MasterCard 2010 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

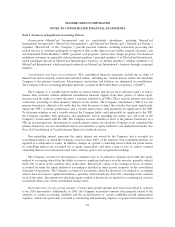

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—continued

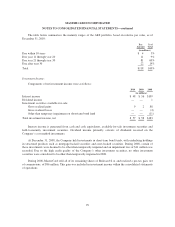

Share based payments—The Company recognizes the fair value of all share-based payments to employees

in its financial statements. The Company uses the straight-line method of attribution for expensing equity awards.

Compensation expense is recorded net of estimated forfeitures. Estimates are adjusted as appropriate. The

Company recognizes a realized tax benefit associated with dividends on certain equity shares and options as an

increase to additional paid-in capital. The benefit is included in the pool of excess tax benefits available to absorb

potential future tax liabilities on share based payment awards.

Advertising expense—The cost of media advertising is expensed when the advertising takes place.

Advertising production costs are expensed as incurred. Promotional items are expensed at the time the

promotional event occurs. Sponsorship costs are recognized over the period of benefit based on the estimated

value of certain events.

Foreign currency translation—The Company’s functional currencies include the U.S. dollar, the euro, the

Brazilian real, the Australian dollar, and the U.K. pound sterling. For foreign currency remeasurement from each

local currency into the appropriate functional currency, monetary assets and liabilities are remeasured to U.S.

dollars using current exchange rates in effect at the balance sheet date. Non-monetary assets and liabilities are

recorded at historical exchange rates, and revenue and expense accounts are remeasured at a weighted average

exchange rate for the period. Resulting exchange gains and losses related to remeasurement are included in

general and administrative expenses in the consolidated statement of operations.

Where a non-U.S. currency is the functional currency, translation from that functional currency to U.S.

dollars is performed for balance sheet accounts using current exchange rates in effect at the balance sheet date

and for revenue and expense accounts using a weighted average exchange rate for the period. Resulting

translation adjustments are reported as a component of other comprehensive income (loss).

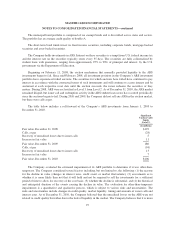

Earnings (loss) per share—A new accounting standard related to instruments granted in share-based

payment transactions became effective for the Company on January 1, 2009, resulting in the retrospective

adjustment of earnings per share (“EPS”) for prior periods. See Note 3 (Earnings (Loss) Per Share) for further

detail.

Recent accounting pronouncements

Transfers of financial assets—In June 2009, the accounting standard for transfers and servicing of financial

assets and extinguishments of liabilities was amended. The change eliminates the qualifying special purpose

entity concept, establishes a new unit of account definition that must be met for the transfer of portions of

financial assets to be eligible for sale accounting, clarifies and changes the derecognition criteria for a transfer to

be accounted for as a sale, changes the amount of gain or loss on a transfer of financial assets accounted for as a

sale when beneficial interests are received by the transferor, and requires additional new disclosures. The

Company adopted the new standard upon its effective date of January 1, 2010. The adoption did not have an

impact on the Company’s financial position or results of operations.

Variable interest entities—In June 2009, there was a revision to the accounting standard for the

consolidation of variable interest entities. The revision eliminates the exemption for qualifying special purpose

entities, requires a new qualitative approach for determining whether a reporting entity should consolidate a

variable interest entity, and changes the requirement of when to reassess whether a reporting entity should

consolidate a variable interest entity. During February 2010, the scope of the revised standard was modified to

indefinitely exclude certain entities from the requirement to be assessed for consolidation. The Company adopted

the new standard upon its effective date of January 1, 2010. The adoption did not have an impact on the

Company’s financial position or results of operations.

89