MasterCard 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

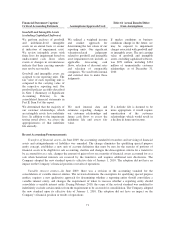

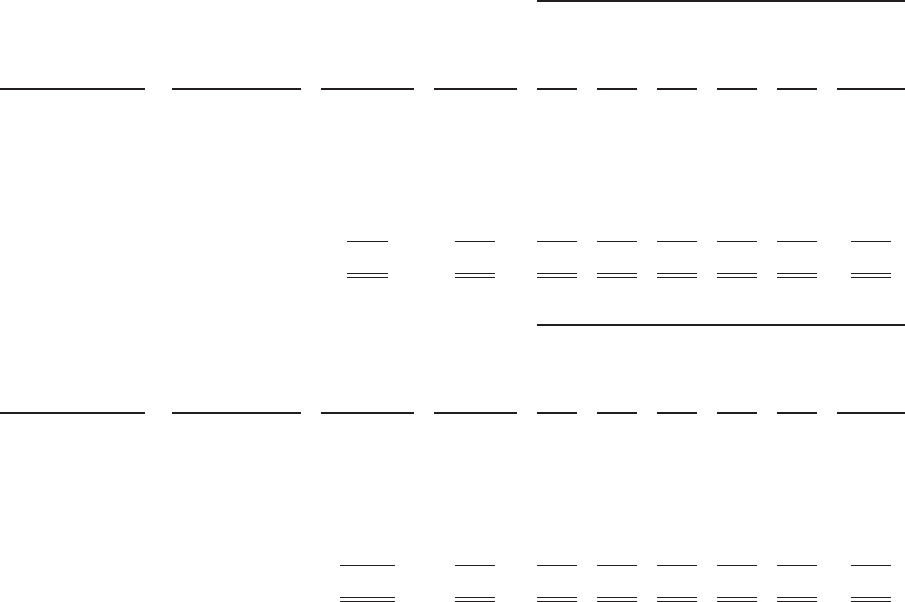

Interest Rate Risk

Our interest rate sensitive assets are our investments in debt securities, which we generally hold as

available-for-sale investments. Our general policy is to invest in high quality securities, while providing adequate

liquidity and maintaining diversification to avoid significant exposure. The fair value and maturity distribution of

the Company’s available for sale investments as of December 31 was as follows:

Maturity

(in millions)

Financial Instrument Summary Terms

Fair Market

Value at

December 31,

2010

No

Contractual

Maturity 2011 2012 2013 2014 2015

2016 and

thereafter

Municipal

bonds ......... fixed interest $315 $— $ 8 $ 33 $ 93 $ 69 $ 55 $ 57

Short-term bond

funds .........

fixed/variable

interest 516 516 ————— —

Auction rate

securities ...... variable interest 106 — ————— 106

Total ........... $937 $516 $ 8 $ 33 $ 93 $ 69 $ 55 $163

Maturity

(in millions)

Financial Instrument Summary Terms

Fair Market

Value at

December 31,

2009

No

Contractual

Maturity 2010 2011 2012 2013 2014

2015 and

thereafter

Municipal

bonds ......... fixed interest $ 514 $— $ 28 $ 97 $ 96 $120 $ 80 $ 93

Short-term bond

funds .........

fixed/variable

interest 310 310 ————— —

Auction rate

securities ...... variable interest 180 — ————— 180

Total ........... $1,004 $310 $ 28 $ 97 $ 96 $120 $ 80 $273

At December 31, 2010, we have a credit facility which provides liquidity for general corporate purposes,

including providing liquidity in the event of one or more settlement failures by the Company’s customers. This

credit facility has variable rates, which are applied to the borrowing based on terms and conditions set forth in the

agreement. We had no borrowings under this facility at December 31, 2010 or 2009. See Note 15 (Debt) to the

consolidated financial statements in Part II, Item 8 for additional information.

Equity Price Risk

The Company did not have significant equity price risk as of December 31, 2010 and 2009.

74