MasterCard 2010 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

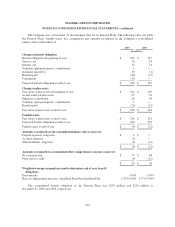

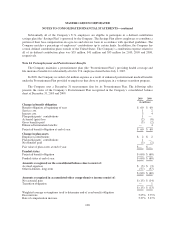

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—continued

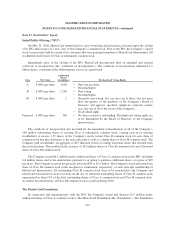

In February 2009, the Company’s Board of Directors authorized the conversion and sale or transfer of up to

11 million shares of Class B common stock into Class A common stock. In May 2009, the Company

implemented and completed a conversion program in which 10.9 million shares of Class B common stock were

converted into an equal number of shares of Class A common stock and subsequently sold or transferred to

public investors.

Commencing on May 31, 2010, the fourth anniversary of the IPO, each share of Class B common stock

became eligible for conversion, at the holder’s option, into a share of Class A common stock on a one-for-one

basis. In February 2010, the Company’s Board of Directors authorized programs to facilitate conversions of

shares of Class B common stock (without limits as to the number of shares) on a one-for-one basis into shares of

Class A common stock for subsequent sale or transfer to public investors, beginning after May 31, 2010. The

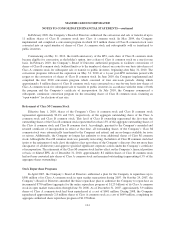

conversion programs followed the expiration on May 31, 2010 of a 4-year post-IPO restriction period with

respect to the conversion of shares of Class B common stock. In June 2010, the Company implemented and

completed the first 2010 conversion program which consisted of four one-week periods, during which

approximately 8 million shares of Class B common stock were converted on a one-for-one basis into shares of

Class A common stock for subsequent sale or transfer to public investors in accordance with the terms of both

the program and the Company’s certificate of incorporation. In July 2010, the Company commenced a

subsequent, continuous conversion program for the remaining shares of Class B common stock, featuring an

“open window” for elections of any size.

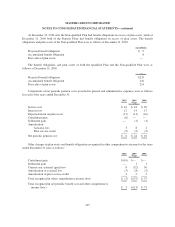

Retirement of Class M Common Stock

Effective June 1, 2010, shares of the Company’s Class A common stock and Class B common stock

represented approximately 90.4% and 9.6%, respectively, of the aggregate outstanding shares of the Class A

common stock and Class B common stock. This level of Class B ownership represented the first time the

outstanding shares of the Class B common stock represented less than 15% of the aggregate outstanding shares of

the Class A common stock and Class B common stock. Accordingly, pursuant to the Company’s amended and

restated certificate of incorporation in effect at that time, all outstanding shares of the Company’s Class M

common stock were automatically transferred to the Company and retired, and are no longer available for issue

or reissue. Additionally, the Company no longer has authority to issue additional shares of Class M common

stock. Although the Class M common stock was generally non-voting, the holders of Class M common stock had

(prior to the retirement of such class) the right to elect up to three of the Company’s directors (but not more than

one-quarter of all directors) and approve specified significant corporate actions under the Company’s certificate

of incorporation. The retirement of the Class M common stock had no effect on the Company’s financial position

or basic or diluted EPS. As of December 31, 2010, approximately 8.2 million shares of Class B common stock

had not been converted into shares of Class A common stock and remained outstanding (representing 6.3% of the

aggregate shares outstanding).

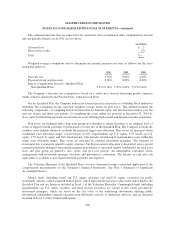

Stock Repurchase Programs

In April 2007, the Company’s Board of Directors authorized a plan for the Company to repurchase up to

$500 million of its Class A common stock in open market transactions during 2007. On October 29, 2007, the

Company’s Board of Directors amended the share repurchase plan to authorize the Company to repurchase an

incremental $750 million (aggregate for the entire repurchase program of $1.25 billion) of its Class A common

stock in open market transactions through June 30, 2008. As of December 31, 2007, approximately 3.9 million

shares of Class A common stock had been repurchased at a cost of $601 million. During 2008, the Company

repurchased approximately 2.8 million shares of Class A common stock at a cost of $649 million, completing its

aggregate authorized share repurchase program of $1.25 billion.

114