MetLife 2000 Annual Report Download

Download and view the complete annual report

Please find the complete 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc. Annual Report

Table of contents

-

Page 1

MetLife, Inc. Annual Report -

Page 2

...and customer service improvements to support future growth. As a result, the increase in operating earnings was 4%. MetLife Auto & Home's operating earnings were down 20% due to higher catastrophe losses and the cost of integrating The St. Paul Companies personal lines property and casualty business... -

Page 3

... channels for MetLife products-particularly variable annuities-through banks, broker-dealers and financial planners. MetLife Investors Group, a new franchise that unites the strengths of Security First Group, Cova, and the supplemental distribution at New England Financial, was formed in 2000 to... -

Page 4

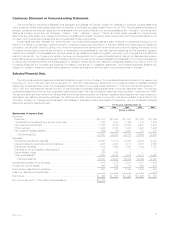

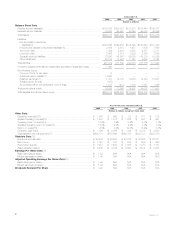

... Data Revenues Premiums 16,317 Universal life and investment-type product policy fees 1,820 Net investment income(3)(4 11,768 Other revenues 2,432 Net investment (losses) gains(5 390) Total revenues(1)(2) Expenses Policyholder beneï¬ts and claims(6 Interest credited to policyholder account... -

Page 5

... and casualty policyholder liabilities(10 Short-term debt Long-term debt Separate account liabilities Other liabilities(4 Total liabilities Company-obligated mandatorily redeemable securities of subsidiary trusts ********** Stockholders' Equity: Common Stock, at par value Additional paid-in... -

Page 6

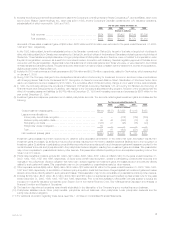

...the disposition of the Company's group medical insurance business. Policyholder liabilities include future policy beneï¬ts, policyholder account balances, other policyholder funds, policyholder dividends and the policyholder dividend obligation. For additional information regarding these items, see... -

Page 7

... (loss). The Company believes that supplemental adjusted operating return on equity data provides information useful in measuring operating trends by excluding the unusual amounts of expenses associated with sales practices and asbestos-related claims. Adjusted operating return on equity should... -

Page 8

... Life Policyholder Trust, cash or an adjustment to their policy values in the form of policy credits, as provided in the plan. In addition, Metropolitan Life's Canadian branch made cash payments to holders of certain policies transferred to Clarica Life Insurance Company in connection with the sale... -

Page 9

...growth in the bank-owned life insurance business and increases in the cash values of executive and corporate-owned universal life plans. These increases are partially offset by a decrease in retirement and savings products of $30 million, due to a continued shift in customers' investment preferences... -

Page 10

... traditional life insurance policies, which reï¬,ects a continued shift in customers' investment preferences from those policies to variable life products, as well as decreased sales of supplementary contracts with life contingencies. Universal life and investment-type product policy fees increased... -

Page 11

... premium growth within its group dental and disability businesses. The increase in Auto & Home is primarily due to the St. Paul acquisition of $195 million, a 6% increase in the number of policies in force and $23 million of unfavorable claims development due to lower than expected savings resulting... -

Page 12

... due to a decline in sales of traditional life insurance policies, which reï¬,ects a continued shift in policyholders' preferences from those policies to variable life products. Premiums from annuity and investment products increased by $10 million, or 14%, to $84 million in 2000 from $74 million in... -

Page 13

... due to lower sales of supplementary contracts with life contingencies. The relatively high level of supplemental contract premiums in 1998 reï¬,ected the initial offering of a payout annuity feature in that year. Universal life and investment-type product policy fees increased by $71 million... -

Page 14

...$482 million in 2000 from $398 million in 1999. This increase is primarily due to asset growth in customer account balances and the bank-owned life insurance business, as well as an increase in the cash values of executive and corporate-owned universal life plans. Retirement and savings decreased by... -

Page 15

.... Universal life and investment-type product policy fees increased by 6% to $502 million in 1999 from $475 million in 1998. This increase reï¬,ects the continued growth in the sale of products used in executive- and corporate-owned beneï¬t plans due to the continued favorable tax status associated... -

Page 16

... due to annual salary increases and higher stafï¬ng levels. Variable compensation increased by $3 million, or 8%, to $42 million in 2000 from $39 million in 1999. Variable incentive payments are based upon proï¬tability, investment portfolio performance, new business sales and growth in revenues... -

