MasterCard 2010 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2010 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—continued

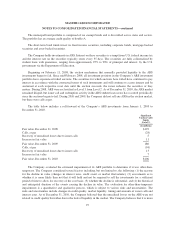

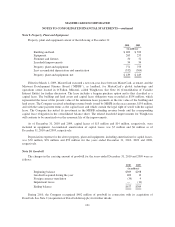

in O’Fallon, Missouri, called Winghaven. The Company has netted the refunding revenue bonds and the

corresponding capital lease obligation in the consolidated balance sheet and estimates that the carrying value

approximates the fair value for these bonds. See Note 9 (Property, Plant and Equipment) for further details.

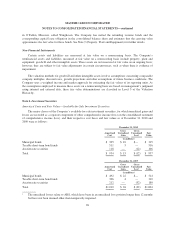

Non-Financial Instruments

Certain assets and liabilities are measured at fair value on a nonrecurring basis. The Company’s

nonfinancial assets and liabilities measured at fair value on a nonrecurring basis include property, plant and

equipment, goodwill and other intangible assets. These assets are not measured at fair value on an ongoing basis;

however, they are subject to fair value adjustments in certain circumstances, such as when there is evidence of

impairment.

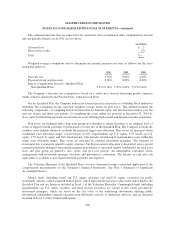

The valuation methods for goodwill and other intangible assets involve assumptions concerning comparable

company multiples, discount rates, growth projections and other assumptions of future business conditions. The

Company uses a weighted income and market approach for estimating the fair values of its reporting units. As

the assumptions employed to measure these assets on a nonrecurring basis are based on management’s judgment

using internal and external data, these fair value determinations are classified in Level 3 of the Valuation

Hierarchy.

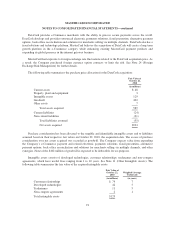

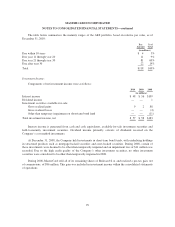

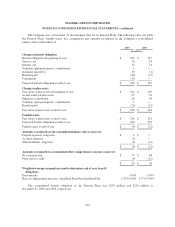

Note 6. Investment Securities

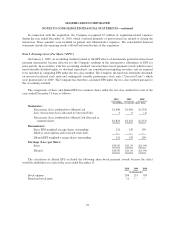

Amortized Costs and Fair Values—Available-for-Sale Investment Securities:

The major classes of the Company’s available-for-sale investment securities, for which unrealized gains and

losses are recorded as a separate component of other comprehensive income (loss) on the consolidated statement

of comprehensive income (loss), and their respective cost bases and fair values as of December 31, 2010 and

2009 were as follows:

December 31, 2010

Amortized

Cost

Gross

Unrealized

Gain

Gross

Unrealized

Loss1

Fair

Value

(in millions)

Municipal bonds $ 305 $ 10 $— $ 315

Taxable short-term bond funds 511 5 — 516

Auction rate securities 118 — (12) 106

Total $ 934 $ 15 $ (12) $ 937

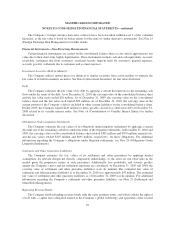

December 31, 2009

Amortized

Cost

Gross

Unrealized

Gain

Gross

Unrealized

Loss1

Fair

Value

(in millions)

Municipal bonds $ 492 $ 22 $— $ 514

Taxable short-term bond funds 306 4 — 310

Auction rate securities 212 — (32) 180

Total $1,010 $ 26 $ (32) $1,004

1The unrealized losses relate to ARS, which have been in an unrealized loss position longer than 12 months

but have not been deemed other-than-temporarily impaired.

96