MasterCard 2010 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—continued

included in level 2 of the Valuation Hierarchy as the fair value of these contracts are based on broker quotes for

the same or similar instruments. Changes in the fair value of derivative instruments are reported in current-period

earnings. The Company did not have any derivative contracts accounted for under hedge accounting as of

December 31, 2010 and 2009.

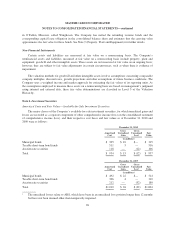

Income taxes—The Company follows an asset and liability based approach in accounting for income taxes

as required under GAAP. Deferred income tax assets and liabilities are recorded to reflect the tax consequences

on future years of temporary differences between the financial statement carrying amounts and income tax bases

of assets and liabilities. Deferred income taxes are displayed as separate line items or are included in other

current liabilities on the consolidated balance sheet. Valuation allowances are provided against assets which are

not more likely than not to be realized. The Company recognizes all material tax positions, including all

significant uncertain tax positions in which it is more likely than not that the position will be sustained based on

its technical merits and if challenged by the relevant taxing authorities. At each balance sheet date, unresolved

uncertain tax positions are reassessed to determine whether subsequent developments require a change in the

amount of recognized tax benefit. The allowance for uncertain tax positions is recorded in other current and

noncurrent liabilities on the consolidated balance sheet.

The Company records interest expense related to income tax matters as interest expense in its statement of

operations. The company includes penalties related to income tax matters in the income tax provision.

The Company does not provide for U.S. federal income tax and foreign withholding taxes on undistributed

earnings from non-U.S. subsidiaries when such earnings are intended to be reinvested indefinitely outside of the

U.S.

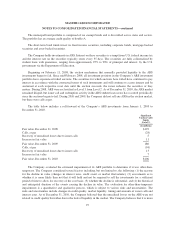

Revenue recognition—Revenues are recognized when persuasive evidence of an arrangement exists,

delivery has occurred or services have been rendered, the price is fixed or determinable, and collectibility is

reasonably assured. Revenues are generally based upon transactional information accumulated by our systems or

reported by our customers. The Company’s revenues are based on the volume of activity on cards that carry the

Company’s brands, the number of transactions processed or the nature of other payment-related services.

Volume-based revenues (domestic assessments and cross-border volume fees) are recorded as revenue in the

period they are earned, which is when the related volume is generated on the cards. Certain quarterly revenues

are estimated based upon aggregate transaction information and historical and projected customer quarterly

volumes. Actual results may differ from these estimates. Transaction-based revenues (transaction processing

fees) are calculated by multiplying the number and type of transactions by the specific price for each service.

Transaction-based fees are recognized as revenue in the same period as the related transactions occur. Other

payment-related services are dependent on the nature of the products or services provided to our customers and

are recognized as revenue in the same period as the related transactions occur or services are rendered.

MasterCard has business agreements with certain customers that provide for fee rebates when the customers

meet certain volume hurdles as well as other support incentives such as marketing, which are tied to

performance. Rebates and incentives are recorded as a reduction of revenue in the same period as the revenue is

earned or performance has occurred. Rebates and incentives are calculated on a monthly basis based upon

estimated performance and the terms of the related business agreements. In addition, MasterCard may incur costs

directly related to the acquisition of the contract, which are deferred and amortized over the life of the contract.

Pension and other postretirement plans—Compensation cost of an employee’s pension benefit is

recognized in general and administrative expenses on the projected unit credit method over the employee’s

approximate service period. The unit credit cost method is utilized for funding purposes.

The Company recognizes the overfunded or underfunded status of its single-employer defined benefit plan

or postretirement plan as an asset or liability in its balance sheet and recognizes changes in the funded status in

the year in which the changes occur through comprehensive income. The Company also measures the funded

status of a plan as of the date of its year-end balance sheet.

88