MasterCard 2010 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Overview

MasterCard is a leading global payments company that provides a critical economic link among financial

institutions, businesses, merchants, cardholders and governments worldwide, enabling them to use electronic

forms of payment instead of cash and checks. We provide a variety of services in support of the credit, debit,

prepaid and related payment programs of approximately 22,000 financial institutions and other entities that are

our customers. We primarily:

• offer a wide range of payment solutions, which enable our customers to develop and implement credit,

debit, prepaid and related payment programs for their customers (which include cardholders, businesses

and government entities),

• manage a family of well-known, widely accepted payment card brands, including MasterCard, Maestro

and Cirrus, which we license to our customers for use in their payment programs,

• process payment transactions over the MasterCard Worldwide Network,

• provide support services to our customers and, depending upon the service, merchants and other clients,

and

• as part of managing our brands and our franchise, establish and enforce a common set of standards for

adherence by our customers for the efficient and secure use of our payment card network.

We generate revenues from the fees that we charge our customers for providing transaction processing and

other payment-related services and by assessing our customers based primarily on the dollar volume of activity

on the cards that carry our brands. Cardholder and merchant relationships are managed principally by our

customers. We do not issue cards, extend credit to cardholders, determine the interest rates (if applicable) or

other fees charged to cardholders by issuers, or establish the merchant discount charged by acquirers in

connection with the acceptance of cards that carry our brands.

We believe the trend within the global payments industry from paper-based forms of payment, such as cash

and checks, toward electronic forms of payment, such as payment card transactions, creates significant

opportunities for the growth of our business over the longer term. Our focus is on continuing to:

• grow our offerings by extending our strength in our core businesses globally, including credit, debit,

prepaid and processing payment transactions over the MasterCard Worldwide Network,

• diversify our business by seeking new areas of growth in markets around the world, expanding points of

acceptance for our brands in new geographies, seeking to maintain unsurpassed acceptance, and

working with new business partners such as merchants, government agencies and telecommunications

companies, and

• build new businesses through continued strategic efforts with respect to innovative payment methods

such as electronic commerce (e-Commerce) and mobile capabilities.

See “—Business Environment” for a discussion of environmental considerations related to our long-term

strategic objectives.

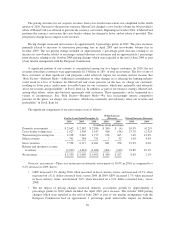

We recorded net income of $1.8 billion, or $14.05 per diluted share, in 2010 versus net income of $1.5

billion, or $11.16 per diluted share, in 2009 and a net loss of $0.3 billion, or ($1.94) per diluted share, in 2008.

As of December 31, 2010, our liquidity and capital positions remained strong, with $3.9 billion in cash and cash

equivalents and current available-for-sale securities and $5.2 billion in equity. In addition, we generated cash

flows from operations of $1.7 billion for the year ended December 31, 2010.

Our net revenues increased 8.6% in 2010, primarily due to the increased dollar volume of activity on cards

carrying our brands, pricing changes and increased transactions. The net foreign currency impact of changes in

the U.S. dollar average exchange rates against the euro and Brazilian real reduced net revenue growth by

48