MasterCard 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.payments across the world. DataCash develops and provides outsourced electronic payments solutions, fraud

prevention, alternative payment options, back-office reconciliation and solutions for merchants selling via

multiple channels. DataCash also has a fraud solutions and technology platform. MasterCard believes the

acquisition of DataCash will create a long-term growth platform in the e-Commerce category while enhancing

existing MasterCard payment products and expanding its global presence in the internet gateway business.

On December 9, 2010, MasterCard entered into an agreement to acquire the prepaid card program

management operations of Travelex Holdings Ltd. (“Travelex CPM”) for 290 million U.K. pound sterling, or

approximately $458 million, with contingent consideration (an “earn-out”) of up to an additional 35 million U.K.

pound sterling, or approximately $55 million, if certain performance targets are met. We will acquire the

operations that manage and deliver consumer and corporate prepaid travel cards to business partners around the

world, including financial institutions, retailers, travel agents and foreign exchange bureaus. The acquisition of

Travelex CPM is an expansion of MasterCard into program management services. Combined with our existing

processing assets and other strategic alliances, the asset will augment and support partners and issuers of prepaid

cards around the world, with a focus outside of the United States. The acquisition is intended to enable us to offer

end-to-end prepaid solutions encompassing branded switching, issuing, processing and program management

services, initially focused on the travel sector. We expect to consummate the acquisition in the first half of 2011.

Business Environment

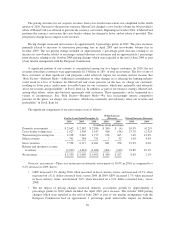

We process transactions from more than 210 countries and territories and in more than 150 currencies.

Revenue generated in the United States was approximately 41.6%, 42.4% and 44.1% of total revenues in 2010,

2009 and 2008, respectively. No individual country, other than the United States, generated more than 10% of

total revenues in any period, but differences in market maturity, economic health, price changes and foreign

exchange fluctuations in certain countries have increased the proportion of revenues generated outside the United

States over time. While the global nature of our business helps protect our operating results from adverse

economic conditions in a single or a few countries, the significant concentration of our revenues generated in the

United States makes our business particularly susceptible to adverse economic conditions in the United States.

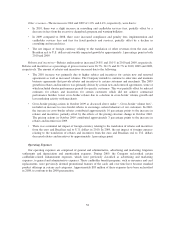

The competitive and evolving nature of the global payments industry provides both challenges to and

opportunities for the continued growth of our business. Unprecedented events which began during 2008 impacted

the financial markets around the world, including continued distress in the credit environment, continued equity

market volatility and additional government intervention. In particular, the economies of the United States and

the United Kingdom were significantly impacted by this economic turmoil, and it has also impacted other

economies around the world. More recently, European countries including Portugal, Ireland, Greece and Spain

have experienced downgrades in sovereign credit ratings by ratings agencies, driven by fiscal challenges. Some

existing customers have been placed in receivership or administration or have a significant amount of their stock

owned by their governments. Many financial institutions are facing increased regulatory and governmental

influence, including potential further changes in laws and regulations. Many of our financial institution

customers, merchants that accept our brands and cardholders who use our brands have been directly and

adversely impacted.

MasterCard’s financial results may be negatively impacted by actions taken by individual financial

institutions or by governmental or regulatory bodies in response to the economic crisis and the state of economic

environments. The severity of the economic environments may accelerate the timing of or increase the impact of

risks to our financial performance that have historically been present. As a result, our revenue growth has been

and may be negatively impacted, or the Company may be impacted in several ways, including but not limited to

the following:

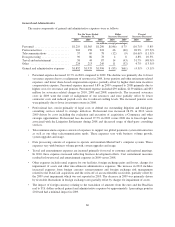

• Declining economies, foreign currency fluctuations and the pace of economic recovery can change

consumer spending behaviors; for example, a significant portion of our revenues is dependent on cross-

border travel patterns, which may continue to change.

50