MasterCard 2010 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—continued

Note 19. Commitments

On December 9, 2010, MasterCard entered into an agreement to acquire the prepaid card program

management operations of Travelex Holdings Ltd. (“Travelex CPM”) for 290 million U.K. pound sterling, or

approximately $458 million, with contingent consideration (an “earn-out”) of up to an additional 35 million U.K.

pound sterling, or approximately $55 million, if certain performance targets are met. The acquisition agreement

is subject to conditions precedent to the consummation of the transaction, which is expected to occur during the

first half of 2011.

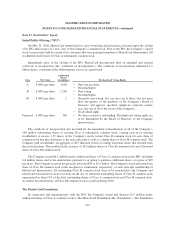

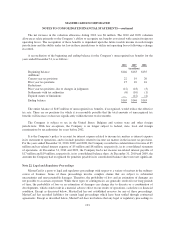

In addition to the commitment to purchase Travelex CPM, at December 31, 2010, the Company had the

following future minimum payments due under non-cancelable agreements:

Total

Capital

Leases

Operating

Leases

Sponsorship,

Licensing &

Other

(in millions)

2011 $359 $ 7 $26 $326

2012 173 5 23 145

2013 88 38 13 37

2014 26 — 10 16

2015 14 — 9 5

Thereafter 17 — 16 1

Total $677 $ 50 $97 $530

Included in the table above are capital leases with imputed interest expense of $5 million and a net present

value of minimum lease payments of $45 million. In addition, at December 31, 2010, $96 million of the future

minimum payments in the table above for leases, sponsorship, licensing and other agreements was accrued.

Consolidated rental expense for the Company’s office space, which is recognized on a straight line basis over the

life of the lease, was approximately $27 million, $40 million and $43 million for the years ended December 31,

2010, 2009 and 2008, respectively. Consolidated lease expense for automobiles, computer equipment and office

equipment was $8 million, $9 million and $8 million for the years ended December 31, 2010, 2009 and 2008,

respectively.

In January 2003, MasterCard purchased a building in Kansas City, Missouri for approximately $24 million.

The building is a co-processing data center which replaced a back-up data center in Lake Success, New York.

During 2003, MasterCard entered into agreements with the City of Kansas City for (i) the sale-leaseback of the

building and related equipment which totaled $36 million and (ii) the purchase of municipal bonds for the same

amount which have been classified as investment securities held-to-maturity. The agreements enabled

MasterCard to secure state and local financial benefits. No gain or loss was recorded in connection with the

agreements. The leaseback has been accounted for as a capital lease as the agreement contains a bargain purchase

option at the end of the ten-year lease term on April 1, 2013. The building and related equipment are being

depreciated over their estimated economic life in accordance with the Company’s policy. Rent of $2 million is

due annually and is equal to the interest due on the municipal bonds. The future minimum lease payments are

$40 million and are included in the table above. A portion of the building was subleased to the original building

owner for a five-year term with a renewal option. This sublease expires on June 30, 2011. As of December 31,

2010, the future minimum sublease rental income is $1 million.

119