MasterCard 2010 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—continued

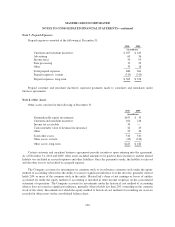

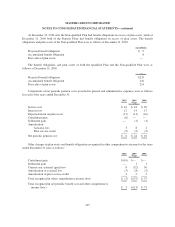

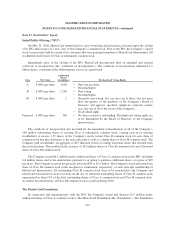

The Company does not make any contributions to its Postretirement Plan other than funding benefit

payments. The following table summarizes expected net benefit payments from the Company’s general assets

through 2020:

Benefit

Payments

Expected

Subsidy

Receipts

Net

Benefit

Payments

(in millions)

2011 $ 3 $— $ 3

2012 4 — 4

2013 4 — 4

2014 4 — 4

2015 4 — 4

2016 – 2020 21 1 20

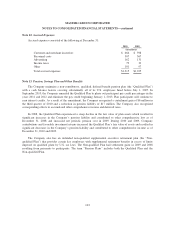

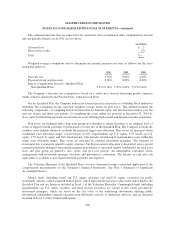

The Company provides limited postemployment benefits to eligible former U.S. employees, primarily

severance under a formal severance plan (the “Severance Plan”). The Company accounts for severance expense

by accruing the expected cost of the severance benefits expected to be provided to former employees after

employment over their relevant service periods. The Company updates the assumptions in determining the

severance accrual by evaluating the actual severance activity and long-term trends underlying the assumptions.

As a result of updating the assumptions, the Company recorded incremental severance expense related to the

Severance Plan of $3 million in each of the years 2010, 2009 and 2008. These amounts were part of total

severance expenses of $39 million, $135 million and $33 million in 2010, 2009 and 2008, respectively, included

in general and administrative expenses in the accompanying consolidated statement of operations.

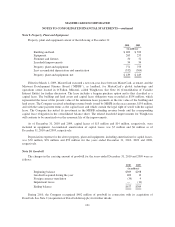

Note 15. Debt

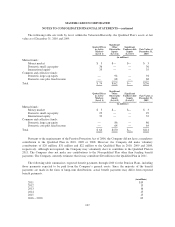

On November 22, 2010, the Company entered into a committed three-year unsecured $2.75 billion

revolving credit facility (the “Credit Facility”) with certain financial institutions. The Credit Facility, which

expires on November 22, 2013, replaced the Company’s prior credit facility which was to expire on April 26,

2011 (the “Prior Credit Facility”). The available funding under the Prior Credit Facility was $2.5 billion from

April 28, 2006 through April 27, 2010 and then decreased to $2 billion for the remaining period of the Prior

Credit Facility agreement. Borrowings under the Credit Facility are available to provide liquidity for general

corporate purposes, including providing liquidity in the event of one or more settlement failures by the

Company’s customers. The facility fee and borrowing cost under the Credit Facility are contingent upon the

Company’s credit rating. At December 31, 2010, the applicable facility fee was 20 basis points on the average

daily commitment (whether or not utilized). In addition to the facility fee, interest on borrowings under the Credit

Facility would be charged at the London Interbank Offered Rate (LIBOR) plus an applicable margin of 130 basis

points or an alternate base rate plus 30 basis points.

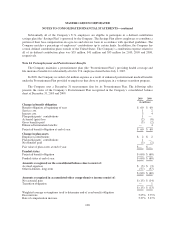

The Credit Facility contains customary representations, warranties and affirmative and negative covenants,

including a maximum level of consolidated debt to earnings before interest, taxes, depreciation and amortization

(EBITDA) financial covenant and events of default. MasterCard was in compliance with the covenants of the

Credit Facility and had no borrowings under the Credit Facility at December 31, 2010. MasterCard was in

compliance with the covenants of the Prior Credit Facility and had no borrowings under the Prior Credit Facility

at December 31, 2009. The majority of Credit Facility lenders are members or affiliates of members of

MasterCard International.

In June 1998, MasterCard International issued ten-year unsecured, subordinated notes (the “Notes”) paying

a fixed interest rate of 6.67% per annum. MasterCard repaid the entire principal amount of $80 million on

June 30, 2008 pursuant to the terms of the Notes.

110