MasterCard 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Advertising and Marketing

Our brands, principally MasterCard, are valuable strategic assets that drive card acceptance and usage and

facilitate our ability to successfully introduce new service offerings and access new markets globally. Our

advertising and marketing strategy is to increase global MasterCard brand awareness, preference and usage

through integrated advertising, sponsorship, promotional, interactive media and public relations programs on a

global scale. We will also continue to invest in marketing programs at the regional and local levels and sponsor

diverse events aimed at multiple target audiences.

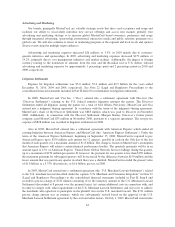

Advertising and marketing expenses increased $26 million, or 3.5%, in 2010 mainly due to customer-

specific initiatives and sponsorships. In 2009, advertising and marketing expenses decreased $179 million, or

19.2%, primarily due to cost management initiatives and market realities. Additionally, the impact of foreign

currency relating to the translation of amounts from the euro and the Brazilian real to U.S. dollars reduced

advertising and marketing expenses by approximately 1 percentage point and 2 percentage points in 2010 and

2009, respectively.

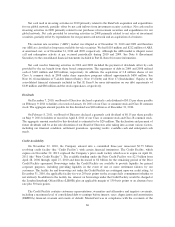

Litigation Settlements

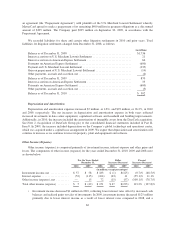

Expense for litigation settlements was $5.0 million, $7.0 million and $2.5 billion for the years ended

December 31, 2010, 2009 and 2008, respectively. See Note 22 (Legal and Regulatory Proceedings) to the

consolidated financial statements included in Part II, Item 8 for information on litigation settlements.

In 2008, MasterCard and Visa Inc. (“Visa”) entered into a settlement agreement with Discover (the

“Discover Settlement”) relating to the U.S. federal antitrust litigation amongst the parties. The Discover

Settlement ended all litigation among the parties for a total of $2.8 billion. Previously, MasterCard and Visa

entered into a judgment sharing agreement. In accordance with the terms of the judgment sharing agreement,

MasterCard’s share of the Discover Settlement was $863 million, which was paid to Discover in November

2008. Additionally, in connection with the Discover Settlement, Morgan Stanley, Discover’s former parent

company, paid MasterCard $35 million in November 2008, pursuant to a separate agreement. The net pre-tax

expense of $828 million was recorded in litigation settlements in 2008.

Also in 2008, MasterCard entered into a settlement agreement with American Express which ended all

existing litigation between American Express and MasterCard (the “American Express Settlement”). Under the

terms of the American Express Settlement, beginning on September 15, 2008, MasterCard is required to pay

American Express up to $150 million each quarter for 12 quarters, payable in cash on the 15th day of the last

month of each quarter, for a maximum amount of $1.8 billion. The charge is based on MasterCard’s assumption

that American Express will achieve certain financial performance hurdles. The quarterly payments will be in an

amount equal to 15% of American Express’ United States Global Network Services billings during the quarter,

up to a maximum of $150 million per quarter. If, however, the payment for any quarter is less than $150 million,

the maximum payment for subsequent quarters will be increased by the difference between $150 million and the

lesser amount that was paid in any quarter in which there was a shortfall. MasterCard recorded the present value

of $1.8 billion, at a 5.75% discount rate, or $1.6 billion, pre-tax, in 2008.

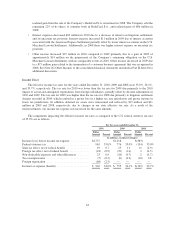

In 2003, MasterCard entered into a settlement agreement (the “U.S. Merchant Lawsuit Settlement”) related

to the U.S. merchant lawsuit described under the caption “U.S. Merchant and Consumer Litigations” in Note 22

(Legal and Regulatory Proceedings) to the consolidated financial statements included in Part II, Item 8 and

recorded a pre-tax charge of $721 million consisting of (i) the monetary amount of the U.S. Merchant Lawsuit

Settlement (discounted at 8 percent over the payment term), (ii) certain additional costs in connection with, and

in order to comply with, other requirements of the U.S. Merchant Lawsuit Settlement, and (iii) costs to address

the merchants who opted not to participate in the plaintiff class in the U.S. merchant lawsuit. The $721 million

pre-tax charge amount was an estimate, which was subsequently revised based on the approval of the U.S.

Merchant Lawsuit Settlement agreement by the court and other factors. On July 1, 2009, MasterCard entered into

61