MasterCard 2010 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—continued

Note 17. Stockholders’ Equity

Initial Public Offering (“IPO”)

On May 31, 2006, MasterCard transitioned to a new ownership and governance structure upon the closing

of its IPO and issuance of a new class of the Company’s common stock. Prior to the IPO, the Company’s capital

stock was privately held by certain of its customers that were principal members of MasterCard International. All

stockholders held shares of Class A redeemable common stock.

Immediately prior to the closing of the IPO, MasterCard Incorporated filed an amended and restated

certificate of incorporation (the “certificate of incorporation”). The certificate of incorporation authorized 4.5

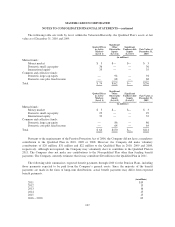

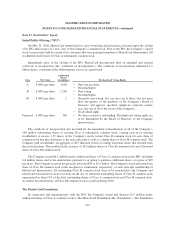

billion shares, consisting of the following new classes of capital stock:

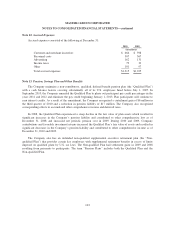

Class Par Value

Authorized

Shares

(in millions) Dividend and Voting Rights

A $.0001 per share 3,000 • One vote per share

• Dividend rights

B $.0001 per share 1,200 • Non-voting

• Dividend rights

M $.0001 per share 1 • Generally non-voting, but can elect up to three, but not more

than one-quarter, of the members of the Company’s Board of

Directors and approve specified significant corporate actions

(e.g., the sale of all of the assets of the Company)

• No dividend rights

Preferred $.0001 per share 300 • No shares issued or outstanding. Dividend and voting rights are

to be determined by the Board of Directors of the Company

upon issuance.

The certificate of incorporation also provided for the immediate reclassification of all of the Company’s

100 million outstanding shares of existing Class A redeemable common stock, causing each of its existing

stockholders to receive 1.35 shares of the Company’s newly issued Class B common stock for each share of

common stock that they held prior to the reclassification as well as a single share of Class M common stock. The

Company paid stockholders an aggregate of $27 thousand in lieu of issuing fractional shares that resulted from

the reclassification. This resulted in the issuance of 135 million shares of Class B common stock and 2 thousand

shares of Class M common stock.

The Company issued 66.1 million newly authorized shares of Class A common stock in the IPO, including

4.6 million shares sold to the underwriters pursuant to an option to purchase additional shares, at a price of $39

per share. The Company received net proceeds from the IPO of $2.4 billion. The Company issued and retired one

share of Class M common stock at the inception or termination, respectively, of each principal membership of

MasterCard International. All outstanding Class M common stock were to be transferred to the Company and

retired and unavailable for issue or reissue on the day on which the outstanding shares of Class B common stock

represented less than 15% of the total outstanding shares of Class A common stock and Class B common stock.

As further described below, all Class M common stock was retired during 2010.

The MasterCard Foundation

In connection and simultaneously with the IPO, the Company issued and donated 13.5 million newly

authorized shares of Class A common stock to The MasterCard Foundation (the “Foundation”). The Foundation

112