MasterCard 2010 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

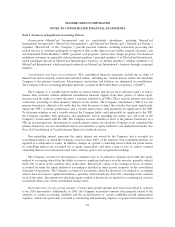

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—continued

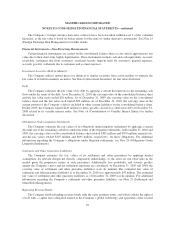

Revenue arrangements with multiple deliverables—In September 2009, the accounting standard for the

allocation of revenue in arrangements involving multiple deliverables was amended. Current accounting

standards require companies to allocate revenue based on the fair value of each deliverable, even though such

deliverables may not be sold separately either by the company itself or other vendors. The new accounting

standard eliminates (i) the residual method of revenue allocation and (ii) the requirement that all undelivered

elements must have objective and reliable evidence of fair value before a company can recognize the portion of

the overall arrangement fee that is attributable to items that already have been delivered. The Company will

adopt the revised accounting standard effective January 1, 2011 via prospective adoption. The Company does not

expect the adoption to have a material impact on the Company’s financial position or results of operations.

Fair value disclosures—In January 2010, fair value disclosure requirements were amended to require

detailed disclosures about transfers to and from Level 1 and 2 of the Valuation Hierarchy effective January 1,

2010 and disclosures regarding purchases, sales, issuances, and settlements on a “gross” basis within the Level 3

(of the Valuation Hierarchy) reconciliation effective January 1, 2011. The Company adopted the new guidance

for disclosures about transfers to and from Level 1 and 2 of the Valuation Hierarchy effective January 1, 2010.

The adoption did not have an impact on the Company’s financial position or results of operations. The Company

will adopt the guidance that requires disclosure of a reconciliation of purchases, sales, issuances, and settlements

on a “gross” basis within Level 3 (of the Valuation Hierarchy) effective January 1, 2011, as required, and the

adoption will have no impact on the Company’s financial position or results of operations.

Disclosure about the Credit Quality of Financing Receivables and the Allowance for Credit Losses—In July

2010, a new accounting standard was issued. This standard provides new disclosure guidance that will require

companies to provide more information about the credit quality of their financing receivables in the disclosures

to financial statements including, but not limited to, significant purchases and sales of financing receivables,

aging information and credit quality indicators. The Company adopted this accounting standard upon its effective

date, periods ending on or after December 15, 2010, and the adoption had no impact on the Company’s financial

position or results of operations.

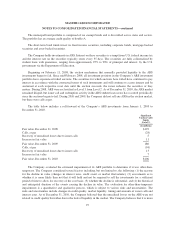

Impairment testing for goodwill—In December 2010, a new accounting standard was issued. This standard

requires Step 2 of the goodwill impairment test to be performed for reporting units with zero or negative carrying

amounts if qualitative factors indicate that it is more likely than not that a goodwill impairment exists. The

provisions for this pronouncement are effective for fiscal years beginning after December 15, 2010, with no early

adoption permitted. The Company will adopt this accounting standard on January 1, 2011, and does not

anticipate that this adoption will have an impact on the Company’s financial position or results of operations.

Business combinations—In December 2010, a new accounting standard was issued. This standard requires a

company to disclose revenue and earnings of the combined entity as though the business combination that

occurred during the current year had occurred as of the beginning of the comparable prior annual reporting

period, only when comparative financial statements are presented. The disclosure provisions are effective

prospectively for business combinations for which the acquisition date is on or after the beginning of the first

annual reporting period beginning on or after December 15, 2010, with early adoption permitted. The Company

will adopt this accounting standard on January 1, 2011, and the adoption will have no impact on the Company’s

financial position or results of operations.

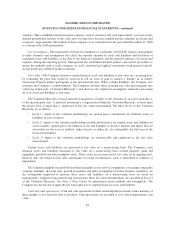

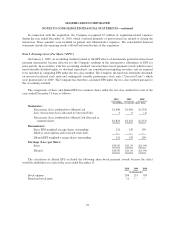

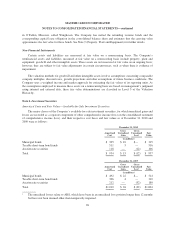

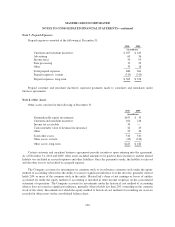

Note 2. Acquisition of DataCash Group plc

On August 19, 2010, MasterCard entered into an agreement to acquire all the outstanding shares of

DataCash Group plc (“DataCash”), a European payment service provider. Pursuant to the terms of the acquisition

agreement, the Company acquired DataCash on October 22, 2010 at a purchase price of 334 million U.K. pound

sterling, or $534 million. There was no contingent consideration related to the acquisition.

90