MasterCard 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

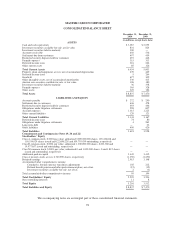

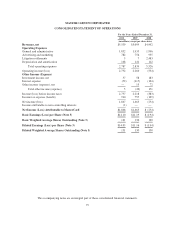

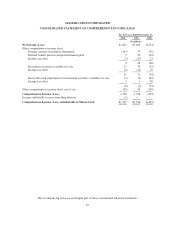

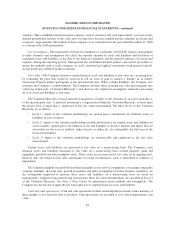

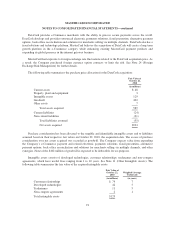

MASTERCARD INCORPORATED

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Total

Retained

Earnings

(Accumulated

Deficit)

Accumulated

Other

Comprehensive

Income,

net of tax

Common Shares Additional

Paid-In

Capital

Treasury

Stock

Non-

Controlling

InterestsClass A Class B

(in millions, except per share data)

Balance at December 31, 2007 $3,032 $ 38 $ 278 $— $— $3,312 $ (601) $ 5

Net loss (254) (254) — — — — — —

Other comprehensive loss, net of tax (169) — (169) — — — — —

Cash dividends declared on Class A and

Class B common stock, $0.60 per share (79) (20) — — — (59) — —

Share based payments 61 — — — — 61 — —

Stock units withheld for taxes (67) — — — — (67) — —

Tax benefit for share based compensation 48 — — — — 48 — —

Purchases of treasury stock (649) — — — — — (649) —

Conversion of Class B to Class A common

stock — — — — — — — —

Exercise of stock options 9 — — — — 9 — —

Balance at December 31, 2008 1,932 (236) 109 — — 3,304 (1,250) 5

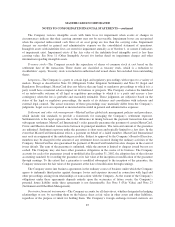

Redemption of non-controlling interest (5) — — — — — — (5)

Investment in majority owned entity 8 — — — — — — 8

Net income 1,463 1,463 — — — — — —

Other comprehensive income, net of tax 85 — 85 — — — — —

Cash dividends declared on Class A and

Class B common stock, $0.60 per share (79) (79) — — — — — —

Share based payments 88 — — — — 88 — —

Stock units withheld for taxes (28) — — — — (28) — —

Tax benefit for share based compensation 39 — — — — 39 — —

Conversion of Class B to Class A common

stock — — — — — — — —

Exercise of stock options 9 — — — — 9 — —

Balance at December 31, 2009 3,512 1,148 194 — — 3,412 (1,250) 8

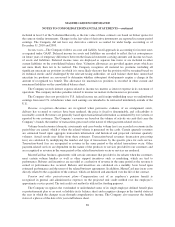

Investment in majority owned entity 2 — — — — — — 2

Net income 1,847 1,846 — — — — — 1

Other comprehensive loss, net of tax (99) — (99) — — — — —

Cash dividends declared on Class A and

Class B common stock, $0.60 per share (79) (79) — — — — — —

Share based payments 63 — — — — 63 — —

Stock units withheld for taxes (126) — — — — (126) — —

Tax benefit for share based compensation 85 — — — — 85 — —

Conversion of Class B to Class A common

stock — — — — — — — —

Exercise of stock options 11 — — — — 11 — —

Balance at December 31, 2010 $5,216 $2,915 $ 95 $— $— $3,445 $(1,250) $ 11

The accompanying notes are an integral part of these consolidated financial statements.

81