MasterCard 2010 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

www.mastercard.com 5

Moving to electronic payments is just plain smart. The benefits of electronic payments far outweigh those of

cash. Beyond the obvious advantages of speed, convenience and guaranteed payment, electronic payments offer

a host of advantages that cash can’t touch, including security and transparency for everyone.

The MasterCard Advantage: A Range of Payment Solutions

In all markets, we’re aggressively seizing opportunities to curtail the use of cash and checks and meet consumers’

unique needs.

One way we’re doing this is through our portfolio of debit products, including Maestro. Our debit solutions are

aimed at meeting payment needs based on local market requirements. And, they can be used with some of our

most innovative payment methods, including Tap & Go, reloadable prepaid and payroll cards.

We’re also well positioned in the commercial space, an area that is fast-growing. By 2015, the commercial segment

is expected to equate to $1.7 trillion globally. And, this segment is not very developed outside of the United States

and parts of Europe.(3)

We’re poised to seize that opportunity. We already have one of the largest commercial payroll programs in place

with Walmart, and we currently capture approximately 60 percent of U.S. public-sector volume. Our commercial

prepaid cards include everything from payroll to employee benefits to government social benefit programs. These

programs are benefiting people in numerous countries, including Italy, Peru, Russia, China and the U.S.

I believe the benefits of prepaid will continue to drive demand, as total global volume on open-loop prepaid cards

is predicted to reach nearly $840 billion by 2017, according to a study we commissioned last year.

We’re also seeing significant opportunities in e-commerce and mobile. That’s why we’re forging strategic

partnerships in this space and developing the infrastructure needed to drive the migration to e-commerce and

mobile payments. Global e-commerce sales are projected to reach more than $1 trillion in 2011.

(4) And, since cash

is useless when shopping online, consumers really appreciate the convenience of electronic payments.

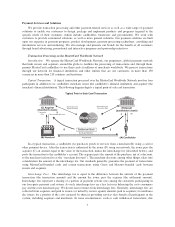

MasterCard cardholders in some of the world’s busiest

cities are benefiting from our innovative Tap & Go™

PayPass contactless technology. With MasterCard PayPass,

riders always have the exact fare, whether traveling by

subway, bus or taxi.

In the last year alone, we’ve expanded our global footprint, making

it easier for consumers to use public transportation in cities from

New York to Seoul.

•InNewYorkandNewJersey,MasterCardPayPasshelped

commuters get where they wanted to go faster — above ground

andbelow.InJune2010,wesuccessfullypilotedourcontactless

payments system linking multiple agencies: New York City Transit,

an operating agency of the New York Metropolitan Transportation

Authority (MTA), Port Authority of NY, NJ/PATHandNJTRANSIT.

With MasterCard PayPass, riders can Tap & Go quickly and easily,

paying fares directly at turnstiles and transferring seamlessly

between transit systems using credit, debit or prepaid-enabled

MasterCard PayPass cards.

•InRomania,ultrafastaccessto10subwaystationsinBucharest

is now possible through the BRD Groupe Société Générale

Speeding

up transit

card, Instant Pay. Based on contactless MasterCard PayPass

technology, the Instant Pay card eliminates the need for

travelers to purchase a separate card for transportation.

•InPoland,MasterCardPayPassisacceptedintransitstations,

taxis and at bus stops within the Warsaw vicinity, allowing

quick,non-cashpayments.Inaddition,Poland’sCitiHandlowy

isnowissuingCitiHandlowyMasterCardPayPasscontactless

debit cards with an application that allows travelers to reload

their transport tickets at unattended machines.

•InSingapore,thePostOfceSavingsBank(POSB)Everyday

MasterCard card features MasterCard PayPass and local

contactless e-Purse Application functionality. This allows

cardholders to use the card for everyday purchases as well

as throughout the public transport network, which includes

trains, buses and taxis.

•InKorea,aco-brandMasterCardcardwithPayPasstechnology

and a local transit application offers MasterCard PayPass

cardholders greater convenience when riding the transit system.

MasterCard PayPass means no waiting in line. No fumbling for

cash and coins. No watching your train leave the station while

you try to buy a fare card or token from a vending machine or

clerk. You just Tap & Go with your card, mobile phone or key fob,

and you’re on your way.

In cities around the world, “smart” consumers are benefiting

from the MasterCard Advantage.