MasterCard 2010 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—continued

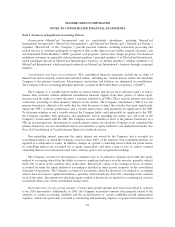

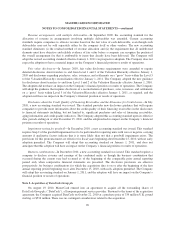

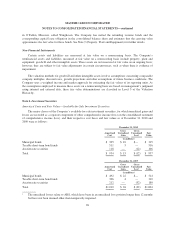

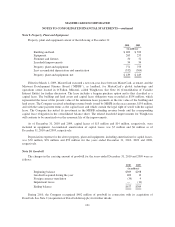

Note 4. Supplemental Cash Flows

The following table includes supplemental cash flow disclosures for each of the years ended December 31:

2010 2009 2008

(in millions)

Cash paid for income taxes $540 $ 457 $ 4931

Cash paid for interest 3 11 14

Cash paid for legal settlements (Notes 20 and 22) 607 946 1,263

Non-cash investing and financing activities:

Dividend declared but not yet paid 20 20 20

Municipal bonds cancelled — 1542—

Revenue bonds received — (154)3—

Building and land assets recorded pursuant to capital lease — (154)3—

Capital lease obligation — 1543—

Fair value of assets acquired, net of original investment, cash paid and cash

acquired 553417 124

Fair value of liabilities assumed related to investments in affiliates 554155436

Fair value of non-controlling interest acquired 2 8 —

1$198 million of these payments were recorded as an income tax receivable as of December 31, 2008.

2See Note 16 (Consolidation of Variable Interest Entity) for further details.

3See Note 9 (Property, Plant, and Equipment) for further details.

4See Note 2 (Acquisition of DataCash Group plc) for further details.

5Includes $9 million to be extinguished in 2013 and 2016 for future benefits to be provided by MasterCard in

the establishment of a joint venture.

6Includes $20 million due in 2011 relating to the MasterCard France acquisition.

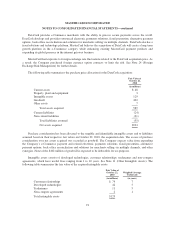

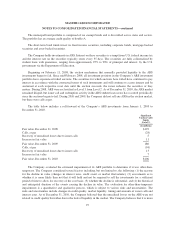

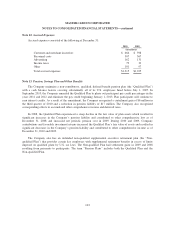

Note 5. Fair Value

In accordance with accounting requirements for fair value, the Company is disclosing the estimated fair

values as of December 31, 2010 and 2009 of the assets and liabilities that are within the scope of the accounting

guidance, as well as the methods and significant assumptions used to estimate the fair value of those financial

instruments. Furthermore, the Company classifies its fair value measurements in the Valuation Hierarchy. No

transfers were made among the three levels in the Valuation Hierarchy during the year ended December 31,

2010.

93