Page 17

... group business and is in line with the increase in premiums discussed above. Payments of $327 million related to Metropolitan Life's demutualization were made during the second quarter of 2000 to holders of certain policies transferred to Clarica Life Insurance Company in connection with the sale... -

Page 18

... life insurance premiums, annuity considerations and deposit funds. A primary liquidity concern with respect to these cash inï¬,ows is the risk of early contract holder and policyholder withdrawal. The Company seeks to include provisions limiting withdrawal rights from general account institutional... -

Page 19

...to strong sales and improved policyholder retention in non-medical health, predominately in the dental and disability businesses. The growth in Auto & Home is primarily due to the acquisition of the standard personal lines property and casualty insurance operations of The St. Paul Companies, as well... -

Page 20

... the reinvestment of sales proceeds as a result of the funding agreement exchange offer in connection with the GenAmerica acquisition, as well as the purchase of the individual disability income business of Lincoln National Insurance Company. Cash ï¬,ows from investing activities increased by $5,840... -

Page 21

... and 1998, respectively. (5) Adjustments to investment gains and losses include amortization of deferred policy acquisition costs, charges and credits to participating contracts, and adjustments to the policyholder dividend obligation resulting from investment gains and losses. 18 MetLife, Inc. -

Page 22

... securities laws and illiquid trading markets. The Securities Valuation Ofï¬ce of the NAIC evaluates the bond investments of insurers for regulatory reporting purposes and assigns securities to one of six investment categories called ''NAIC designations.'' The NAIC designations parallel the credit... -

Page 23

... at such date. At December 31, 2000, investments of $6,262 million, or 67.4% of the Yankee/Foreign sector, represented exposure to traditional Yankee bonds. The balance of this exposure was primarily dollar-denominated, foreign private placements and project ï¬nance loans. The Company diversiï¬es... -

Page 24

... or corporate credits such as credit card holders, equipment lessees, and corporate obligors. Capital market risks include the general level of interest rates and the liquidity for these securities in the marketplace. Mortgage Loans The Company's mortgage loans are collateralized by commercial... -

Page 25

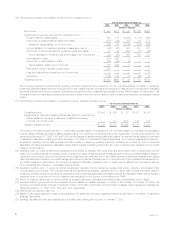

... ofï¬ces overseen by its investment department. The following table presents the distribution across geographic regions and property types for commercial mortgage loans at December 31, 2000 and 1999: At December 31, 2000 Carrying Value 1999 % of Carrying Total Value (Dollars in millions) % of Total... -

Page 26

.... Capital market risks include the general level of interest rates, the liquidity for these securities in the marketplace and the capital available loan for reï¬nancing. Agricultural mortgage loans. The Company diversiï¬es its agricultural mortgage loans by both geographic region and product type... -

Page 27

.... Substantially all of the common stock is publicly traded on major securities exchanges. The carrying value of the other limited partnership interests which primarily represent ownership interests in pooled investment funds that make private equity investments in companies in the U.S. and overseas... -

Page 28

... and invested assets at December 31, 2000 and 1999, respectively. Derivative Financial Instruments The Company uses derivative instruments to reduce the risk associated with changing market values or variable cash ï¬,ows related to the Company's ï¬nancial assets and liabilities. This objective is... -

Page 29

... and related fees on mortgage loans and consistent monitoring of the pricing of the Company's products in order to better match the duration of the assets and the liabilities they support. Equity prices. The Company's investments in equity securities expose it to changes in equity prices. It... -

Page 30

... Company used market rates at December 31, 2000 to re-price its invested assets and other ï¬nancial instruments. The sensitivity analysis separately calculated each of MetLife's market risk exposures (interest rate, equity price and currency exchange rate) related to its non-trading invested assets... -

Page 31

[This page intentionally left blank] 28 MetLife, Inc. -

Page 32

... TO CONSOLIDATED FINANCIAL STATEMENTS Independent Auditors' Report Financial Statements as of December 31, 2000 and 1999 and for the years ended 2000, 1999 and 1998: Consolidated Balance Sheets Consolidated Statements of Income Consolidated Statements of Stockholders' Equity Consolidated Statements... -

Page 33

... Auditors' Report The Board of Directors and Shareholders of MetLife, Inc.: We have audited the accompanying consolidated balance sheets of MetLife, Inc. and subsidiaries (the ''Company'') as of December 31, 2000 and 1999, and the related consolidated statements of income, stockholders' equity, and... -

Page 34

...,232 LIABILITIES AND STOCKHOLDERS' EQUITY Liabilities: Future policy beneï¬ts 81,974 Policyholder account balances 54,309 Other policyholder funds 5,705 Policyholder dividends payable 1,082 Policyholder dividend obligation 385 Short-term debt 1,094 Long-term debt 2,426 Current income taxes... -

