MasterCard 2010 Annual Report Download - page 64

Download and view the complete annual report

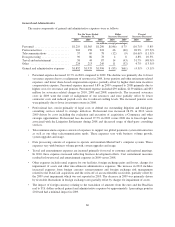

Please find page 64 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Signature-based (credit and off-line debit) or PIN-based (on-line debit, including automated teller

machine (“ATM”) cash withdrawals and retail purchases)

• Tiered pricing, with rates decreasing as customers meet incremental volume/transaction hurdles

• Geographic region or country

• Retail purchase or cash withdrawal

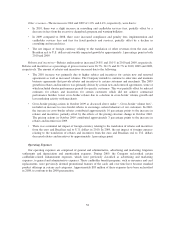

Cross-border transactions generate greater revenue than do domestic transactions since cross-border fees are

higher than domestic fees. We review our pricing and implement pricing changes on an ongoing basis and expect

pricing to continue to be a component of revenue growth in the future. In addition, standard pricing varies among

our regional businesses, and such pricing can be customized further for our customers through incentive and

rebate agreements.

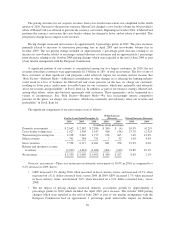

The Company classifies its net revenues into the following five categories:

1. Domestic assessments: Domestic assessments are fees charged to issuers and acquirers based

primarily on the volume of activity on cards that carry our brands where the merchant country and the

cardholder country are the same. A portion of these assessments is estimated based on aggregate

transaction information collected from our systems and projected customer performance and is

calculated by converting the aggregate volume of usage (purchases, cash disbursements, balance

transfers and convenience checks) from local currency to the billing currency and then multiplying by

the specific price. In addition, domestic assessments include items such as card assessments, which are

fees charged on the number of cards issued or assessments for specific purposes, such as acceptance

development or market development programs. Acceptance development fees are charged primarily to

U.S. issuers based on components of volume, and support our focus on developing merchant

relationships and promoting acceptance at the point of sale.

2. Cross-border volume fees: Cross-border volume fees are charged to issuers and acquirers based on

the volume of activity on cards that carry our brands where the merchant country and the cardholder

country are different. Cross-border volume fees are calculated by converting the aggregate volume of

usage (purchases and cash disbursements) from local currency to the billing currency and then

multiplying by the specific price. Cross-border volume fees also include fees, charged to issuers, for

performing currency conversion services.

3. Transaction processing fees: Transaction processing fees are charged for both domestic and cross-

border transactions and are primarily based on the number of transactions. These fees are calculated by

multiplying the number and type of transactions by the specific price for each service. Transaction

processing fees include charges for the following:

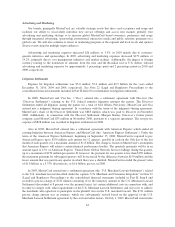

•Transaction Switching—Authorization, Clearing and Settlement.

a. Authorization refers to a process in which a transaction is approved by the issuer or, in

certain circumstances such as when the issuer’s systems are unavailable or cannot be

contacted, by MasterCard or others on behalf of the issuer in accordance with either the

issuer’s instructions or applicable rules. MasterCard’s rules, which vary across regions,

establish the circumstances under which merchants and acquirers must seek authorization of

transactions. Fees for authorization are primarily paid by issuers.

b. Clearing refers to the exchange of financial transaction information between issuers and

acquirers after a transaction has been completed. Fees for clearing are primarily paid by

issuers.

c. Settlement refers to facilitating the exchange of funds between parties. Fees for settlement are

primarily paid by issuers.

54