MasterCard 2010 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—continued

Company has global risk management policies and procedures, which include risk standards, to provide a

framework for managing the Company’s settlement risk. Member-reported transaction data and the transaction

clearing data underlying the settlement risk calculation may be revised in subsequent reporting periods.

In the event that MasterCard International effects a payment on behalf of a failed member, MasterCard

International may seek an assignment of the underlying receivables. Subject to approval by the Board of

Directors, members may be charged for the amount of any settlement loss incurred during the ordinary activities

of the Company.

MasterCard requires certain members that are not in compliance with the Company’s risk standards in effect

at the time of review to post collateral, typically in the form of cash, letters of credit, or guarantees. This

requirement is based on management review of the individual risk circumstances for each member that is out of

compliance. In addition to these amounts, MasterCard holds collateral to cover variability and future growth in

member programs. The Company also holds collateral to pay merchants in the event of merchant bank/acquirer

failure. Although it is not contractually obligated under MasterCard International’s standards to effect such

payments to merchants, the Company may elect to do so to protect brand integrity. MasterCard monitors its

credit risk portfolio on a regular basis and the adequacy of collateral on hand. Additionally, from time to time,

the Company reviews its risk management methodology and standards. As such, the amounts of estimated

settlement risk are revised as necessary.

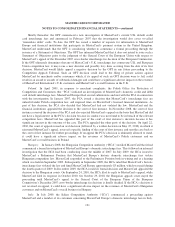

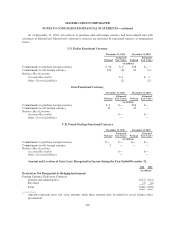

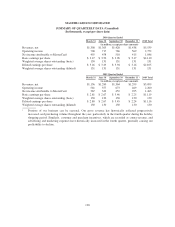

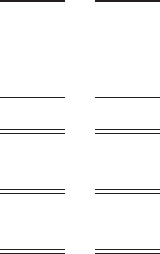

Estimated Settlement Exposure, and the portion of the Company’s uncollateralized Settlement Exposure for

MasterCard-branded transactions that relates to members that are deemed not to be in compliance with, or that

are under review in connection with, the Company’s risk management standards, were as follows:

2010 2009

(in millions)

MasterCard-branded transactions:

Gross Settlement Exposure $28,509 $25,279

Collateral held for Settlement Exposure (2,993) (2,688)

Net uncollateralized Settlement Exposure $25,516 $22,591

Uncollateralized Settlement Exposure attributable to non-compliant

members $ 273 $ 205

Cirrus and Maestro transactions:

Gross Settlement Exposure $ 2,962 $ 3,830

Although MasterCard holds collateral at the member level, the Cirrus and Maestro estimated Settlement

Exposures are calculated at the regional level. Therefore, these Settlement Exposures are reported on a gross

basis, rather than net of collateral.

Of the total estimated Settlement Exposure under the MasterCard brand, net of collateral, the U.S. accounted

for approximately 35% and 37% at December 31, 2010 and 2009, respectively. With the exception of Brazil,

which was 12% at December 31, 2010, no individual country other than the United States accounted for more

than 10% of total uncollateralized Settlement Exposure at either December 31, 2010 or 2009. Of the total

uncollateralized Settlement Exposure attributable to non-compliant members, five members represented

approximately 66% and 57% at December 31, 2010 and 2009, respectively.

MasterCard guarantees the payment of MasterCard-branded travelers cheques in the event of issuer default.

The guarantee estimate is based on all outstanding MasterCard-branded travelers cheques, reduced by an

actuarial determination of cheques that are not anticipated to be presented for payment. The term of the guarantee

is unlimited, while the amount is limited to cheques issued but not yet cashed. MasterCard calculated its

134