MasterCard 2010 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—continued

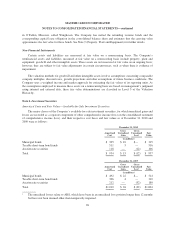

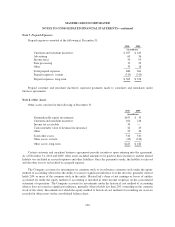

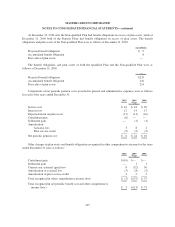

At December 31, 2010 only the Non-qualified Plan had benefit obligations in excess of plan assets, while at

December 31, 2009 both of the Pension Plans had benefit obligations in excess of plan assets. The benefit

obligations and plan assets of the Non-qualified Plan were as follows at December 31, 2010:

(in millions)

Projected benefit obligation $ 9

Accumulated benefit obligation 8

Fair value of plan assets —

The benefit obligations and plan assets of both the Qualified Plan and the Non-qualified Plan were as

follows at December 31, 2009:

(in millions)

Projected benefit obligation $235

Accumulated benefit obligation 216

Fair value of plan assets 214

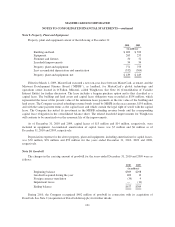

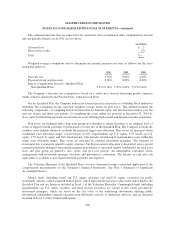

Components of net periodic pension costs recorded in general and administrative expenses were as follows

for each of the years ended December 31:

2010 2009 2008

(in millions)

Service cost $ 16 $ 18 $ 20

Interest cost 12 14 13

Expected return on plan assets (17) (13) (16)

Curtailment gain (6) — —

Settlement gain — (1) (1)

Amortization:

Actuarial loss 3 8 2

Prior service credit (2) (2) (2)

Net periodic pension cost $ 6 $ 24 $ 16

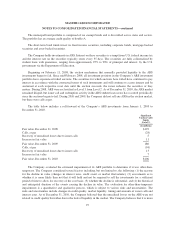

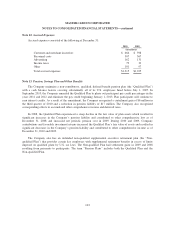

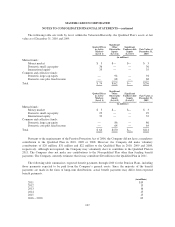

Other changes in plan assets and benefit obligations recognized in other comprehensive income for the years

ended December 31 were as follows:

2010 2009 2008

(in millions)

Curtailment gain $ (10) $— $—

Settlement gain — 1 1

Current year actuarial (gain) loss 8 (32) 56

Amortization of actuarial loss (3) (8) (2)

Amortization of prior service credit 2 2 2

Total recognized in other comprehensive income (loss) $ (3) $ (37) $ 57

Total recognized in net periodic benefit cost and other comprehensive

income (loss) $ 3 $ (13) $ 73

105