MasterCard 2010 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—continued

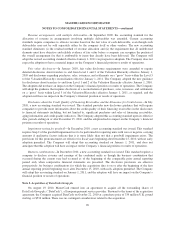

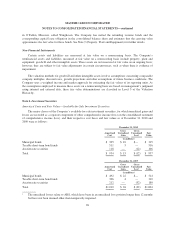

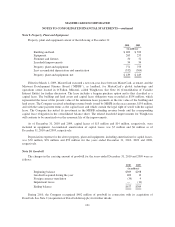

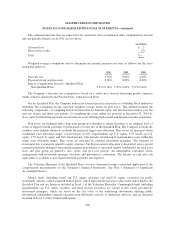

The table below summarizes the maturity ranges of the ARS portfolio, based on relative par value, as of

December 31, 2010:

Par

Amount

%of

Total

(in millions)

Due within 10 years $4 3%

Due year 11 through year 20 11 9%

Due year 21 through year 30 81 69%

Due after year 30 22 19%

Total $118 100%

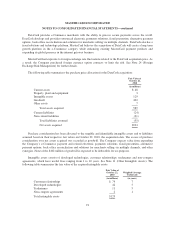

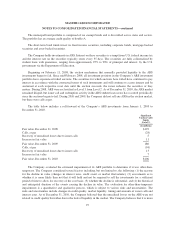

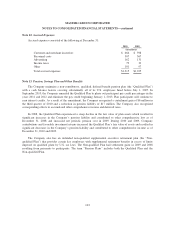

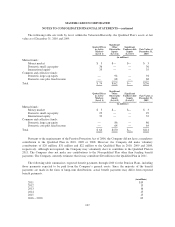

Investment Income:

Components of net investment income were as follows:

2010 2009 2008

(in millions)

Interest income $ 48 $ 56 $109

Dividend income — — 1

Investment securities available-for-sale:

Gross realized gains 9 2 88

Gross realized losses — — (4)

Other than temporary impairment on short-term bond fund — — (11)

Total investment income, net $ 57 $ 58 $183

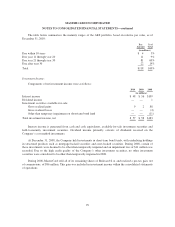

Interest income is generated from cash and cash equivalents, available-for-sale investment securities and

held-to-maturity investment securities. Dividend income primarily consists of dividends received on the

Company’s cost method investments.

At December 31, 2008, the Company held investments in short-term bond funds, with underlying holdings

in structured products such as mortgage-backed securities and asset-backed securities. During 2008, certain of

these investments were deemed to be other-than-temporarily impaired and an impairment loss of $11 million was

recorded. Due to the high credit quality of the Company’s other investment securities, no other investment

securities were considered to be other-than-temporarily impaired in 2008.

During 2008, MasterCard sold all of its remaining shares of Redecard S.A. and realized a pre-tax gain, net

of commissions, of $86 million. This gain was included in investment income within the consolidated statements

of operations.

99