MasterCard 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

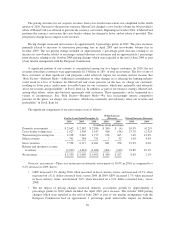

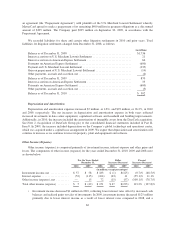

The Company’s GAAP effective income tax rate for 2008 was significantly affected by the tax benefits

related to the charges for the Litigation Settlements. Due to the non-recurring nature of these items, the Company

believes that the calculation of the 2009 and 2008 effective tax rates, excluding the impacts of the Litigation

Settlements, which are non-GAAP financial measures, will be helpful in comparing effective tax rates for 2009

and 2008, which are the most directly comparable GAAP measures.

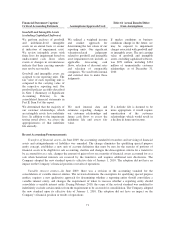

GAAP effective tax rate calculation

2010 2009 2008

(in millions, except percentages)

Income (loss) before income taxes ................................... $2,757 $2,218 $(383)

Income tax expense (benefit)1...................................... 910 755 (129)

Net income (loss) ................................................ $1,847 $1,463 $(254)

Effective tax rate ................................................ 33.0% 34.1% 33.7%

Non-GAAP effective

tax rate calculation

2009 2008

(in millions, except

percentages)

GAAP income (loss) before income taxes ........................................ $2,218 $ (383)

Litigation settlements ........................................................ 7 2,483

Non-GAAP income before income taxes ......................................... $2,225 $2,100

Income tax expense (benefit)1.................................................. 755 (129)

Impact of litigation settlements on income tax expense (benefit) ....................... (2) (941)

Non-GAAP income tax expense ................................................ 758 812

Non-GAAP net income ....................................................... $1,467 $1,288

Non-GAAP effective tax rate .................................................. 34.1% 38.7%

* Note that figures in the above table may not sum due to rounding.

1The Litigation Settlements will be deductible in future periods as payments are made and are therefore

considered in the calculation of non-GAAP income tax expense.

During 2010, the Company’s unrecognized tax benefits related to tax positions taken during the current and

prior periods increased by $19 million. The increase in the Company’s unrecognized tax benefits for 2010 is

primarily due to judgments related to current year tax positions. As of December 31, 2010, the Company’s

unrecognized tax benefits related to positions taken during the current and prior periods were $165 million, all of

which would reduce the Company’s effective tax rate if recognized.

The Company’s operations are conducted in various geographies with different tax rates. As the Company’s

operations evolve, this may impact the Company’s future effective tax rate. As a result of the Company’s

expansion in its business activities in Asia Pacific (with its regional headquarters in Singapore), it received a tax

incentive grant from the Singapore Ministry of Finance. The incentive is effective as of January 1, 2010, and

provides for a 5% income tax rate based on annual taxable income in excess of a base amount for a 10-year

period. The Company did not recognize significant tax benefits in 2010 as a result of the incentive as its

expansion commenced in November 2010. The Company continues to explore additional opportunities in this

region which may result in a tax rate potentially lower than 5%.

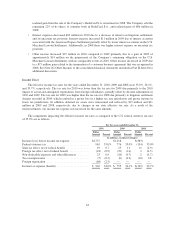

Liquidity and Capital Resources

We need liquidity and access to capital to fund our global operations; to provide for credit and settlement

risk; to finance capital expenditures; to make continued investments in our business and to service our

obligations related to litigation settlements. At December 31, 2010 and 2009, we had $3.9 billion and $2.9

billion, respectively, of cash and cash equivalents and current available-for-sale securities to use for our

operations. Our equity was $5.2 billion and $3.5 billion as of December 31, 2010 and 2009, respectively.

64