MasterCard 2010 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—continued

In connection with the acquisition, the Company recognized $7 million of acquisition-related expenses

during the year ended December 31, 2010, which consisted primarily of professional fees related to closing the

transaction. These amounts were included in general and administrative expenses. The consolidated financial

statements include the operating results of DataCash from the date of the acquisition.

Note 3. Earnings (Loss) Per Share (“EPS”)

On January 1, 2009, an accounting standard related to the EPS effects of instruments granted in share-based

payment transactions became effective for the Company resulting in the retrospective adjustment of EPS for

prior periods. In accordance with this accounting standard, unvested share-based payment awards which receive

non-forfeitable dividend rights, or dividend equivalents, are considered participating securities and are required

to be included in computing EPS under the two-class method. The Company declared non-forfeitable dividends

on unvested restricted stock units and contingently issuable performance stock units (“Unvested Units”) which

were granted prior to 2009. The Company has therefore calculated EPS under the two-class method pursuant to

this accounting standard.

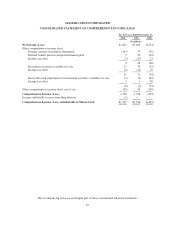

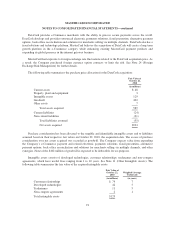

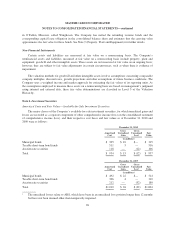

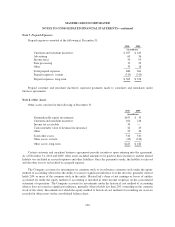

The components of basic and diluted EPS for common shares under the two-class method for each of the

years ended December 31 were as follows:

2010 2009 2008

(in millions, except per share data)

Numerator:

Net income (loss) attributable to MasterCard $1,846 $1,463 $ (254)

Less: Net income (loss) allocated to Unvested Units 3 9 (1)

Net income (loss) attributable to MasterCard allocated to

common shares $1,843 $1,454 $ (253)

Denominator:

Basic EPS weighted average shares outstanding 131 130 130

Dilutive stock options and restricted stock units — — —

Diluted EPS weighted-average shares outstanding 131 130 130

Earnings (Loss) per Share:

Basic $14.10 $11.19 $(1.94)

Diluted $14.05 $11.16 $(1.94)

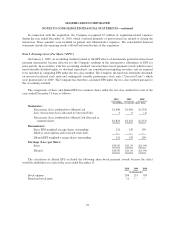

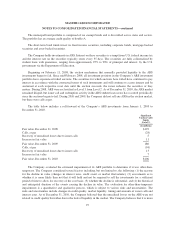

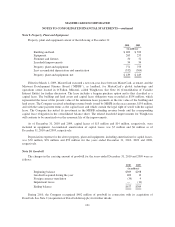

The calculation of diluted EPS excluded the following share-based payment awards because the effect

would be antidilutive for each of the years ended December 31:

2010 2009 2008

(in thousands)

Stock options 204 251 705

Restricted stock units 11 — —

92