MetLife 2000 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

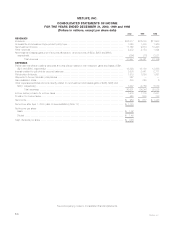

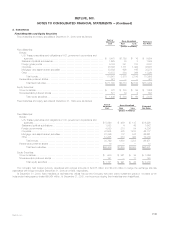

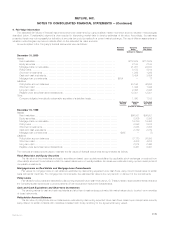

Information regarding deferred policy acquisition costs is as follows:

Years ended December 31,

2000 1999 1998

(Dollars in millions)

Balance at January 1********************************************************************** $ 9,070 $ 7,028 $6,948

Capitalization of policy acquisition costs ****************************************************** 1,863 1,160 1,025

Value of business acquired ***************************************************************** 1,681 156 32

Total **************************************************************************** 12,614 8,344 8,005

Amortization allocated to:

Net investment (losses) gains ************************************************************* (95) (46) 240

Unrealized investment gains (losses) ******************************************************* 590 (1,628) (216)

Other expenses ************************************************************************ 1,478 930 641

Total amortization ***************************************************************** 1,973 (744) 665

Dispositions and other ********************************************************************* (23) (18) (312)

Balance at December 31 ****************************************************************** $10,618 $ 9,070 $7,028

Amortization of deferred policy acquisition costs is allocated to (1) investment gains and losses to provide consolidated statement of income

information regarding the impact of such gains and losses on the amount of the amortization, (2) unrealized investment gains and losses to provide

information regarding the amount of deferred policy acquisition costs that would have been amortized if such gains and losses had been recognized, and

(3) other expenses to provide amounts related to the gross margins or profits originating from transactions other than investment gains and losses.

Investment gains and losses related to certain products have a direct impact on the amortization of deferred policy acquisition costs. Presenting

investment gains and losses net of related amortization of deferred policy acquisition costs provides information useful in evaluating the operating

performance of the Company. This presentation may not be comparable to presentations made by other insurers.

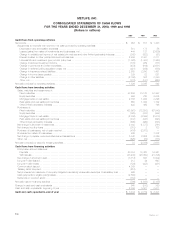

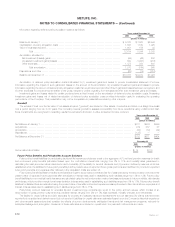

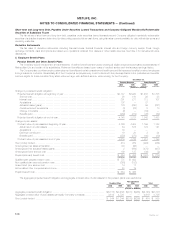

Goodwill

The excess of cost over the fair value of net assets acquired (‘‘goodwill’’) is included in other assets. Goodwill is amortized on a straight-line basis

over a period ranging from ten to 30 years. The Company reviews goodwill to assess recoverability from future operations using undiscounted cash

flows. Impairments are recognized in operating results if a permanent diminution in value is deemed to have occurred.

Years ended December 31

2000 1999 1998

(Dollars in millions)

Net Balance at January 1********************************************************************************* $611 $404 $359

Acquisitions ******************************************************************************************** 279 237 67

Amortization ******************************************************************************************** (62) (30) (22)

Dispositions ******************************************************************************************** (125) — —

Net Balance at December 31 ***************************************************************************** $703 $611 $404

December 31

2000 1999

(Dollars in millions)

Accumulated Amortization ******************************************************************************* $ 74 $118

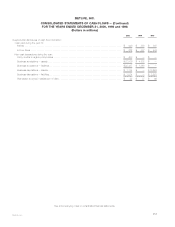

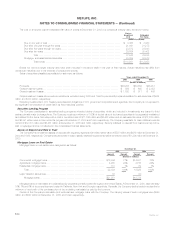

Future Policy Benefits and Policyholder Account Balances

Future policy benefit liabilities for participating traditional life insurance policies are equal to the aggregate of (1) net level premium reserves for death

and endowment policy benefits (calculated based upon the nonforfeiture interest rate, ranging from 3% to 11%, and mortality rates guaranteed in

calculating the cash surrender values described in such contracts), (2) the liability for terminal dividends, and (3) premium deficiency reserves, which are

established when the liabilities for future policy benefits plus the present value of expected future gross premiums are insufficient to provide for expected

future policy benefits and expenses after deferred policy acquisition costs are written off.

Future policy benefit liabilities for traditional annuities are equal to accumulated contractholder fund balances during the accumulation period and the

present value of expected future payments after annuitization. Interest rates used in establishing such liabilities range from 3% to 12%. Future policy

benefit liabilities for non-medical health insurance are calculated using the net level premium method and assumptions as to future morbidity, withdrawals

and interest, which provide a margin for adverse deviation. Interest rates used in establishing such liabilities range from 3% to 11%. Future policy benefit

liabilities for disabled lives are estimated using the present value of benefits method and experience assumptions as to claim terminations, expenses and

interest. Interest rates used in establishing such liabilities range from 3% to 11%.

Policyholder account balances for universal life and investment-type contracts are equal to the policy account values, which consist of an

accumulation of gross premium payments plus credited interest, ranging from 2% to 17%, less expenses, mortality charges, and withdrawals.

The liability for unpaid claims and claim expenses for property and casualty insurance represents the amount estimated for claims that have been

reported but not settled and claims incurred but not reported. Liabilities for unpaid claims are estimated based upon the Company’s historical experience

and other actuarial assumptions that consider the effects of current developments, anticipated trends and risk management programs, reduced for

anticipated salvage and subrogation. Revisions of these estimates are included in operations in the year such refinements are made.

MetLife, Inc.

F-10