MasterCard 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Credit Facility and had no borrowings under the Credit Facility at December 31, 2010. MasterCard was in

compliance with the covenants of the Prior Credit Facility and had no borrowings under the Prior Credit Facility

at December 31, 2009. The majority of Credit Facility lenders are members or affiliates of members of

MasterCard International.

On November 4, 2009, the Company filed a universal shelf registration statement to provide additional

access to capital, if needed. Pursuant to the shelf registration statement, the Company may from time to time

offer to sell debt securities, preferred stock or Class A common stock in one or more offerings.

On January 5, 2009, HSBC Bank plc (“HSBC”) notified the Company that, effective December 31, 2008, it

had terminated an uncommitted credit agreement totaling 100 million euros between HSBC and MasterCard

Europe. There was no borrowing under this facility at December 31, 2008.

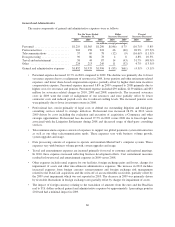

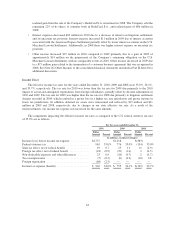

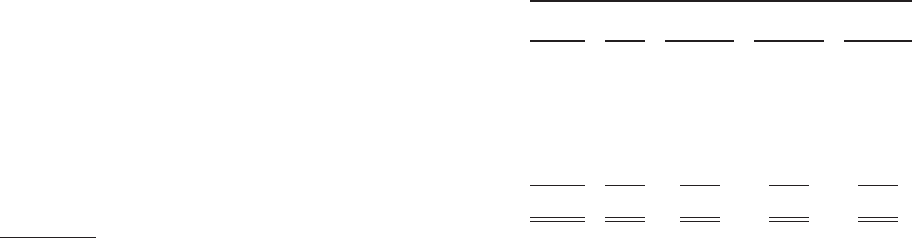

Future Obligations

In addition to the $458 million commitment to purchase Travelex CPM, the following table summarizes our

obligations as of December 31, 2010 that are expected to impact liquidity and cash flow in future periods. We

believe we will be able to fund these obligations through cash generated from operations and our existing

balances of cash and cash equivalents.

Payments Due by Period

Total 2011 2012-2013 2014-2015

2016 and

thereafter

(in millions)

Capital leases1....................................... $ 50 $ 7 $ 43 $— $—

Operating leases2..................................... 97 26 36 19 16

Sponsorship, licensing and other3,4 ....................... 534 330 182 21 1

Litigation settlements5................................ 308 304 4 — —

Debt6.............................................. 20 20 — — —

Total .............................................. $1,009 $687 $265 $ 40 $ 17

*Note that totals in above table may not sum due to rounding.

1Mostly related to certain property, plant and equipment. The capital lease for our global technology and

operations center located in O’Fallon, Missouri has been excluded from this table; see Note 9 (Property,

Plant and Equipment) to the consolidated financial statements included in Part II, Item 8 for further

discussion. There is a capital lease for the Kansas City, Missouri co-processing data center.

2We enter into operating leases in the normal course of business. Substantially all lease agreements have

fixed payment terms based on the passage of time. Some lease agreements provide us with the option to

renew the lease or purchase the leased property. Our future operating lease obligations would change if we

exercised these renewal options and if we entered into additional lease agreements.

3Amounts primarily relate to sponsorships with certain organizations to promote the MasterCard brand. The

amounts included are fixed and non-cancelable. In addition, these amounts include amounts due in

accordance with merchant agreements for future marketing, computer hardware maintenance, software

licenses and other service agreements. Future cash payments that will become due to our customers under

agreements which provide pricing rebates on our standard fees and other incentives in exchange for

transaction volumes are not included in the table because the amounts due are indeterminable and

contingent until such time as performance has occurred. MasterCard has accrued $666 million as of

December 31, 2010 related to customer and merchant agreements.

4Includes current liability of $4 million relating to the accounting for uncertainty in income taxes. Due to the

high degree of uncertainty regarding the timing of the non-current liabilities for uncertainties in income

taxes, we are unable to make reasonable estimates of the period of cash settlements with the respective

taxing authority.

67