MasterCard 2010 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—continued

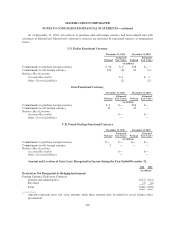

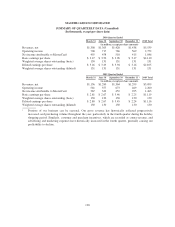

As of December 31, 2010, all contracts to purchase and sell foreign currency had been entered into with

customers of MasterCard. MasterCard’s derivative contracts are classified by functional currency as summarized

below:

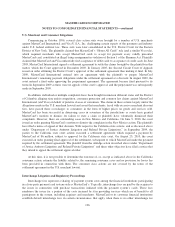

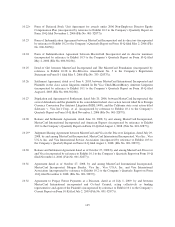

U.S. Dollar Functional Currency

December 31, 2010 December 31, 2009

Notional

Estimated

Fair Value 1Notional

Estimated

Fair Value 1

(in millions)

Commitments to purchase foreign currency $ 36 $ 11$38 $— 1

Commitments to sell foreign currency 129 (2)150 (1)1

Balance Sheet Location:

Accounts Receivable $1 $ 1

Other Current Liabilities (2) (2)

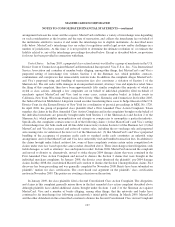

Euro Functional Currency

December 31, 2010 December 31, 2009

Notional

Estimated

Fair Value 1Notional

Estimated

Fair Value 1

(in millions)

Commitments to purchase foreign currency $ 2 $— $16 $—

Commitments to sell foreign currency 14 — 45 —

Balance Sheet Location:

Accounts Receivable $— $—

Other Current Liabilities ——

U.K. Pound Sterling Functional Currency

December 31, 2010 December 31, 2009

Notional

Estimated

Fair Value 1Notional

Estimated

Fair Value 1

(in millions)

Commitments to purchase foreign currency $— $— $— $—

Commitments to sell foreign currency 5 — — —

Balance Sheet Location:

Accounts Receivable $— $—

Other Current Liabilities ——

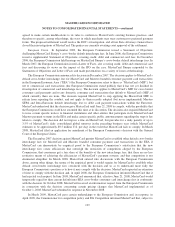

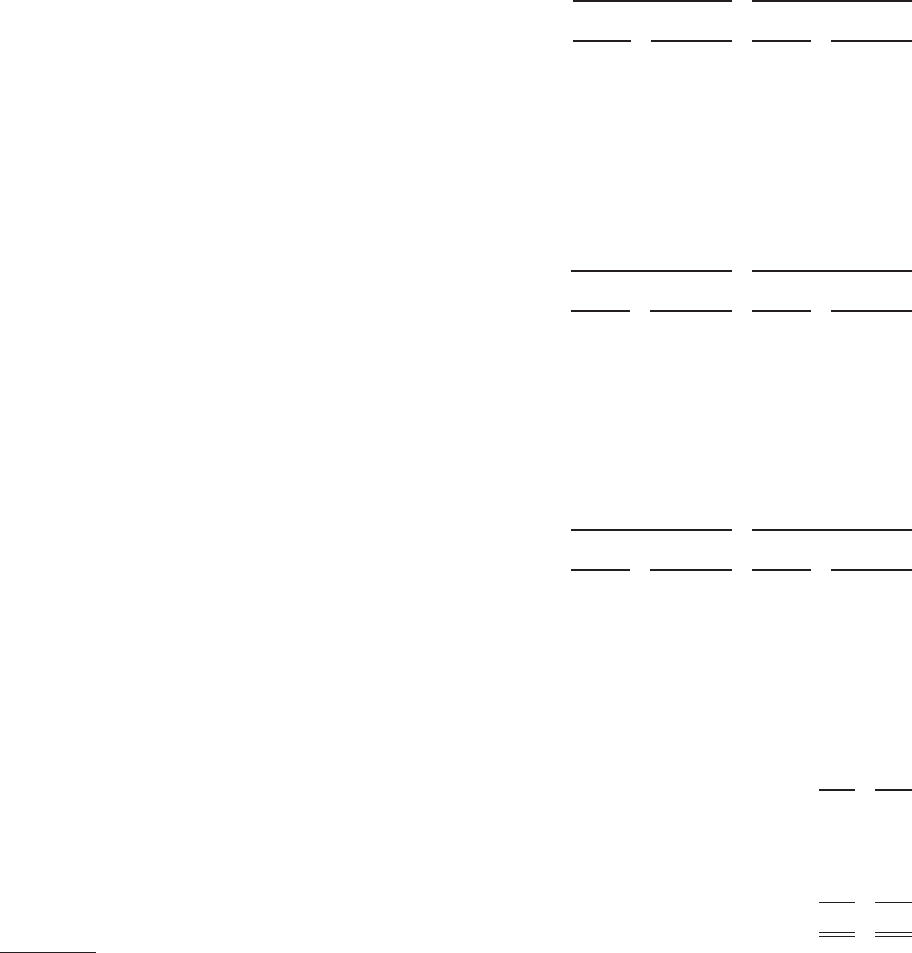

Amount and Location of Gain (Loss) Recognized in Income during the Year Ended December 31,

2010 2009

(in millions)

Derivatives Not Designated As Hedging Instruments

Foreign Currency Derivative Contracts

General and administrative $(17) $(12)

Revenues (3) (6)

Total $(20) $(18)

1Amounts represent gross fair value amounts while these amounts may be netted for actual balance sheet

presentation.

136