be permitted to pay a stockholder dividend to the Holding Company in excess of the lesser of such two amounts only if it files notice of its

intention to declare such a dividend and the amount thereof with the New York Superintendent of Insurance (the ‘‘Superintendent’’) and the Superintendent does

not disapprove the distribution. Under the New York Insurance Law, the Superintendent has broad discretion in determining whether the financial condition of a

stock life insurance company would support the payment of such dividends to its stockholders. The New York Insurance Department has established informal

guidelines for such determinations. The guidelines, among other things, focus on the insurer’s overall financial condition and profitability under statutory accounting

practices. Management of the Company cannot provide assurance that Metropolitan Life will have statutory earnings to support payment of dividends to the

Holding Company in an amount sufficient to fund its cash requirements and pay cash dividends or that the Superintendent will not disapprove any dividends that

Metropolitan Life must submit for the Superintendent’s consideration. MetLife’s other insurance subsidiaries are also subject to restrictions on the payment of

dividends to their respective parent companies.

The dividend limitation is based on statutory financial results. Statutory accounting practices differ in certain respects from accounting principles

used in financial statements prepared in conformity with GAAP. The significant differences relate to deferred policy acquisition costs, deferred income

taxes, required investment reserves, reserve calculation assumptions, capital notes and surplus notes.

In connection with the contribution of the net proceeds from the initial public offering, the private placements and the offering of equity security units,

Metropolitan Life issued to the Holding Company a $1,006 8.00% mandatorily convertible capital note due 2005.

The Superintendent approved the issuance of the capital note on April 4, 2000. If the payment of interest is prevented by application of the payment

restrictions described in Note 9 in Notes to Consolidated Financial Statements, the interest on the capital note will not be available as a source of liquidity

for the Holding Company.

Based on the historic cash flows and the current financial results of Metropolitan Life, subject to any dividend limitations which may be imposed upon

Metropolitan Life or its subsidiaries by regulatory authorities, management believes that cash flows from operating activities, together with the dividends it

is permitted to pay without prior insurance regulatory clearance and the interest received on the capital note from Metropolitan Life, will be sufficient to

enable the Holding Company to make dividend payments on its Common Stock, to pay all operating expenses, make payments on the debentures

issued to MetLife Capital Trust I and meet its other obligations.

The Company

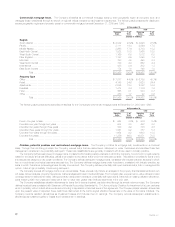

Liquidity sources. The Company’s principal cash inflows from its insurance activities come from life insurance premiums, annuity considerations

and deposit funds. A primary liquidity concern with respect to these cash inflows is the risk of early contract holder and policyholder withdrawal. The

Company seeks to include provisions limiting withdrawal rights from general account institutional pension products (generally group annuities, including

guaranteed interest contracts and certain deposit fund liabilities) sold to employee benefit plan sponsors.

The Company’s principal cash inflows from its investment activities result from repayments of principal and proceeds from maturities and sales of

invested assets, investment income, as well as dividends and distributions from subsidiaries. The primary liquidity concerns with respect to these cash

inflows are the risks of default by debtors, interest rate and other market volatilities and potential illiquidity of subsidiaries. The Company closely monitors

and manages these risks.

Additional sources of liquidity to meet unexpected cash outflows are available from the Company’s portfolio of liquid assets. These liquid assets

include substantial holdings of U.S. treasury securities, short-term investments, common stocks and marketable fixed maturity securities. The Company’s

available portfolio of liquid assets was approximately $101 billion and $88 billion at December 31, 2000 and December 31, 1999, respectively.

Sources of liquidity also include facilities for short- and long-term borrowing as needed, primarily arranged through MetLife Funding, Inc., a subsidiary

of Metropolitan Life. See ‘‘— Financing’’ below.

MetLife, Inc. 15