Page 35

... and 1998 (Dollars in millions, except per share data) 2000 1999 1998 REVENUES Premiums Universal life and investment-type product policy fees Net investment income Other revenues Net investment (losses) gains (net of amounts allocable to other accounts of $(54), $(67) and $608, respectively... -

Page 36

...31, 1999 Policy credits and cash payments to eligible policyholders ** Common stock issued in demutualization Initial public offering of common stock Private placement of common stock Unit offering Treasury stock acquired Dividends on common stock Comprehensive income: Net loss before date of... -

Page 37

... limited partnership interests ******** (200) Interest credited to other policyholder account balances 2,935 Universal life and investment-type product policy fees 1,820) Change in accrued investment income 170) Change in premiums and other receivables 454) Change in deferred policy acquisition... -

Page 38

... 2000, 1999 and 1998 (Dollars in millions) 2000 1999 1998 Supplemental disclosures of cash ï¬,ow information: Cash paid during the year for: Interest Income taxes Non-cash transactions during the year: Policy credits to eligible policyholders Business acquisitions - assets Business acquisitions... -

Page 39

... to their policy values in the form of policy credits aggregating $408 million, as provided in the plan. In addition, Metropolitan Life's Canadian branch made cash payments of $327 million to holders of certain policies transferred to Clarica Life Insurance Company in connection with the sale of... -

Page 40

... over the expected life of the contract for participating traditional life, universal life and investment-type products. Generally, deferred policy acquisition costs are amortized in proportion to the present value of estimated gross margins or proï¬ts from investment, mortality, expense margins... -

Page 41

... to claim terminations, expenses and interest. Interest rates used in establishing such liabilities range from 3% to 11%. Policyholder account balances for universal life and investment-type contracts are equal to the policy account values, which consist of an accumulation of gross premium payments... -

Page 42

... for annuities, the amount of expected future policy beneï¬t payments. Premiums related to non-medical health contracts are recognized on a pro rata basis over the applicable contract term. Deposits related to universal life and investment-type products are credited to policyholder account balances... -

Page 43

METLIFE, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Application of Accounting Pronouncements Effective December 31, 2000, the Company early adopted Statement of Position (''SOP'') 00-3, Accounting by Insurance Enterprises for Demutualizations and Formations of Mutual Insurance ... -

Page 44

...States and political subdivisions Foreign governments Corporate Mortgage- and asset-backed securities Other Total bonds Redeemable preferred stocks Total ï¬xed maturities Equity Securities: Common stocks Nonredeemable preferred stocks Total equity securities $ 5,990 1,583 4,090 47,505... -

Page 45

... New York and Georgia, respectively. Generally, the Company (as the lender) requires that a minimum of one-fourth of the purchase price of the underlying real estate be paid by the borrower. Certain of the Company's real estate joint ventures have mortgage loans with the Company. The carrying values... -

Page 46

METLIFE, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Changes in mortgage loan valuation allowances were as follows: Years ended December 31, 2000 1999 1998 (Dollars in millions) Balance at January 1 Additions Deductions for writedowns and dispositions Acquisitions (dispositions... -

Page 47

... by the related property. Net Investment Income The components of net investment income were as follows: Years ended December 31, 2000 1999 1998 (Dollars in millions) Fixed maturities Equity securities Mortgage loans on real estate Real estate and real estate joint ventures Policy loans Other... -

Page 48

... securities Mortgage loans on real estate Real estate and real estate joint ventures Other limited partnership interests Sales of businesses Other Total Amounts allocable to: Future policy beneï¬t loss recognition Deferred policy acquisition costs Participating contracts Policyholder... -

Page 49

... 2000 Carrying Value Notional Amount Current Market or Fair Value Carrying Assets Liabilities Value (Dollars in millions) 1999 Notional Amount Current Market or Fair Value Assets Liabilities Financial futures Interest rate swaps Floors Caps Foreign currency swaps Exchange traded options Total... -

Page 50

... Equity securities Mortgage loans on real estate Policy loans Short-term investments Cash and cash equivalents Mortgage loan commitments Liabilities: Policyholder account balances Short-term debt Long-term debt Payable under securities loaned transactions Other: Company-obligated... -

Page 51

...and sales representatives of Metropolitan Life and certain of its subsidiaries. Retirement beneï¬ts are based upon years of credited service and ï¬nal average earnings history. The Company also provides certain postemployment beneï¬ts and certain postretirement health care and life insurance bene... -

