MasterCard 2010 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.issuing customers with a complete processing solution to help create differentiated products and

services and allow quick deployment of payments portfolios across banking channels. Through a

single processing platform, IPS can, among other things, authorize debit and prepaid transactions,

assist issuers in managing risk using fraud detection tools, manage an issuer’s card base, and

manage and monitor an issuer’s ATMs. The proprietary MasterCard Total Portfolio Viewer™

provides a user-friendly customer interface to IPS, delivering aggregate cardholder intelligence

across accounts and product lines to provide our customers with a view of information that can help

them customize their products and programs. We continue to develop opportunities to further

enhance our IPS offerings and global presence.

OInternet Payment Gateways. MasterCard provides e-Commerce processing solutions through

internet payment gateways, which are interfaces between the merchant and its acquirer as a

transaction moves to a payments network. Our gateways include our MasterCard Internet Gateway

Service (MiGS), which provides gateway infrastructure in Asia Pacific, and DataCash, a European

payment service provider which MasterCard acquired in October 2010. DataCash offers a single

interface that provides e-Commerce merchants with the ability to process secure payments across

the world, and develops and provides outsourced electronic payments solutions, fraud prevention,

alternative payment options, and other solutions.

OStrategic Alliances. We have invested in strategic alliances to pursue opportunities in prepaid and

acquirer and third-party processing both through joint ventures and minority investments. These

alliances include: (1) Prepay Solutions, a joint venture with Edenred (previously named Accor

Services) which supports prepaid processing in Europe, (2) Strategic Payment Services, which

provides acquirer processing in Asia Pacific, (3) ElectraCard Services, which provides third-party

processing services and software, as well as switching solutions, in Asia Pacific, the Middle East

and Africa and (4) Trevica, which provides third-party issuer processing services in Poland and

other central and eastern European markets.

MasterCard Programs and Solutions

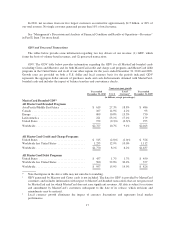

Our principal payment programs and solutions, which are facilitated through our brands, include consumer

credit and charge, debit and prepaid programs, commercial payment solutions and emerging payments solutions.

Our issuer customers determine the competitive features for the cards issued under our programs, including

interest rates and fees. We determine other aspects of our card programs—such as required services and the

marketing strategy—in order to ensure consistency in connection with these programs.

Consumer Credit and Charge. MasterCard offers a number of consumer credit and charge programs that

are designed to meet the needs of our customers. For the year ended December 31, 2010, our consumer credit and

charge programs generated approximately $1.6 trillion in GDV globally, representing 57% of our total GDV for

this period. As of December 31, 2010, the MasterCard brand mark appeared on approximately 648 million

consumer credit and charge cards worldwide, representing a 2.4% decline from December 31, 2009.

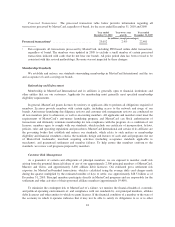

•United States. We offer customized programs to customers in the United States to address specific

consumer segments. Our consumer credit programs include Standard (general purpose cards targeted to

consumers with basic credit card needs), Gold and Platinum (cards featuring higher credit lines and

spending limits and a varying level of enhanced services) and World and World Elite MasterCard®

(cards offered to affluent consumers which feature a wider range of enhanced services).

•Regions Outside of the United States. MasterCard makes available to customers outside of the United

States a variety of consumer card programs in selected markets throughout the world. Examples of such

programs include MasterCard Electronic™ cards (which offer additional control and risk management

features designed to curb fraud and control exposure in high risk markets) and cards targeted to affluent

consumers (such as Platinum MasterCard®and MasterCard Black™ cards in Latin America, World and

World Signia MasterCard®cards in Europe, World and World Elite MasterCard®cards in Canada and

Platinum and World MasterCard®cards in Asia/Pacific, Middle East and Africa (“APMEA”)).

10