MasterCard 2010 Annual Report Download - page 76

Download and view the complete annual report

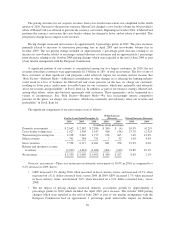

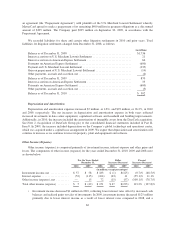

Please find page 76 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Net cash used in investing activities in 2010 primarily related to the DataCash acquisition and expenditures

for our global network, partially offset by net cash inflows from investment security activities. Net cash used in

investing activities in 2009 primarily related to net purchases of investment securities and expenditures for our

global network. Net cash provided by investing activities in 2008 primarily related to net sales of investment

securities, partially offset by expenditures for our payment card network and an acquisition of a business.

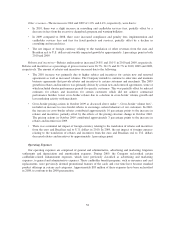

The auction rate securities (“ARS”) market was illiquid as of December 31, 2010 and 2009 and therefore

our ARS are classified as long-term available-for-sale securities. We had $118 million and $212 million of ARS,

at amortized cost, as of December 31, 2010 and 2009, respectively. Although the ARS market is illiquid, issuer

call and redemption activity at par occurred periodically during 2010 and 2009. See Note 6 (Investment

Securities) to the consolidated financial statements included in Part II, Item 8 for more information.

Net cash used in financing activities in 2010 and 2009 included the payment of dividends offset by cash

provided by the tax benefit from share based compensation. The repayment of debt in 2009 and 2008 utilized

cash of $149 million and $80 million, respectively. In addition, the acquisition of 2.8 million shares of our

Class A common stock in 2008 under share repurchase programs utilized approximately $650 million. See

Note 16 (Consolidation of Variable Interest Entity), Note 15 (Debt) and Note 17 (Stockholders’ Equity) to the

consolidated financial statements included in Part II, Item 8 for more information on our debt repayments of

$149 million and $80 million and the stock repurchases, respectively.

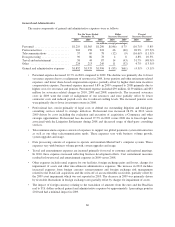

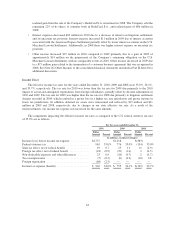

Dividends

On December 7, 2010, our Board of Directors declared a quarterly cash dividend of $0.15 per share payable

on February 9, 2011 to holders of record on January 10, 2011 of our Class A common stock and Class B common

stock. The aggregate amount payable for this dividend was $20 million as of December 31, 2010.

On February 8, 2011, our Board of Directors declared a quarterly cash dividend of $0.15 per share payable

on May 9, 2011 to holders of record on April 8, 2011 of our Class A common stock and Class B common stock.

The aggregate amount needed for this dividend is estimated to be $20 million. The declaration and payment of

future dividends will be at the sole discretion of our Board of Directors after taking into account various factors,

including our financial condition, settlement guarantees, operating results, available cash and anticipated cash

needs.

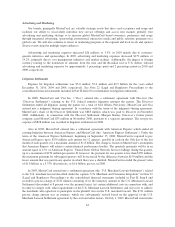

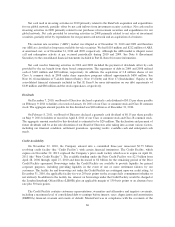

Credit Availability

On November 22, 2010, the Company entered into a committed three-year unsecured $2.75 billion

revolving credit facility (the “Credit Facility”) with certain financial institutions. The Credit Facility, which

expires on November 22, 2013, replaced the Company’s prior credit facility which was to expire on April 26,

2011 (the “Prior Credit Facility”). The available funding under the Prior Credit Facility was $2.5 billion from

April 28, 2006 through April 27, 2010 and then decreased to $2 billion for the remaining period of the Prior

Credit Facility agreement. Borrowings under the Credit Facility are available to provide liquidity for general

corporate purposes, including providing liquidity in the event of one or more settlement failures by our

customers. The facility fee and borrowing cost under the Credit Facility are contingent upon our credit rating. At

December 31, 2010, the applicable facility fee was 20 basis points on the average daily commitment (whether or

not utilized). In addition to the facility fee, interest on borrowings under the Credit Facility would be charged at

the London Interbank Offered Rate (LIBOR) plus an applicable margin of 130 basis points or an alternate base

rate plus 30 basis points.

The Credit Facility contains customary representations, warranties and affirmative and negative covenants,

including a maximum level of consolidated debt to earnings before interest, taxes, depreciation and amortization

(EBITDA) financial covenant and events of default. MasterCard was in compliance with the covenants of the

66