Page 52

...-force. The expected life of the closed block is over 100 years. The Company uses the same accounting principles to account for the participating policies included in the closed block as it used prior to the date of demutualization. However, the Company establishes a policyholder dividend obligation... -

Page 53

... policy beneï¬ts Other policyholder funds Policyholder dividends payable Policyholder dividend obligation Payable under securities loaned transactions Other Total closed block liabilities Assets Designated to the Closed Block Investments: Fixed maturities available-for-sale, at fair value... -

Page 54

... a minimum return or account value to the policyholder. Fees charged to the separate accounts by the Company (including mortality charges, policy administration fees and surrender charges) are reï¬,ected in the Company's revenues as universal life and investment-type product policy fees and totaled... -

Page 55

... 15, 2005. The number of shares to be purchased at such date will be determined based on the average trading price of the Holding Company's common stock. The proceeds from the sale of the units were used to acquire $1,006 million 8.00% debentures of the Holding Company (''MetLife debentures''). The... -

Page 56

... Tower Life Insurance Company for policies or annuities issued during the class period. Approximately 20,000 class members elected to exclude themselves from the settlement. At December 31, 2000, approximately 300 of these ''opt-outs'' have ï¬led new individual lawsuits. The settlement provides... -

Page 57

...December 31, 1998. Each excess of loss reinsurance agreement for sales practices claims and mortality losses contains an experience fund, which provides for payments to Metropolitan Life at the commutation date if experience is favorable at such date. The Company accounts for the aggregate excess of... -

Page 58

... to policyholders regarding the plan. These actions name as defendants some or all of Metropolitan Life, the Holding Company, the individual directors, the New York Superintendent of Insurance and the underwriters for MetLife, Inc.'s initial public offering, Goldman Sachs & Company and Credit Suisse... -

Page 59

... in 2000 in the United States District Courts for the Southern District of New York, for the Eastern District of Louisiana, and for the District of Kansas, alleging racial discrimination in the marketing, sale, and administration of life insurance policies, including ''industrial'' life insurance... -

Page 60

... assumption of certain funding agreements. The fee has been considered as part of the purchase price of GenAmerica. GenAmerica is a holding company which includes General American Life Insurance Company, approximately 49% of the outstanding shares of RGA common stock, a provider of reinsurance, and... -

Page 61

... it indemniï¬es another insurance company for all or a portion of the insurance risk underwritten by the ceding company. See Note 10 for information regarding certain excess of loss reinsurance agreements providing coverage for risks associated primarily with sales practices claims. The amounts in... -

Page 62

... of 60,000,000 shares of its common stock at an initial public offering price of $14.25 per share. The shares of common stock issued in the offerings were in addition to 494,466,664 shares of common stock of the Holding Company distributed to the Metropolitan Life Policyholder Trust for the bene... -

Page 63

..., the Holding Company may purchase the common stock from the Metropolitan Life Policyholder Trust, in the open market, and in private transactions. Through December 31, 2000, 26,084,751 shares of common stock have been acquired for $613 million. Dividend Restrictions Under the New York Insurance Law... -

Page 64

...-term care, and dental insurance, and other insurance products and services. Reinsurance provides life reinsurance and international life and disability on a direct and reinsurance basis. Auto & Home provides insurance coverages, including private passenger automobile, homeowners and personal excess... -

Page 65

...673 Universal life and investment-type product policy fees 1,221 Net investment income 6,475 Other revenues 838 Net investment gains (losses) ****** 227 Policyholder beneï¬ts and claims **** 5,054 Interest credited to policyholder account balances 1,680 Policyholder dividends 1,742 Payments to... -

Page 66

...Premiums 4,323 Universal life and investment-type product policy fees 817 Net investment income 5,480 Other revenues 474 Net investment gains 659 Policyholder beneï¬ts and claims **** 4,606 Interest credited to policyholder account balances 1,423 Policyholder dividends 1,445 Demutualization... -

Page 67

...Metropolitan Life Insurance Company Member, Governance and Finance Committee and Executive Committee HELENE L. KAPLAN Retired Chairman and Chief Executive Ofï¬cer New York Stock Exchange, Inc. Member, Audit Committee, Governance and Finance Committee and Executive Committee HUGH B. PRICE Chairman... -

Page 68

... publicly traded company during the ï¬rst quarter of 2000. **MetLife, Inc. became a publicly traded company on April 5, 2000. Transfer Agent/Shareholder Records For information or assistance regarding shareholder accounts or dividend checks, please contact MetLife's transfer agent: Mellon Investor...